In late May 2024, Germany permitted the unrestricted sale of HVO at filling stations, which has been seen as a milestone by the market. Argus estimates about 2pc of stations in Germany now offer HVO, with more planned to come. Additionally, more import terminals for HVO are coming on line, and a first major investment in domestic standalone HVO production has been announced at Holborn refinery in Hamburg.

Hagen Reiners, editor of Argus German Fuels, explores what is driving demand for renewable diesel and the challenges the industry faces.

Some consider HVO to be the first “real” chance to save CO2 in heavy duty transport. HVO, also known as renewable diesel, is chemically identical to conventional road diesel and can be used as a “drop-in” fuel to replace fossil fuel diesel. While other countries have led the way in HVO adoption, Germany — the single biggest European consumer of diesel — could have the potential to take HVO consumption to the next level.

What may impact the HVO market ramp-up in Germany?

Price

German retailers agree that for HVO100 to be successful with end-users, the price premium of HVO-to-diesel needs to be low. If the cost is too high, end-users may stick to diesel as the cheaper option. Forecourt operators believe for a serious uptick in private HVO demand, the difference to diesel would need to be less than €5/100 litres. But right now, prices are at premiums between €5-10/100l, according to Argus assessments of wholesale prices (point of truck loading).

Source: O.M.R. Fuels

Just this year, the HVO premium to diesel has shown volatility – including a relatively low premium for several weeks. This reflects trends in the wider northwest European HVO market, as well as shifting German GHG savings certificates prices. Northwest European HVO supply outweighed demand at the start of the year, with Sweden’s decision to cut domestic road emissions targets for 2024-26 leading to an increase in HVO entering the ARA hub. Lower HVO prices have incentivised blending of renewable diesel in some markets, eating into European supply. Improvements in used cooking oil (UCO) supply and high stocks in ARA allowed the prices to cool down, just in time for the legalisation of the public sale of HVO in Germany, the last important road fuel market in Europe to adopt the paraffinic fuel. Following the announcement of the legalisation, prices and premiums stayed low and stable in Germany as media coverage about HVO increased, sparking enthusiasm among sellers. But at the end of May, when the legalisation of HVO at public gas stations came into force, German GHG certificate values plummeted to new record lows, which in turn prompted sellers to increase their HVO-prices versus diesel.

Global demand and supply

Potentially large end consumers such as logistics companies and OEMs are investigating demand versus supply scenarios for HVO before taking it into their portfolio.

Demand for HVO and HVO feedstocks such as UCO and animal fats is on the rise. In the EU, member states are broadly making progress towards the bloc's increased emissions savings ambitions, notably under the revamped Renewable Energy Directive (RED III), which targets a 29pc share of renewables in final energy consumption in transport by 2030. And changes to national mandates could prompt a more immediate increase in biofuels blending. For example, the Netherlands has approved — and retroactively increased — the renewable energy annual obligation to 28.4pc from 19.9pc for 2024, and to 29.4pc from 21pc for 2025.

Demand for HVO feedstock UCO is also increasing rapidly, with a growing share of the waste raw material being used to produce sustainable aviation fuel (SAF). Argus Consulting estimates global UCO availability to be around 8.9mn t in 2024. Global collection sits at 57pc, with a large portion of theoretical availability around the world not currently collected. UCO availability is expected to increase to 10.8mn t by 2030 as populations and the share of urban areas increase throughout the world.

Big demand potential meets growing supply

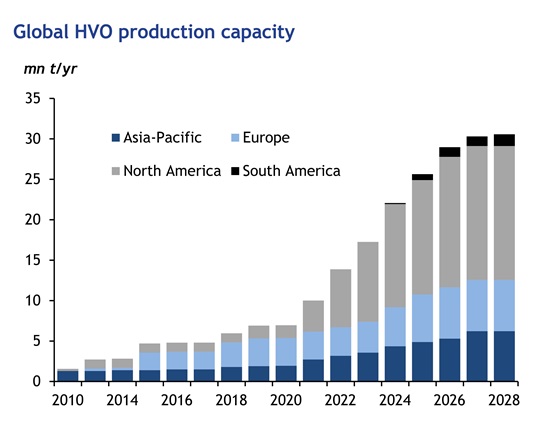

Germany consumes around 33mn t/yr of diesel, while global HVO production is projected to reach 22mn t in 2024. With most production added in North America, the overall availability of HVO might also be a limiting factor to a large-scale German switch from fossil diesel to HVO. German distributors estimate that HVO100 sales in Germany were at 50,000-60,000t in 2023 — a far smaller amount compared with Germany’s diesel consumption — yet importers are registering significantly rising figures for this year.

Source: Argus Biofuels Outlook

Infrastructure

Germany produces hardly any HVO, and so relies on imports via the Rhine river and seaports in the north. Every month companies are repurposing more individual diesel tanks at import terminals for HVO100.

What's driving demand for HVO100 in Germany?

First real option to save CO2 in heavy duty transport

The main buyers of HVO in Germany are companies operating truck fleets looking to lower their CO2 emissions. For several reasons, electrification remains a challenge in this sector, while HVO is the first viable opportunity to reduce CO2 emissions without having to replace engines.

Future growth opportunities

Several distributors and major oil companies are investing in HVO production and infrastructure, as they believe HVO demand will continue to rise, albeit not drastically, in the short-term. One basis for an increase in HVO demand in Germany is the national greenhouse gas (GHG) emissions reduction mandate, which will increase to 25pc by 2030 from 9.35pc in 2024. This quota regulates the share of CO2 companies need to compensate for when selling diesel and gasoline at the wholesale level. Selling HVO is one way to generate GHG savings certificates for this purpose and is therefore an additional revenue stream to the mere product margin. Furthermore, HVO’s competitiveness with fossil diesel may rise as the CO2 tax rises for the latter, but not for HVO.

Despite the challenges, HVO100 will (eventually) be part of the fuel mix

It is unlikely German HVO consumption will increase drastically in the short term. But it seems realistic to assume in the mid and longer term HVO100 will have a relevant share in Germany’s transportation fuels mix as its rising application in heavy duty transport continues. Several large end consumers have indicated they are keen to switch from fossil diesel to HVO. When they do, this may lead to a substantial rise in demand.

Sufficient supply and rising environmental incentives (GHG quota) will be key for keeping the premium of HVO to diesel at a low level, making it a viable alternative. But it is unlikely HVO will soon be cheaper than diesel in Germany, because there is not sufficient HVO supply to fully replace diesel. Indeed, the HVO premium to diesel may be volatile in the coming years as legislation develops, GHG quota prices may recover, and supply and demand may go through periods of imbalance – both for feedstocks and the finished product.

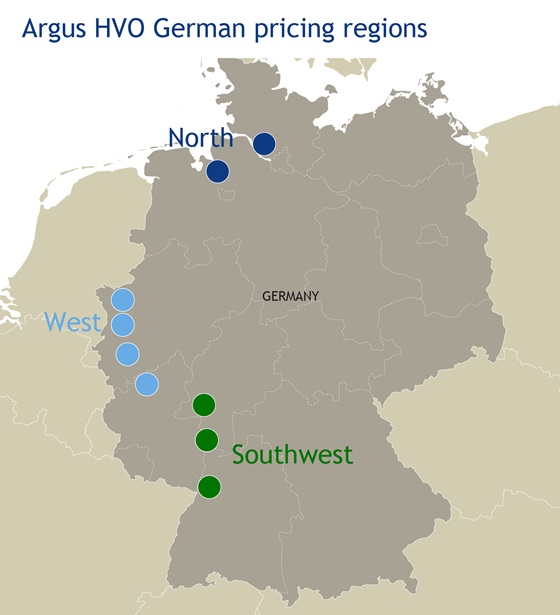

Argus’ editorial coverage, and suite of independent HVO prices for ARA barge loading and for truck loading in Germany provide a comprehensive picture of the European and German market. Both offer the opportunity to price HVO at its fair market value.

Learn more about HVO and our leading coverage of this increasingly important market. Visit the Argus HVO hub.

Author: Hagen Reiners, Editor, Oil Products