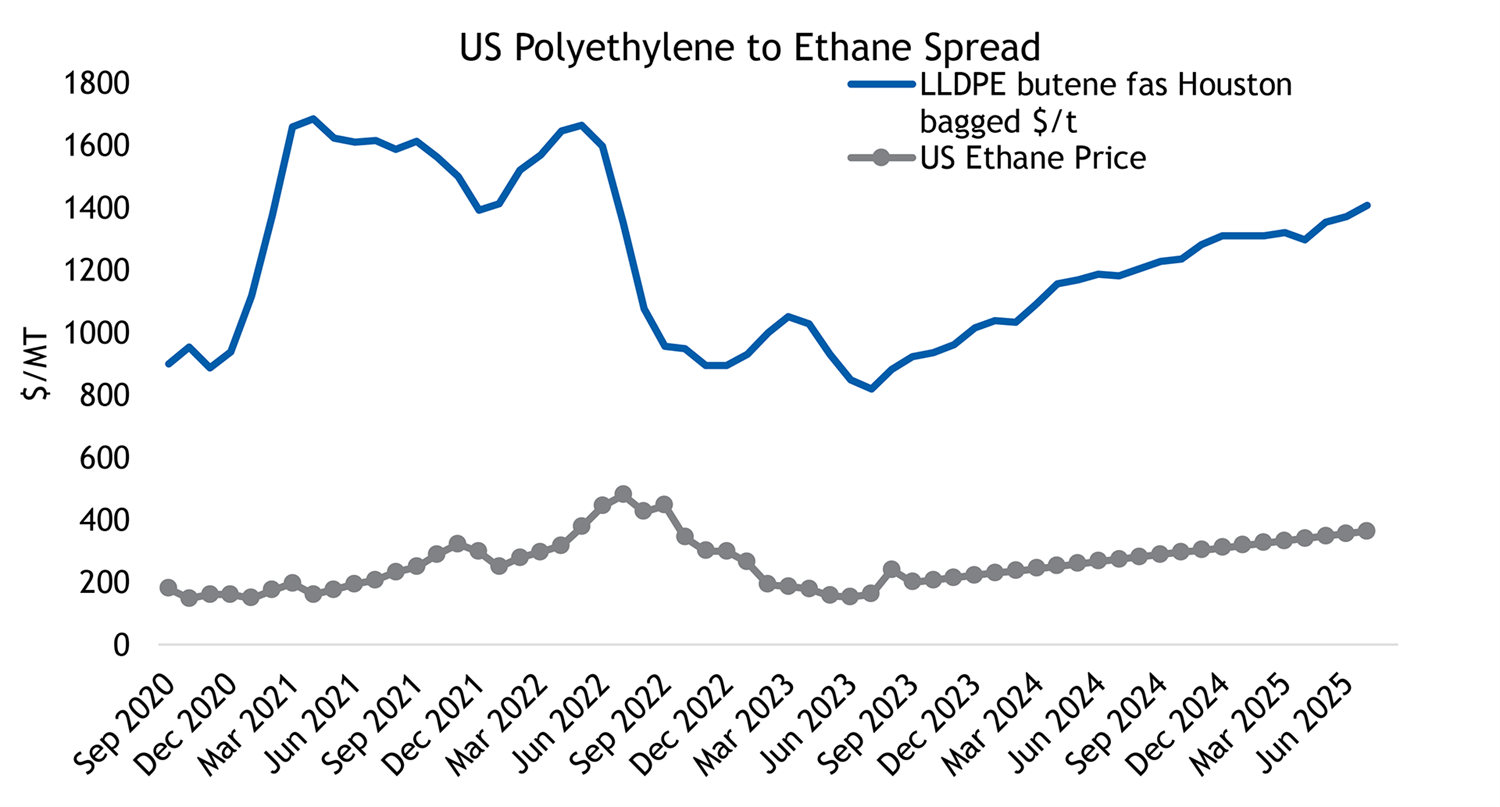

Integrated polyethylene producers in the US have greatly benefitted from the spread between the price of US ethane and the price of LLDPE butene.

The US market is in stark contrast to that of northeast Asia, where producers have been experiencing negative margins (described in our recent blog here). While Argus forecasts the US ethane price to slightly increase into 2024 and 2025, we also expect the price of LLDPE to increase at a similar or higher rate, barring any significant production disruptions. This news is welcomed by integrated polyethylene producers because the ethylene margins are forecasted to remain narrow into the near future.

Ethylene margins are expected to be slim, excluding any supply disruption or substantial economic change. In recent years, ethylene margins have been affected by both. First, supply disruptions due to winter ice storms in February 2021 caused prices and therefore margins to reach record highs of over 1000 $/mt. After coming down from this peak, from March 2022 into the current month has been influenced by several economic factors, such as additional capacity coming online, slower global demand that occurred in the second half of 2022, the war in Ukraine, and climbing interest rates. All of which caused the market to lengthen and margins to reach near-record lows. However, even during the lowest margin months, margins never went negative like they did in Asia. While disruptions can occur at any time, both positively and negatively affecting ethylene margins, integrated PE producers must look toward the bigger and much larger picture.

.png?rev=-1&hash=6CCF5790AC3F1DA771D56322F395A14A)

Integrated PE producers, which is arguably a large majority of ethylene producers, should not grow weary looking at the forecasted narrow ethylene margins, as the integrated PE margins will continue to increase. Argus has forecast these margins to continue to grow steadily into 2H25 as noted alongside the continual increase of LLDPE butene fas Houston bagged contract price. As seen in the chart below, producers could make two times as much as their costs in the coming years. This should leave US integrated PE producers feeling optimistic about their PE margins, even if ethylene margins remain narrow.

.png?rev=-1&hash=3739AC8BFF6545E4F0A60EB41082CCD1)

The data and insight used in this article is taken from the Argus Olefins Outlook and Argus Polyethylene Outlook.

Author Cassidy Staggers