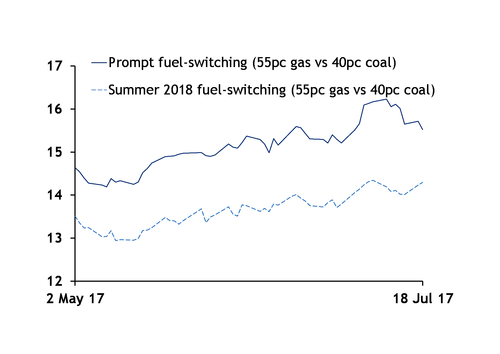

The coal curve's backwardation could make it more difficult for Statoil to optimise Troll production, although there could still be some incentive to turn down output in August-September.

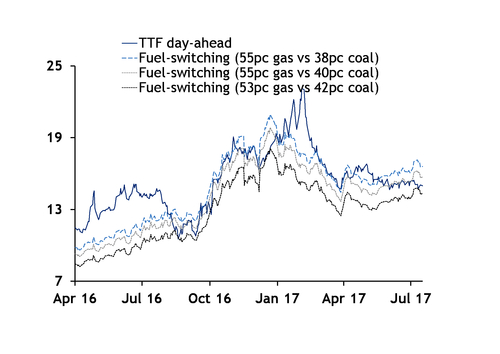

TTF prompt prices have found support at levels that have brought gas into competition with coal in the generation mix this summer.

But the coal curve's backwardation — with prompt prices higher than forward prices — has lifted prompt fuel-switching prices, assuming a 55pc-efficient gas-fired plant and 40pc-efficient coal-fired unit — above the summer 2018 equivalent.

Unless TTF prompt prices drop below the fuel-switching price it could be difficult for them to open a substantial discount to forward contracts.

But a contango has been able to develop at the TTF, in part because the summer 2018 market has remained above fuel-switching prices.

Russian state-controlled Gazprom's record second-quarter sales to Europe, brisk UK exports through the Interconnector and strong Norwegian production so far this summer have weighed on TTF prompt prices. The TTF day-ahead market has moved deeper into fuel-switching territory in the past two months, sliding to levels that would bring 54pc-efficient gas-fired plants into competition with 41pc-efficient coal-fired units.

The TTF curve has moved into contango despite below-average stocks in northwest Europe.

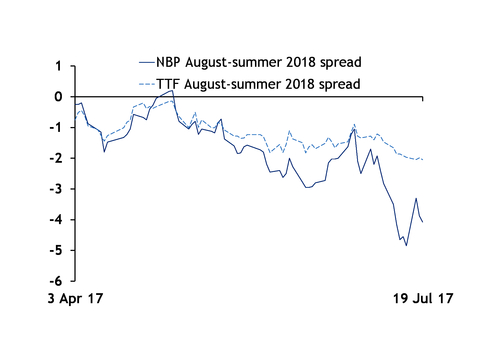

NBP and TTF August and September prices below the summer 2018 markets could encourage Statoil to turn down production from its Troll swing field and possibly defer output into the coming years. But far wider discounts could have opened up had the coal curve not been in backwardation.

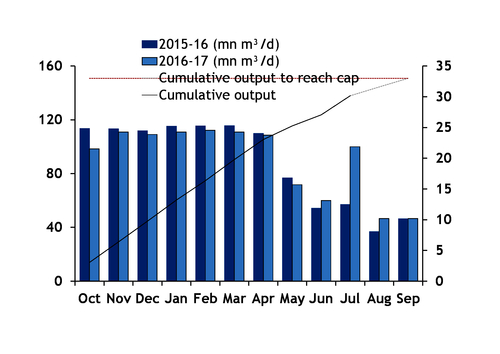

The Norwegian firm would need to reduce output over the next two months just to hit the field's 33bn m³ cap for the 2017-18 gas year. This could mean that even a sharp drop in Troll offtake in August-September from this month's quick output may not result in gas being pushed back into the 2018 summer.

Statoil has previously said that it is easier for its trading business to profit with commodity curves in contango.

The marketing, processing and renewable energy segments "are typically more able to make profit in a contango market than in a backwardated market on the oil side," Statoil's Torgrim Reitan, who was then chief financial officer, said on 25 July 2013.

"On the gas side you will typically also be subject to the structures in the market as such," Reitan said. He has since become Statoil's vice-president for US development and production.

Statoil's trading department can profit from prompt and near-curve prices opening a wide discount to forward contracts. The firm could buy back some of the Troll production it has already sold for the remainder of the third quarter and sell it into the 2018 summer. This would enable the firm to profit from unwinding its hedges without actually producing some of the Troll gas it had planned to take this summer, providing the spreads are wide enough to cover the cost of the deferrals.

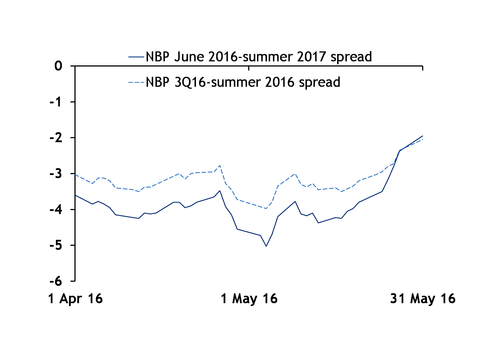

Statoil reduced Troll production in June-September 2016, saying that it had sold it into future periods.

The June 2016 contract was as much as 5p/th below the summer 2017 market in early May last year, although the spread tightened towards the end of the month.

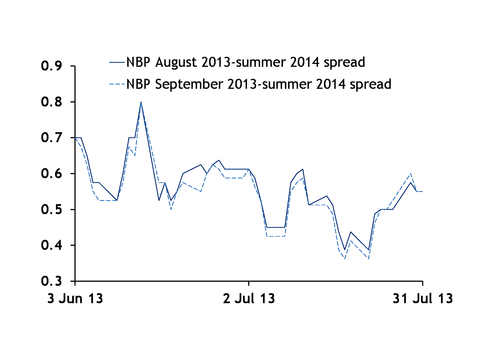

In contrast, Statoil's trading revenues had come under pressure in 2013. The TTF curve had been in backwardation at the time, with the August 2013 contract closing €0.50/MWh above the summer 2014 market on 25 July 2013.

Low stocks following the cold 2012-13 winter combined with the crude curve's backwardation had lifted the TTF curve from the front during the 2013 summer.

But coal prices have increasingly replaced oil as the main driver of European gas markets since 2013 with the spread of hub-indexation.