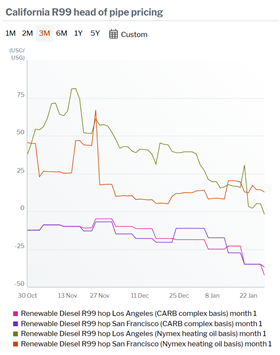

US renewable diesel: Trade moves hop diffs lower R99 at the head of the pipeline (hop) in California continued its descent on the back of fresh trade this week.

Renewable diesel production capacity is set to double by the end of 2027. With this anticipated growth over the coming years, it is critical to ensure fair and reflective values are provided for market participants. As the leading source of global renewable diesel pricing intelligence, this weekly market insight will shine a light on this relatively new and fast paced market and provide visibility to price indicators.

January 29, 2024

R99 head of the pipeline in Los Angeles was heard to have traded 5¢/USG lower than the week prior on a CARB ULSD + attributes basis for February, with the best offer for the week surfacing at the same level of trade. Week-on-week, R99 hop differentials in Los Angeles fell by 7.5¢/USG on a CARB ULSD + attributes basis, while those in San Francisco fell by 2¢/USG. San Francisco R99 shipping at the head of the pipeline in February was valued 5-6¢/USG above that in Los Angeles.

In rail markets, volumes shipping into California in February were offered as low as where Los Angeles R99 hop traded during the week, with no bids surfacing. Meanwhile, vessels with February timing in California were heard offered 8¢/USG lower than offers the prior week on a CARB ULSD + attributes basis.

The premium for R99 hop in Los Angeles flipped to a discount on 26 January for the first time since Argus began tracking prices in September. The differential fell by around 33¢/USG on the week.

International supply of renewable diesel continues to make its way into California. Argus vessel tracking data indicates that in the next month, a maximum of 1.1mn bl is set to be delivered into the state from Singapore. US Gulf coast supply will also make its way to California, with a maximum of 323,000 bl to be sent from Port Arthur, Texas, to Long Beach.

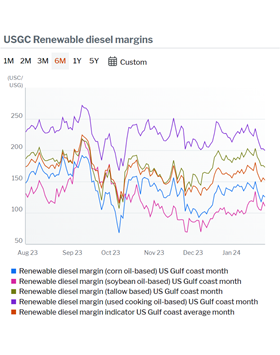

In the US Gulf coast, renewable diesel margin indicators are trending above the fourth quarter average on lower feedstock prices across all types. In the fourth quarter, the Argus US Gulf coast renewable diesel indicator averaged 154¢/USG, compared to 164¢/USG year-to-date.

Stay on top of pricing changes in the renewable diesel market. Sign-up to receive a free weekly price snapshot of the California R99 spot price assessments.

Argus launched independent price assessments for the California R99 spot market in November, to help drive enhanced visibility. Learn more about these prices.

Explore Argus Americas Biofuels