Canadian canola crush volumes in September rose to a fresh high for the month during strong biodiesel demand in North America and as poor oil content of crops required greater use of feedstocks.

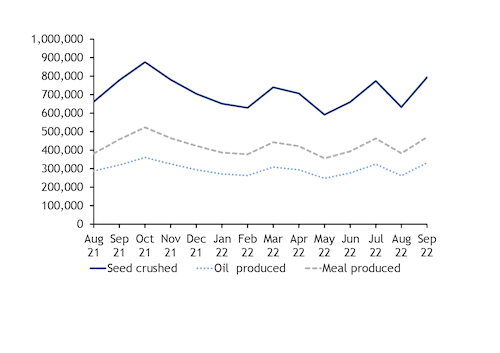

About 794,000t of canola seeds were crushed last month, up from 633,000t in August and 778,500t in September 2021, Statistics Canada data show. This was also the highest monthly volume since October last year (see chart).

Last month's crushing activity led to an oil output of 332,000t, while canola meal production totalled 470,000t — also at their highest since October.

That said, Canada's canola crush volumes so far this marketing season (August-July) reached 1.43mn t, marginally lagging volumes seen a year ago of 1.44mn t. The nation is anticipated to crush 10.2mn t of canola in 2022-23, up from a multi-year low of 8.56mn t last season, under the US Department of Agriculture estimates, reflecting an improved domestic harvest and stronger biodiesel consumption.

Also, Canadian crushers are having to use greater input this season because of the poor oil content of domestic canola crops that were carried over from 2021-22. September volumes implied an oil content of 41.8pc compared with a national average of 41.3pc for the 2021-22 crop, under Canadian Grain Commission assessments. The latter rate was down from 44.1pc a year ago and a new low since at least 2000-01, as unfavourable weather conditions last season weighed on the crop's quality.

While weather conditions have improved this year, oil content improvement from 2021-22 has lagged gains in overall harvested volumes. Preliminary Canadian Grain Commission data put the oil content of this year's crop in western Canada at 42.4pc, which would still be the second-lowest level since 2003-04. This implies that Canadian crushers might need to use more seeds than in previous years to meet the oil demand. With canola stocks at multi-year lows at the start of this season and rising global interest in canola seeds rather than oil, domestic crushers might have to compete with the export market for feedstock.

Global trade

The US has lifted imports of canola oil from Canada since the start of 2022-23, while also stepping up its own production. The nation received 177,500t of product from Canada in August, up from 163,000t a month ago and 167,200t a year ago. US interest boosted Canada's exports at the same time, which were both higher on the month and the year at a combined 213,000t.

Higher North American demand also more than offset weak buying interest from China. Canada exported just 3,100t of canola oil to China in August, while the latter's receipts from the origin reached 104t over the past two months. Reported volumes from the Chinese customs are likely to reflect weak arrivals of product that were shipped from Canada in July and early August.

That said, lower canola oil trade between Canada and China was in line with the latter's weak interest in imports of product from the global markets. China's canola oil receipts fell for four months running to hit 45,700t in September, with the bulk of supply coming from Russia and the UAE.

But China is instead stepping up imports of canola, particularly from Canada, in an effort to crush seeds domestically and cope with elevated canola oil prices globally. Chinese buyers are reported to have secured 1.8mn t of canola for November-January shipment, while Canadian vessel line-ups show at least 418,000t earmarked for the destination this month.