The annual shutdown of the 55bn m³/yr Nord Stream gas pipeline is unlikely to limit Russian supply in Europe, but Gazprom will need to switch to withdrawals to maintain sales.

Nord Stream is scheduled to be off on 17-30 July. Flows were 1.75 TWh/d on 1-2 July, unchanged from June and well above the pipeline's nameplate capacity of 1.59 GWh/d.

Gazprom has some space to lift transit through Ukraine to help meet nominations, but will also have to draw on its European stocks.

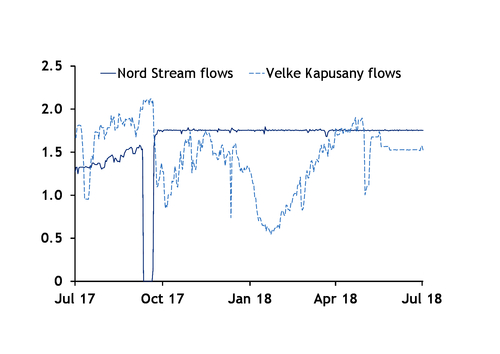

Annual maintenance in 2017 halted Nord Stream deliveries on 11-21 September compared with flows of 1.62 TWh/d over the rest of the month. The firm lifted deliveries to Velke Kapusany to 2.1 TWh/d from 1.6 TWh/d, which left around 1.12 TWh/d to be met using sources other than pipeline flows from Russia.

Russian exports to Europe and Turkey, excluding Blue Stream, fell to 4.69 TWh/d from 5.71 TWh/d, but Gazprom slowed injections and switched to withdrawals at its European storage capacity to make up the difference.

The firm had similarly lifted transit through Ukraine during maintenance in 2016 to make up for the restrictions to Nord Stream capacity.

Flows at Velke Kapusany on the Ukraine-Slovakia border were lower this year compared with last September at 1.54 TWh/d on 1-2 July, up from 1.53 TWh/d in June and below combined firm and interruptible technical capacity of 2.41 TWh/d. This would only allow for an increase in Ukrainian transit of 864 GWh/d, a shortfall of 889 GWh/d compared with deliveries through Nord Stream that would need to be met from other sources.

The highest Velke Kapusany delivery in recent years was the 2.19 TWh/d in September 2013, which if repeated would leave 1.1 TWh/d of Nord Stream that would still need to be offset.

Gazprom could achieve this comfortably with a swing to withdrawals, especially when taking into account that it has been injecting in Europe.

And the firm's stockbuild may have been boosted by Gazprom delivering to itself to fill its European storage capacity ahead of the maintenance.

Lower deliveries to its own storage capacity and withdrawals could reduce the need for higher flows from Russia. Stocks at Gazprom's capacity at Austria's Haidach facility were 11.6TWh yesterday morning, up from 8TWh a year earlier. The firm also holds capacity at the Katharina, Etzel, Rehden and Jemgum facilities in Germany, the Netherlands' Bergermeer facility and the Czech Republic's Damborice facility, among others.

Gazprom says it uses its European storage capacity to meet long-term contract obligations rather than to capitalise on storage spreads.

The firm has previously said it has almost 900 GWh/d of withdrawal capacity in Europe before it contracted extra space in central and eastern Europe last year that may have boosted its withdrawal capacity.

While the firm's European stocks and withdrawal capacity are likely to be lower in July than during last year's Nord Stream maintenance, they would still be sufficient to offset the pipeline's halt once combined with higher Ukrainian transit.

Withdrawals of close to 900 GWh/d would result in a higher swing in net storage movements given that the firm would also reduce injections.

Gazprom maintaining deliveries to customers with a switch to higher Ukrainian transit and storage withdrawals while Nord Stream is off typically results in the maintenance having little effect on outright prices because there is little change in supply at the hub.

The aggregate European stockbuild typically slows when Gazprom reverses to withdrawals, but injections by other firms remain largely steady — at least once adjusted for changes in demand or supply from other sources.

The firm plans to ensure storage capacity abroad of at least 5pc of annual export volume, which means that Gazprom should have around 10bn m³ held in European storage facilities this year, the firm has said. But a final decision on how much gas it will inject for use over the winter will be made in September, it said.

| Gazprom withdrawal capacity at selected sites | ||

| Storage facility | Total stocks (TWh) | Gazprom withdrawal capacity (GWh/d) * |

| Haidach | 11.6 | 198.2 |

| Bergermeer | 22.3 | 279.3 |

| Rehden | 34.6 | 105.8 |

| Damborice | 1.3 | 73.8 |

| Jemgum | 2.5 | |

| Etzel | 16.3 | |

| Total | 88.6 | 657.1 |

| — Gazprom | ||

| * Maximum capacity, independent of withdrawal curves | ||