The ACP’s decision to reduce vessel transit slots owing to low water levels has disrupted spot LPG and VLGC trade and pricing.

The Panama Canal’s announcement in late October that it was to cut daily transits each month this winter has upended typical spot trading and pricing patterns on international LPG markets, as participants readjust to the prospect of US Gulf coast exports having to sail east rather than west.

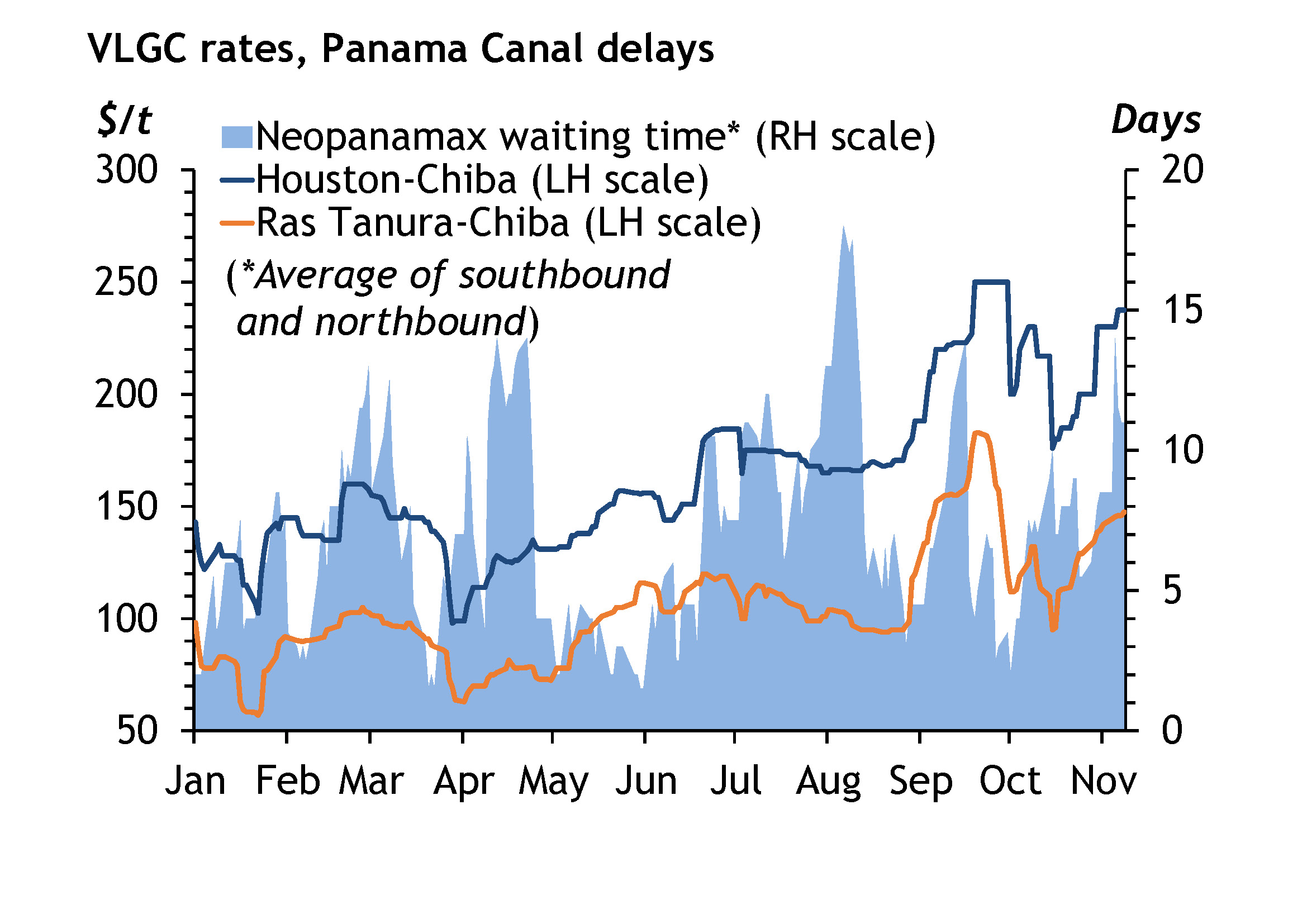

Canal authority ACP said late last month that it would reduce the number of booking slots to 25/d from 3 November, 24/d from 30 November, 22/d from December, 20/d from January and 18/d from February — during the busiest months for the channel — owing to low water levels and falling rainfall projections. These are in addition to the canal’s new “Booking Condition 5”, which redistributes transit slots among different vessel sizes from 8 November, and was already expected to considerably increase vessel waiting time. LPG carriers are designated the lowest priority at the canal, below passenger ships, container vessels and LNG carriers.

The news has shaken LPG markets, in particular in Asia-Pacific, which relies so heavily on imports from the US Gulf coast through the Panama Canal. Japan, China and South Korea are the US’ largest LPG importers, with 64pc, 41pc and 89pc, respectively, of their total intake sourced from the US in the first 10 months of this year, Vortexa data show.

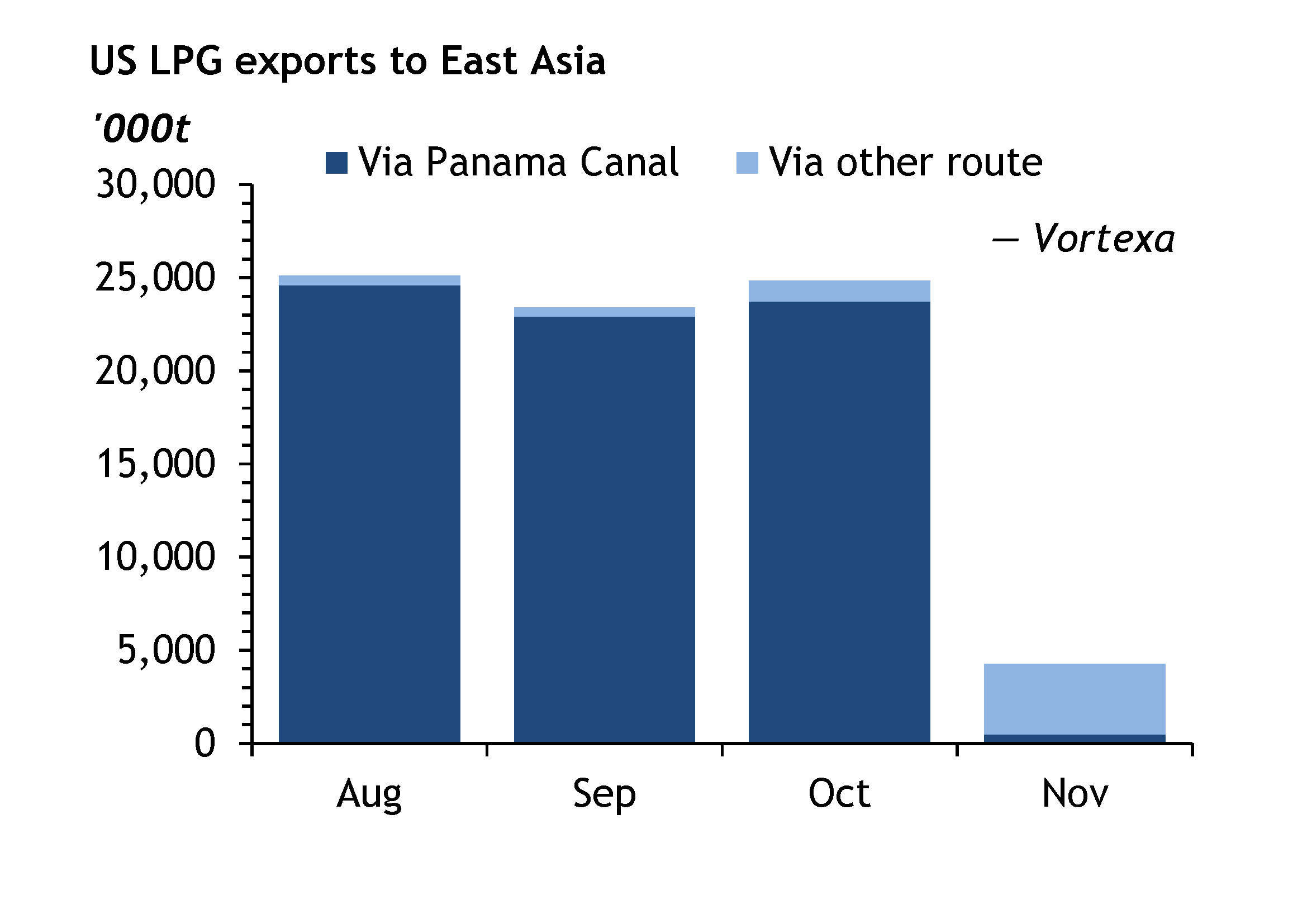

Planned deliveries to Japan and South Korea in the second half of December have been disrupted, as vesselcharterers reroute VLGCs from the canal to far longer journeys east through the Suez Canal and around the Cape of Good Hope. These add around 14-16 days to a journey that typically takes around 30 days from Houston to Japan when sailing through the Panama Canal. So far this month, only a quarter of all US shipments are scheduled to go through the canal, compared with half over the past seven years, Argus data show.

.png?h=2000&w=2588&rev=175648bb73ba451c9cc59f0068d44d35&hash=6286C0935836D75774EBE56EF0A34688)

The number of VLGC shipments from the US to east Asia that have been diverted away from the Panama Canal has surged since August when delays reached record highs at the Neopanamax locks. The latest ACP announcement has led to at least 10 VLGCs sailing east from the US Gulf coast towards the Suez Canal, and eight targeted at ports in Asia, instead heading towards the Cape of Good Hope, ship tracking data show. Both routes cost over $100/t more than regular transits through the Panama Canal.

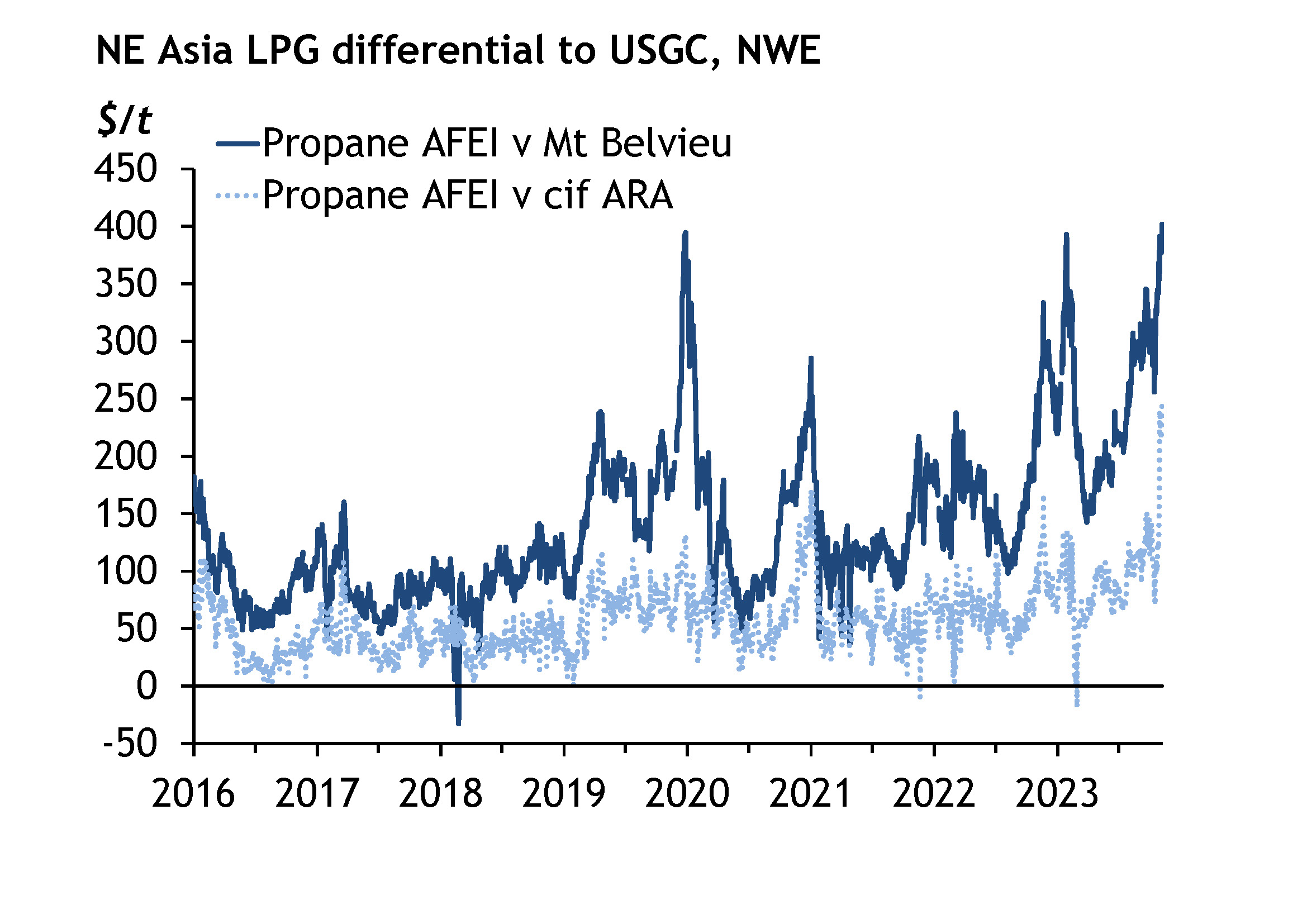

Delivered propane prices on the Argus Far East Index (AFEI) — basis Chiba, Japan — subsequently surged past $725/t by 10 November. The jump is all the more remarkable given crude prices have slumped over the same period, with Brent crude dropping to nearly $80/bl by 10 November from $97.80/bl on 20 October. Chibawill become the furthest export market for US Gulf coast cargoes sailing east instead of through the Panama Canal, meaning importers previously further away, such as Ningbo in China’s Zhejiang province, or India, standto benefit from cheaper freight as a result of the diversions. Some of the diverted US cargoes that were Suez bound have changed to Dahej in India, although it is too early to confirm this as their destination.

Change the channel

Regional buyers that use state-controlled Saudi Aramco’s contract price (CP) for imports are likely to find new ways to price the surge in available US supplies should the Suez Canal and Cape of Good Hope become the main supply routes.

US Mont Belvieu propane prices have also fallen as the already oversupplied country faces up to a worsening glut from the canal restrictions. Estimated prices for US propane deliveries to Japan using Mont Belvieu assessments and Houston-Chiba VLGC rates fell to the widest discount to the AFEI since February, when heating demand in northeast Asia spiked. US propane prices typically track delivered Asian values closely, as the regional arbitrage opens and closes to keep the market in equilibrium.

Mont Belvieu propane prices have fallen by a quarter so far this month compared with a year earlier, while relative to WTI crude they have dropped to around 34pc from 41pc. Domestic inventories stood at 101.2mn bl (8.16mn t) by 27 October, the latest EIA data show, up by 15pc on the year. US propane exports averaged 1.52mn b/d (48mn t/yr) in January-August, according to the EIA, of which 451,000 b/d was delivered to Japan,199,000 b/d to China, and 143,000 b/d to South Korea. Northwest Europe is a far closer market for US sellers, but it has taken 75,000 b/d over the same period, or 5pc of the US total, and has limited capacity to take in any more than it already does.

Prices in northwest Europe have also slumped as a result of the Panama Canal restrictions and the prospectof US LPG inundating the region. Outright large cargo propane prices fell by almost $100/t, dropping nearly $10/t under front-month paper. The regional market is already grappling with weak demand despite the weather getting colder, with weak petrochemical production margins putting a cap on run rates, which have been stuck at about 70pc for the past three months. Temperatures have also been well above average during autumn, keeping inventories abundant.

The uncertainties that have arisen from the canal restrictions have led some US sellers to offer cargoes to Europe, despite the arbitrage being firmly shut. The reality is that these will need to be offered at steep discounts to lure any buyers for storage purposes — some market participants say they would need to fall below a $30/t discount to front-month cif ARA paper.

Freight expectations

VLGC rates meanwhile have been inching higher to close in on the record levels they reached in September — largely a result of Panama Canal congestion — despite relatively lacklustre vessel demand so far this quarter. This poses the question of how high they might climb when demand peaks this winter. The benchmark Ras Tanura-Chiba rate hit a new high of over $180/t in 22 September, before falling to $95/t by mid-October. It hassince risen towards $150/t as of 10 November. The Houston-Chiba rate followed a similar trajectory, hitting $250/t, then $176/t, and then $237.50/t over the same timeframe. Estimated waiting times at the Panama Canal were 10 days northbound and 12 days southbound on 10 November. While these are not out of the ordinary, the new conditions have deterred vessels that do not have a pre-booked slot.

A vessel owned by Japan’s Eneos paid a record $3.97mn to transit the Panama Canal in an 8 November auction — the first time that auctions had resumed after a week’s cancellation owing to ACP water-saving measures. A further two slots were sold at $3mn and $2mn on 9 November.