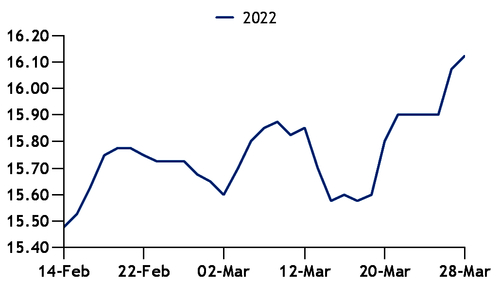

The TTF calendar 2022 contract rose on Wednesday ahead of expected government announcements on the future of Groningen production.

There may be scope for sharp cuts to Groningen production in 2022 from previous years, which could boost northwest Europe's high-calorie import demand.

The government is expected to present scenarios on future Groningen production after its cabinet meeting on Thursday and to also make a decision on whether an additional nitrogen ballasting facility will be built.

A new site could allow for an additional 5bn-7bn m³/yr to be converted into low-calorie gas from high-calorie supply from the first quarter of 2022.

GTS has said that the facility could not be commissioned before early 2022 and that this date could only be met if the scope of the project is unchanged and if a decision to proceed with constructing the site is taken quickly.

Successive governments have delayed a decision on building the site multiple times, saying that additional quality conversion capacity may not be required once the facility could become operational because of reduced low-calorie demand across northwest Europe.

Low-calorie consumption in Germany, France and Belgium is expected to decrease steadily in the 2020s because of the conversion of low-calorie systems to run on high-calorie supply. And FNB expects the sharpest absolute fall in German low-calorie consumption in two consecutive gas years over the next decade from 2020-21 to 2021-22, with demand dropping to 173.8TWh from 209.8TWh.

This could allow for further reductions to Groningen output in 2022 compared with previous years, while lifting northwest Europe's high-calorie demand.

The government plans to switch the country's largest industrial users, which burn a combined 5.5bn m³/yr of low-calorie gas, to other sources of supply by the end of this cabinet period in late 2021.

GTS had recommended switching the seven largest customers by 2021 and a further 25 consumers by 2022, which could cut low-calorie demand by an aggregate 3.4bn m³/yr, although VEMW has said that only smaller reductions in demand may be possible.

But the extent to which such a conversion would lift high-calorie demand would partly depend on the scope for switching consumers to renewable energy sources.

And some industrial consumers may also aim to reduce their low-calorie consumption by increasing energy efficiency measures which could further limit the extent to which it needs to be substituted by high-calorie supply.