Nigerian crude is moving out of storage as a weaker market structure no longer makes it profitable to store cargoes for sale at a later date. This rise in supply is pressuring values.

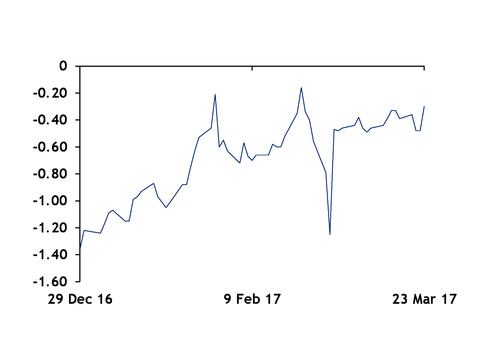

The flattening contango, or narrowing of the forward price premium to prompt prices (see graph), has encouraged traders to sell Nigerian crude from Saldanha Bay, South Africa, mostly to buyers in the Asia-Pacific region. Up to 7mn bl is thought to have been sold from — or fixed to leave — the depot in the past month.

Saldanha Bay, a key strategic facility for west African crude traders, has capacity to hold 45mn bl of oil in concrete storage tanks each storing up to 7.5mn bl. Sources at the facility confirm customers have indicated they will be taking some crude out in the coming months "because there is no market structure."

Trading firm Vitol this week sold 2mn bl of Qua Iboe to India's state-run refiner HPCL, in a tender for cargoes loading in the first half of May, with the crude likely to come from Saldanha Bay. Vito last month sold a similar volume of the light sweet Nigerian grade to Taiwan's CPC, and has fixed the very large crude carrier (VLCC) Astro Chloe to take the cargo there, loading from Saldanha Bay on on 28 March. At around the same time Vitol offered 4mn bl of Qua Iboe to European buyers on a delivered ex-ship (des) basis to Rotterdam or Lavera, France, in the public trading window — an unusually large volume to be offered at one time, which also appeared to reflect Vitol's decision to offload its stored Nigerian crude.

Earlier this month PetroIneos — a joint-venture between Ineos and Chinese state-controlled trading firm PetroChina — bought 1mn bl of Qua Iboe from Vitol out of Saldanha Bay for its 205,000 b/d Grangemouth refinery in Scotland. The cargo loaded on the Suezmax Milos on 14-15 March and is on its way to the Finnart oil terminal, according to vessel tracking. Last week, Total offered a VLCC of Escravos on a delivered to Singapore basis, arriving on 15-25 May. Shipping reports indicate the firm will load the cargo from Saldanha Bay on 20 April.

Nigerian crude is also emerging from storage elsewhere, albeit in smaller sizes. Thailand's PTT bought a partial cargo of Agbami from floating storage in Singapore in a tender to buy crude for 21 April-10 May arrival. A 500,000 bl cargo of Brass River that Argentine refiners Axion and Shell Argentina bought for late-May delivery was heard to have come from storage in the Caribbean.

The relatively large volume of Nigerian crude being pushed out of storage has hampered the sale of April-loading cargoes, and weighed on values relative to North Sea Dated. Late last month, April-loading Qua Iboe was offered at a premium to North Sea Dated of $1.30/bl. Earlier this week, shortly before the May loading programmes emerged, ExxonMobil was still offering an April cargo of the grade, but at a $1/bl premium to Dated, with traders pegging values at least 40¢/bl lower.