Overview

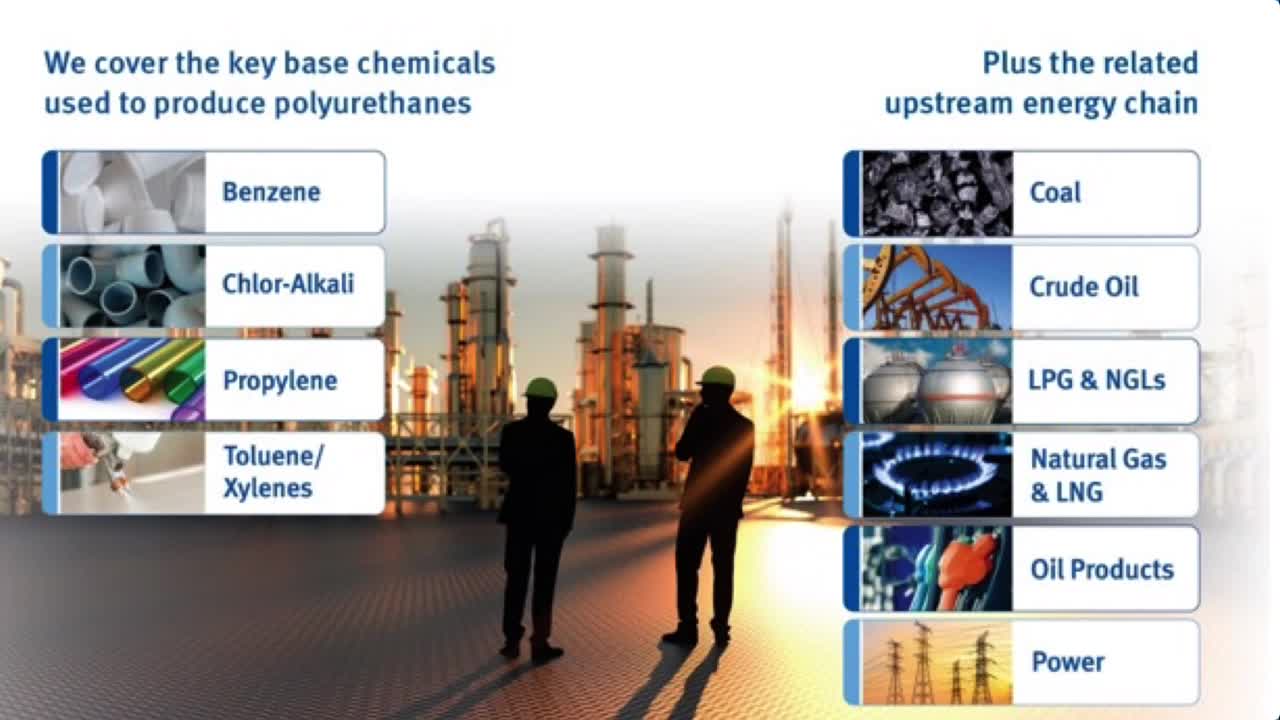

Polyurethanes are a feature of everyday life. They’re present in our furniture, bedding, clothes, shoes, buildings, and cars. The journey from base chemicals such as propylene or benzene to end-use polyurethanes involves multiple steps and chemical products. Argus can help you to navigate this complex and volatile value chain and make better commercial decisions around sales, marketing, distribution and procurement.

Argus’ polyurethanes services give you in-depth global and regional pricing insight, including feedstock analysis, in single, concise and integrated reports. In addition to pricing, you get access to global industry news and analysis of key economic drivers on a weekly basis. We cover isocyanates, propylene oxide, propylene glycols and polyols.

Video: Argus polyurethanes services

Latest polyurethanes news

Browse the latest market moving news on the global polyurethanes industry.

Whirlpool sees 2025 appliance market flat to down

Whirlpool sees 2025 appliance market flat to down

Houston, 28 October (Argus) — Appliance maker Whirlpool anticipates the appliance market to be flat to down slightly, by three percentage points, both overall and for North America this year, Whirlpool said in its third quarter earnings release. Whirlpool's third quarter net sales rose by 1pc to $4bn up from $3.9bn in the prior year because of new product releases, specifically in North America. Whirlpool plans to launch over 100 new products globally in 2025. North American net sales rose by 3pc year over year in the third quarter, strengthened by new product sales. Net sales in Latin America and Asia were down 6pc and 7pc, respectively, because of volume declines. Whirlpool's small domestic appliances (SDA) segment sales increased 10pc in the third quarter supported by new product launches. Of Whirlpool's major appliance products sold in the US, 80pc are produced in the US, lessening the strain poised by tariffs. The company is still battling imports that were front loaded prior to tariffs but is starting to see import inventories and arrivals decline. Appliance makers us polyurethanes for insulation and sealants. Polyurethane demand has been below historic levels this year as tariffs and economic uncertainty have slowed consumer demand, according to market participants. Many polyurethane participants expect next year to look similar to 2025 for appliance application demand. Whirlpool expects recovery in the housing market to benefit the appliance maker as they have a high home builder relationship allowing Whirlpool appliances to be placed in new builds. The US has a shortfall of three to four million housing units, the company said. The company delayed its expectation of the US housing market recovery in 2025 moving it into 2026 to begin a multi-year rebound once interest rates ease. Despite a challenging 2025, the company views its North America business well placed for future growth. Whirlpool reported a $73mn profit in the third quarter, a decrease from $109mn recognized last year. By Catherine Rabe Send comments and request more information at feedback@argusmedia.com Copyright © 2025. Argus Media group . All rights reserved.

Dow to shut Belgian polyols plant by March 2026

Dow to shut Belgian polyols plant by March 2026

London, 2 October (Argus) — US chemical firm Dow will shut its 94,000 t/yr polyether polyols production site at Tertre, Belgium, by the end of March next year, it confirmed to Argus today. The move is part of a broader review of the company's European assets aimed at addressing "the structural challenges of high costs, driven by high energy costs and a burdensome regulatory environment", Dow said. The site is likely to be dismantled after closure, workers' union FGTB said. The plant has three production lines, but two were already idled as part of a restructuring that began in 2023, according to the union. The closure will affect 37 roles and eight contractor positions. Dow said it does not expect any impact to customers and will continue delivering the same product mix. The firm has 530,000 t/yr of polyether polyols capacity at its Terneuzen site in the Netherlands and a further 60,000 t/yr in Tarragona, Spain. Europe's polyether polyols market has been pressured by weak demand and excess production capacity, compounded by rising imports, mainly from Asia. Dow said a loss of competitiveness in the face of increased imports was a key factor in the decision to close the Tertre site. Imports of all polyethers, including polyether polyols, into the EU averaged 286,000 t/yr in 2020–24, with record deliveries of 323,000t last year. Imports in January–July this year were 6.3pc higher than the same period a year earlier. China is the leading supplier, followed by South Korea and Saudi Arabia. Demand from key polyether polyol sectors — including automotive, appliances and soft furnishings — has been hit by limited consumer confidence and lower spending on durable goods. Demand from the construction sector has also faltered on economic uncertainty and a weak investment environment. Argus assessed the September contract price for flexible slabstock polyether polyols at €1,030–1,100/t, down from a midpoint of €1,225/t in January and 24pc lower than the September 2024 price. Early indications for October suggest continued softening in the polyols market. By Laura Tovey-Fall Send comments and request more information at feedback@argusmedia.com Copyright © 2025. Argus Media group . All rights reserved.

US government shutdown delays construction data

US government shutdown delays construction data

Houston, 1 October (Argus) — The US government's shutdown that started today will delay the release of monthly domestic construction spending data closely watched by a number of commodity markets, including polyvinyl chloride (PVC), polyurethane, asphalt, steel and non-ferrous metals. The partial government shutdown started today and marks the first in six years after talks among lawmakers and the White House to reach a last-minute funding agreement failed. The US Census Bureau, which was expected to release its monthly residential and commercial construction data today, anticipates 7pc of its 11,100 staff will be exempted from furloughs during the shutdown, but "most activities will cease", according to the bureau's updated shutdown plan. The bureau's website today posted a message saying information would not be updated due to the lapse of funding and inquiries not answered until after funding has resumed. The monthly report is a critical dataset for domestic PVC market participants and others because it provides insight into construction activities that consume large volumes of certain commodities, especially in the residential market. Domestic PVC and polyurethane demand have remained under pressure this year on a weaker housing market. Participants are closely monitoring construction spending, housing starts and permits for a fundamental shift to stimulate demand, especially after the US Federal Reserve cut its target interest rate and announced a series of cuts during the fourth quarter. The building blocks of polyurethanes, such as isocyanates including polymeric MDI (PMDI), go into insulation, roofing applications and carpet underlay. It is unclear which other government agencies will delay releases or maintain operations. The US Bureau of Labor Statistics, which publishes key data on employment, prices and inflation, plans to "completely cease operations" if funding lapses, according to a shutdown plan dated 26 September. The US Department of Agriculture today added it will not update information on its website during the shutdown. By Catherine Rabe and Gordon Pollock Send comments and request more information at feedback@argusmedia.com Copyright © 2025. Argus Media group . All rights reserved.

Ineos to close European PO, PG production

Ineos to close European PO, PG production

London, 18 September (Argus) — UK-based Ineos will indefinitely shut down propylene oxide (PO) and propylene glycol (PG) production in Europe even if chlorine supply resumes to its idled 210,000 t/yr chlorohydrin-based PO production plant in Germany. The firm has notified clients, in a letter dated 8 September, it would cease production of PO and PG with immediate effect. Argus understands Ineos has also withdrawn from industry association Cefic's PO and PG working group from 2026. Ineos' PO production plant at Cologne supplies its 120,000 t/yr PG production unit nearby. Both plants have been offline since a fire on 12 July caused a power outage at Germany's Chempark Dormagen. That in turn prompted German chemical firm Covestro on 15 July to declare force majeure on a range of products, including chlorine. Covestro provides chlorine to Ineos' Cologne PO production plant, which then had to shut down, and Ineos declared force majeure on its PG production on 18 July. Ineos did not declare force majeure on its PO production, which is mainly for captive use. Repairs are underway at Chempark Dormagen but the damage was extensive and full operations are unlikely to resume before the first quarter of 2026. But Ineos has told clients it will not resume PO or PG production. The decision may predate the fire in July, as some downstream users of Ineos' PO have been seeking alternative sources since at least the middle of the second quarter. Ineos has this week declined to comment. By Laura Tovey-Fall Send comments and request more information at feedback@argusmedia.com Copyright © 2025. Argus Media group . All rights reserved.

Spotlight content

Browse the latest thought leadership produced by our global team of experts.