Houston refiners weather hurricane-force winds: Update

Adds Calcasieu comment, update on flaring reporting

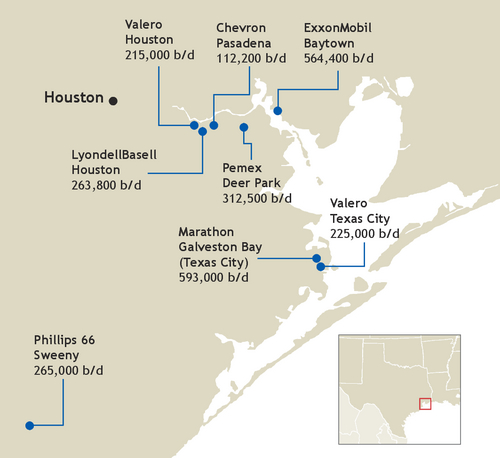

Over 2mn b/d of US refining capacity faced destructive winds Thursday evening as a major storm blew through Houston, Texas, but the damage reported so far has been minimal.

Wind speeds of up to 78 mph were recorded in northeast Houston and the Houston Ship Channel — home to five refineries with a combined 1.5mn b/d of capacity — faced winds up to 74 mph, according to the National Weather Service.

Further South in Galveston Bay, where Valero and Marathon Petroleum refineries total 818,000 b/d of capacity, max wind speeds of 51 mph were recorded.

Chevron's 112,000 b/d Pasadena refinery on the Ship Channel just east of downtown Houston sustained minor damage during the storm and continues to supply customers, the company said.

ExxonMobil's 564,000 b/d Baytown refinery on the Ship Channel and 369,000 b/d Beaumont, Texas, refinery further east faced no significant impact from the storm and the company continues to supply customers, a spokesperson told Argus.

Neither Phillips 66's 265,000 b/d Sweeny refinery southwest of Houston nor its 264,000 b/d Lake Charles refinery 140 miles east in Louisiana were affected by the storm, a spokesperson said.

There was no damage at Motiva's 626,000 b/d Port Arthur, Texas, refinery according to the company.

Calcasieu's 136,000 b/d refinery in Lake Charles, Louisiana, was unaffected by the storm and operations are normal, the refiner said.

Marathon Petroleum declined to comment on operations at its 593,000 b/d Galveston Bay refinery.

Valero, LyondellBasell, Pemex, Total and Citgo did not immediately respond to requests for comment on operations at their refineries in the Houston area, Port Arthur and Lake Charles.

A roughly eight-mile portion of the Houston Ship Channel from the Sidney Sherman Bridge to Greens Bayou closed from 9pm ET 16 May to 1am ET today when two ships brokeaway from their moorings, and officials looked in a potential fuel oil spill, according to the US Coast Guard.

The portion that closed provides access to Valero's 215,000 b/d Houston refinery, LyondellBasell's 264,000 b/d Houston refinery and Chevron's Pasadena refinery.

Emissions filings with the Texas Commission on Environmental Quality (TCEQ) are yet to indicate the extent of any flaring and disruption to operations in the Houston area Thursday evening, but will likely be reported later Friday and over the weekend.

Gulf coast refiners ran their plants at average utilization rates of 93pc in the week ended 10 May, according to the Energy Information Administration (EIA), up by two percentage points from the prior week as the industry heads into the late-May Memorial Day weekend and beginning of peak summer driving season. The next EIA data release on 22 May will likely reveal any dip in Gulf coast refinery throughputs resulting from the storm.

Related news posts

Oil firms in Kurdistan deny Iraqi PM's contract claims

Oil firms in Kurdistan deny Iraqi PM's contract claims

Dubai, 2 June (Argus) — The Association of the Petroleum Industry of Kurdistan (Apikur) has denied claims by Iraq's prime minister Mohammed Shia al-Sudani that international oil companies (IOCs) operating in the country's semi-autonomous Kurdistan region are not ready to amend their contracts. Apikur points to a statement it made last week that said its members would be willing to consider modifications to existing contracts provided the matter is agreed by Iraq's federal government, the Kurdistan Regional Government (KRG) and the firms themselves. Baghdad had proposed a middle ground agreement that would see it amend its federal budget to allow it to pay IOCs operating in Kurdistan, in return for a compromise with the KRG and the IOCs over the recovery cost for oil produced in the Kurdish region. In an interview with Turkish state news agency Anadolu published on 31 May, al-Sudani said his government has agreed to amend the budget law but IOCs operating in Kurdistan are refusing to amend their existing contracts with the KRG. "We have initiated acceptable settlements and legal solutions after a thorough legal study… The federal budget law requires that the cost of producing one barrel of oil in all fields be within the national average production cost, which is about $8/bl, according to the federal oil ministry," al-Sudani said in the interview. "But the KRG's ministry of natural resources calculates the production cost at about $26/bl within the contracts signed with the operating oil companies," he added. "For these reasons, more work is needed to find a legal solution that prioritises ensuring the rights of Iraq and its people to their wealth." His remarks suggest the two sides still have a significant gap to bridge on this issue. It also pours cold water on a recent call by Iraq's oil ministry for a meeting with its Kurdish counterpart and the IOCs to try to reach a deal and accelerate the restart of northern Iraqi crude exports via Turkey's Mediterranean Ceyhan port. Around 470,000 b/d of crude exports from Iraq's semi-autonomous Kurdistan region have been absent from international markets since March 2023 when Turkey closed the pipeline linking oil fields in northern Iraq to Ceyhan. That move followed an international tribunal ruling which said Turkey had breached a bilateral agreement with Baghdad by allowing Kurdish crude to be exported without the federal government's consent. Iraq's federal government is finding it difficult to strike a balance between repairing its rift with the KRG and complying with its Opec+ commitments. It recently submitted a plan outlining how it will compensate for producing above its target in the first quarter. Opec and the wider Opec+ group are holding ministerial meetings today to discuss output targets and whether to extend the group's current voluntary crude supply cuts into the second half of the year and possibly beyond. By Bachar Halabi Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Riyadh monetises Aramco with new share sale

Riyadh monetises Aramco with new share sale

A new share offering offers a cash injection towards Vision 2030 in the face of stagnating oil revenues, and budget deficits, writes Bachar Halabi Dubai, 31 May (Argus) — Riyadh's long-awaited decision to launch a secondary public offering of shares in state-controlled Saudi Aramco could raise up to $13bn for the government's economic diversification plans, at a time when the Opec linchpin's oil production policy is struggling to boost revenues. Aramco plans to sell 1.545bn shares, equivalent to about 0.64pc of the company, in an offering due to kick off on 2 June. The shares are expected to be priced in a range of 26.70-29 riyals ($7.12-7.73) each, which means the firm could raise $12bn at the top end. Proceeds could be as high as $13.1bn if Aramco chooses to exercise an over-allotment option, which would allow the sale of around 1.7bn shares. Aramco's closing share price on 30 May was SR29. Aramco chief executive Amin Nasser said the offering is not only to provide funds to the Saudi state but also to broaden the company's shareholder base among local and international investors. "It also offers us an opportunity to further increase liquidity and to increase global index weighting," he said. Whether further offerings follow in the future will be up to the government. The second offering has already been years in the making. Aramco's record-breaking initial public offering (IPO) in December 2019 raised $29.4bn. The company's mettle — and security risk exposure — was tested just a few months before that event, with an attack on its key Abqaiq oil processing facilities. And the years since the IPO have been a roller coaster ride of risk and opportunity for the oil sector, from the Covid oil demand slump to heightened energy security concerns spurred by Russia's invasion of Ukraine, and the subsequent bifurcation of oil markets under G7 embargoes and price caps on Russian oil. Saudi Arabia — through Aramco — has carried the heaviest load in terms of production cuts by the strengthened Opec+ producer group that emerged from the Covid shock, with individual voluntary reductions alongside group-wide output cuts. And Aramco's secondary offering will test international investment appetite for fossil fuels in the face of growing concerns over global climate targets. Nasser highlights key performance-related reasons that may ensure Aramco is an attractive investment opportunity. The world's largest oil company offers a long-term competitive advantage, in the face of an uncertain oil demand outlook, thanks to the scale, cost efficiency and low carbon intensity of its upstream oil production. Alongside these factors, Aramco claims differentiated growth opportunities in upstream gas, downstream oil, carbon capture, hydrogen and renewables, underpinned by its record planned capital expenditure of $48bn-58bn/yr. Record dividends But most appealing to potential investors may be Aramco's dividend distribution policy. "We distributed a record $98bn in 2023 and we anticipate distributing over $124bn of dividends in 2024. This would represent an almost 30pc increase from 2023," Nasser said. But the higher figure includes a performance-related dividend, reflecting the record profits it made in 2022-23. Whether its financial performance can sustain that additional payout is in question. Proceeds from the offering will help fund Saudi Arabia's Vision 2030 initiative, a government programme of economic, social and cultural diversification that includes hundreds of billions of dollars of investment in giant civil projects. Saudi Arabia recorded a sixth straight quarterly budget deficit in January-March this year as spending outpaced revenue on the back of lower energy prices and curbs on its crude production. The launch of the secondary offering on 2 June coincides with an Opec+ ministers' meeting to decide whether to extend the group's current voluntary crude supply cuts into the second half of the year. Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Dangote jet fuel weighing on European prices

Dangote jet fuel weighing on European prices

London, 31 May (Argus) — Jet fuels cargoes heading to Europe from Nigeria's new 650,000 b/d Dangote refinery are putting downward pressure on regional prices, according to market participants. A BP-purchased cargo was loaded on the Doric Breeze on 25 May at the Dangote refinery, according to sources and ship tracking provider Kpler. The latter said the cargo 45,000t, with an arrival date of 11 June at Rotterdam. BP won a Dangote tender for three jet cargoes totalling 120,000t, according to sources, and Spain's Cepsa has bought one cargo for loading in early June. Refining premiums against North Sea Dated for jet cargoes delivered to northwest Europe have dropped by $3.31/bl this week to a three-week low of $19.72/bl, as participants expect the additional supply from Nigeria to sufficiently cover the summer uplift in air travel demand. Dangote started producing what it called aviation fuel for the Nigerian market in January. A sample dated 26 May seen by Argus shows the jet fuel offered from Dangote now probably meets standard European specification A-1. The test contained 254ppm of sulphur, far below the maximum 0.3pc content in jet A-1, and its freezing point was -57ºC, stricter than the European specification of maximum -47ºC. Weaker margins on jet could prompt refineries towards regrade possibilities for other middle distillates, primarily diesel, traders said. Jet fuel has been at a significant premium over diesel in northwest Europe for the past month, thanks to better demand. But these have weakened by more than half this week, to just $1.10/bl on 30 May from $2.50/bl at the start of the week. Dangote expects to begin exports of European-standard diesel in June . By Olivia Young and George Maher-Bonnett Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Aramco looks to woo global investors with share sale

Aramco looks to woo global investors with share sale

Dubai, 31 May (Argus) — The rationale for state-controlled Saudi Aramco's decision to launch a secondary public offering is not only to provide funds to the Saudi government for its massive socio-economic transformation plan but also to broaden the company's shareholder base among local and international investors, chief executive Amin Nasser said. Aramco revealed yesterday that it plans to sell 1.545bn shares, equivalent to about 0.64pc of the company, in a secondary public offering due to kick off on 2 June. The shares are expected to be priced in a range of 26.70-29 Saudi riyals ($7.12-$7.73) each, which means the firm could raise $12bn at the top end. Proceeds could be as high as $13.1bn at the top end of the range if Aramco chooses to exercise an over-allotment option, which would allow the sale of around 1.7bn shares. Aramco's closing share price on 30 May stood at SR29. "The offering provides us with an opportunity to broaden the shareholder base among both Saudi and international investors," Nasser said. "It also offers us an opportunity to further increase liquidity and to increase global index weighting." The offering has been years in the making. Aramco's initial public offering (IPO) in 2019 raised a record $29.4bn. The secondary offering will test international investment appetite for fossil fuels in the face of growing concerns over global climate targets. Nasser points to four key performance-related reasons as to why he views Aramco as an attractive investment opportunity. The first is the company's competitive advantage due to scale, cost efficiency and low upstream carbon intensity. The second is Aramco's differentiated growth opportunities across upstream, downstream, carbon capture, hydrogen and renewables. The third is its financial strength and the fourth its dividend distribution policy. "We distributed a record $98bn in 2023 and we anticipate distributing over $124bn of dividends in 2024. This would represent an almost 30pc increase from 2023," Nasser said. Proceeds from the offering will help fund Saudi Arabia's Vision 2030 initiative, a government programme which aims to achieve increased diversification economically, socially and culturally. Saudi Arabia's finance minister Mohammed al-Jadaan suggested last month that the country may make changes to its plans, including delays or acceleration for some projects. Saudi Arabia recorded a sixth straight quarterly budget deficit in January-March this year, as spending outpaced revenue on the back of lower energy prices and curbs on its crude production. The launch of the secondary offering on 2 June coincides with an Opec+ ministers' meeting to decide whether to extend the group's current voluntary crude supply cuts into the second half of the year. By Bachar Halabi Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Business intelligence reports

Get concise, trustworthy and unbiased analysis of the latest trends and developments in oil and energy markets. These reports are specially created for decision makers who don’t have time to track markets day-by-day, minute-by-minute.

Learn more