Norwegian state-controlled Statoil's reporting then subsequent retraction of maintenance at its Oseberg field last week was in compliance with remit, the producer said.

Norwegian offshore system operator Gassco added a 20mn m³/d constraint for 20 April-30 September to its schedule on 19 April before removing it the following day. The schedule did not specify the field, although it was the Oseberg field operated by Statoil.

Gassco publishes restrictions based on information from shippers, but said "unfortunately this specific information was wrong".

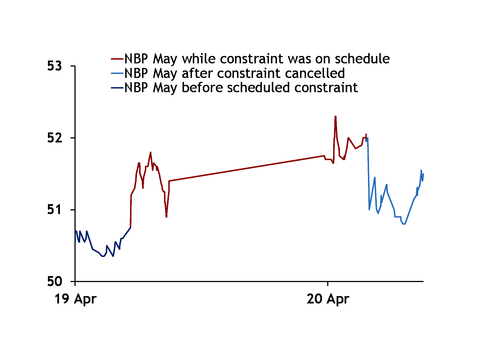

NBP and TTF prices for delivery this summer climbed after the restriction was added to the schedule at 13:45 CEST (11:45 GMT) on 19 April. But they fell after it was removed from the schedule on 20 April at 12:16 CEST — six hours into its 164-day scheduled maintenance period.

The maintenance could have curbed production — had it gone ahead — tightening the supply-demand balance with northwest Europe already requiring record injections this summer to lift stocks to the three-year 1 October average.

Statoil defended its reporting of the maintenance, although would not comment further on the specific remit messages.

"All information or updates on outages expected to affect NCS [Norwegian Continental Shelf] volumes are published in compliance with the remit scheme on Gassco or/and Statoil's web pages," Statoil said. "We do not provide further assessments on remit messages unless it should relate to an ongoing emergency response incident."

Traders called on Gassco to disclose the name of fields in future. Planned maintenance is typically listed as "field" for production constraints, although processing plants are named if they have curtailments.

Market participants were seeking to identify the field after the initial remit notice detailing the 20mn m³/d "reduced availability". Production capacity constraints have different reductions in actual output depending on the field.

There were a number of fields that could have a 20mn m³/d reduction in production capacity, including Troll, Oseberg and Ormen Lange.

Ormen Lange typically operates at full capacity and a 20mn m³/d cut in availability would have resulted in a similar decrease in production, especially with little maintenance scheduled at the Nyhamna processing plant.

But Troll and Oseberg typically operate below capacity during the summer. This can result in reductions in available capacity not reducing actual output. Oseberg would still have about 7mn m³/d of spare capacity with a 20mn m³/d curtailment, but rarely produces this much during the summer.

And Troll could still produce about 100mn m³/d with a 20mn m³/d capacity cut. Output was higher than this at times last summer, especially April, but with extensive maintenance planned at the downstream Kollsnes processing plant planned in April-September this year it would rarely have been able to produce more than 100mn m³/d.

Gassco has increased the amount of remit notices it posts since 4 April as part of an increased market transparency drive.

But a number of remit notices listed do not specify the field's name and sometimes leave the capacity reduction unknown, especially in the event of unplanned constraints. Gassco has a reporting threshold of 5mn m³ for unplanned constraints. Unplanned outages may be initially listed before details are known about the size of the constraint and then removed if it is less than 5mn m³.

Gassco has not yet commented on whether it will increase disclosure of field names.