As crude and natural gas liquids infrastructure continues to point outward from North American inland basins, a small wave of refined products projects is moving against the tide in Texas.

Increasing fuel demand in the state has prompted shipper interest in new pipelines and other projects, and midstream providers have responded, with more possibly to come.

"Demand for refined products on our system has been increasing for the markets we serve in west Texas," Magellan Midstream Partners said earlier this month. "Demand has increased as crude oil production in the Permian is continuing to grow."

Permian pressure

Booming upstream activity in the Permian basin of west Texas and eastern New Mexico has created a feedback loop: production increases, much of it is sent to the coastal refinery belt where it is processed into fuel, which in turn is sent back to power drilling and hydraulic fracturing equipment and the growing fleet of trucks needed to move produced liquids, sand, water, diesel and other items.

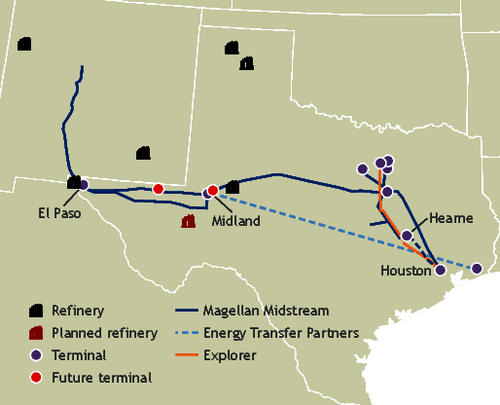

The western leg of Magellan's 100,000 b/d refined products system out of Houston already serves the area, and the company is building new pipe and pumping power to boost that to 150,000 b/d. The expansion from Frost, in north Texas, to Odessa originally was 40,000 b/d when it was announced in March, but it grew by the time an initial open season was completed in early May. Now a second open season for an additional 35,000 b/d of capacity and possibly a new terminal is underway, continuing until 11 July.

And the company might not be done.

"We are constantly evaluating opportunities to provide flexible transportation and storage services to meet the needs of our customers," Magellan said.

The new capacity could be ready in 2020. While greater demand from Abilene to El Paso is the driver, Magellan's system also can feed into its trans-border pipeline at El Paso and Kinder Morgan's SFPP East pipeline that runs from El Paso to Tucson and Phoenix in Arizona.

Magellan's project would come full circle from the early days of the latest Permian boom when it reversed and converted its westbound Longhorn products pipeline into a crude pipeline that today can move 275,000 b/d from the Permian basin town of Crane to Houston. It was the first of what has become many major new crude takeaway projects from the region.

Another major developer of outbound Permian crude pipelines, Energy Transfer Partners (ETP), also is looking to send fuel back. A binding open season ended this week for a proposed 30,000 b/d diesel pipeline from Hebert, near Beaumont, to Midland, with service available by the end of 2020.

The company declined to comment on the status of the open season.

Holly Energy Partners, which operates the 100,000 b/d Navajo refinery in the region at Artesia, New Mexico, has proposed a 30,000 b/d diesel truck rack near Orla, Texas, in the production sweet spot of the Permian.

"This asset will serve growing diesel demand associated with the oil patch activity in and around the Delaware basin," chief executive George Damiris said last month.

Delek, which runs the 73,000 b/d refinery at Big Spring on the Permian's eastern edge, saw 30¢-35¢/USG diesel margins at its 300 Alon-branded stores from central Texas to New Mexico during the first quarter. Chief executive Uzi Yemin said he welcomes competition from incoming fuel providers, but said matching its distribution capability will be a challenge.

"It is not easy to get to that part of the country," Yemin said last month, adding that he expected margins to shrink to 14¢-15¢/USG this summer.

Another possible source of fuel in the region could be the proposed 10,000 b/d MMEX Resources refinery at Fort Stockton, Texas, in the Delaware basin region. Developers say the project, which is not yet under construction, could be producing up to 4,000 b/d of high-sulfur diesel usable by upstream equipment by the end of next year.

Plans eventually call for a 100,000 b/d refinery with an eye toward exporting products to Mexico by rail.

Destination: Dallas

Meanwhile, midstream companies are looking elsewhere in Texas to find new homes for products produced on the coast. The 660,000 b/d Explorer pipeline, which takes Texas fuel and natural gasoline north into the midcontinent, has added at least 10,000 b/d of new capacity from Houston to Arlington, between Dallas and Fort Worth.

"We do have other projects on our plate but just are not quite able to discuss them at this point," Explorer said last week.

Magellan, which in 2013 made a products line from Dallas to southern Oklahoma bidirectional to allow shippers to take advantage of shifting arbitrage conditions, is expanding its southern system by 85,000 b/d. Part of that growth will involve a new line from Houston to Hearne, about halfway to Dallas, and reversal of a southbound line from Frost to Hearne.

Magellan has said the expansion would be ready in late 2018. The company also is reactivating a jet fuel pipeline serving Bush Intercontinental Airport in Houston.