Rising natural gas production this year from North Dakota has curbed western Canadian flows on Northern Border and limited price gains on that pipeline.

Associated gas production from the Williston basin, which includes the Bakken and Three Forks formations in North Dakota, has exceeded year-earlier levels since February. Overall gas production in the state reached a record 1.85 Bcf/d (53mn m³/d) in May, up by 13pc from a year earlier, according to the North Dakota Department of Mineral Resources.

Final production numbers from June may show a new high as producers there are focusing in areas with a high gas-to-oil ratio, the agency said.

Spot gas prices from February to May on Northern Border at Ventura, Iowa, averaged $2.80/mmBtu, up by 55pc from a year earlier. But the price increase lagged that of the NIT/AECO hub in Alberta, where prices almost doubled year over year to $2.06/mmBtu.

Northern Border delivers Canadian gas and supplies from North Dakota, to major midcontinent markets such as Chicago. The pipeline receives production from the Western Canadian Sedimentary Basin through TransCanada's Mainline system near Port of Morgan, Montana.

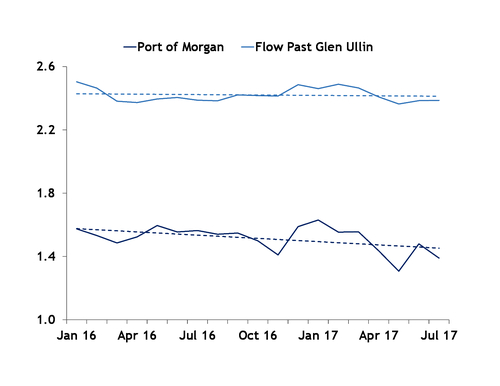

Gas flow from Canada at Port of Morgan in the first half of 2017 averaged 1.5 Bcf/d, down by 3.3pc from the year-earlier period, according to pipeline flow data.

Meanwhile, gas flow on Northern Border past the Glen Ullin compressor station, which indicates Bakken receipts, has been near its full capacity of 2.4 Bcf/d for the past year.

The decrease in flows from Canada does not necessarily mean production from North Dakota has displaced Canadian imports, according to BTU Analytics senior energy analyst Erika Coombs.

Production from western Canada could reach the US using various other pipelines.

Alliance pipeline, which can transport liquids-rich gas from North Dakota and the WCSB to Chicago, had high utilization amid growing production.

Alliance in March held a non-binding open season to gauge interest in expanding the pipeline capacity by 30pc in response to high demand. The pipeline said it could hold a binding open season as early as this fall if there is sufficient interest for capacity.

Demand for gas in the midcontinent in the first half of 2017 averaged 12 Bcf/d, down by 4pc from the year-earlier period primarily on lower power sector demand, according to BTU Analytics.

Power generation from natural gas in the midwest census region in the first half of 2017 should average 294GWh/d, down by 19pc from a year earlier, according to the US Energy Information Administration (EIA). Gas-fired generation in the second half should increase to 377GWh/d, 1pc higher than the year earlier, the agency said.

Pipeline imports from Canada from January to April averaged 8.6 Bcf/d, up by 7pc from a year earlier, according to the EIA.

Some of that gas can be shipped back to eastern Canada to meet demand there.