Even as 2018 volumes of US styrene (SM) exports grow, higher US ethylbenzene (EB) exports to China are poised to continue through 2018 in response to derivative styrene (SM) anti-dumping duty (ADD) measures at least until additional planned styrene capacity comes online in China.

New Chinese styrene capacity is slated to come online starting at the end of 2018 and through 2019, which will shrink China's styrene deficit and add length to the global styrene market. Despite the imposed ADD in February 2018, China is still an estimated 3.2mn t/yr net short styrene, of which 1.7 mn t/yr is imported from ADD countries South Korea, Taiwan and the US.

An estimated 260,000 t/yr of styrene capacity is scheduled to come online in 2018, but another 2.45mn t/yr is slated to come online in 2019. This pending capacity expansion has many US styrene participants concerned about styrene margins in the US in 2019, which enjoyed an average high of roughly $395/t in 2017 and stand at about $300/t in July 2018.

Southeast Asia trade flows are set to change as the US continues to export styrene to world markets, including Asia.

In 2018, the volume of US styrene (SM) exports to China has declined as a result of ADD levied against US styrene producers.

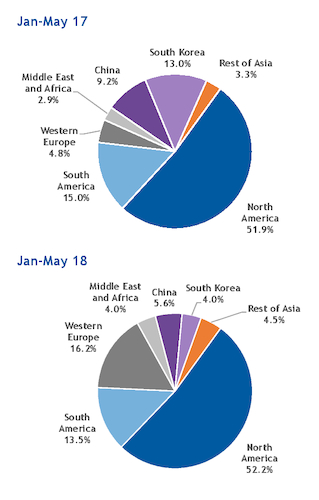

American Fuel and Petrochemical Manufacturer's (AFPM) data shows that US styrene exports to China from January-May 2018 fell to 6pc (37,920t) of total US styrene exports at 632,000t.In January-May 2017 US exports to China were 9pc (55,080t) of total styrene imports 612,000t.

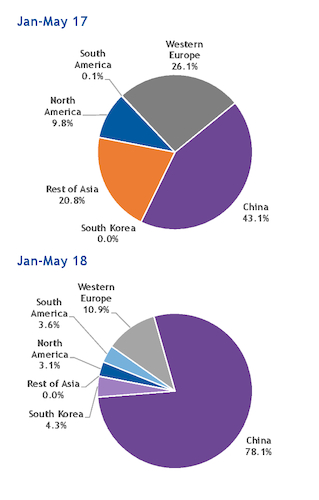

However, feedstock EB exports to China have increased over last year as a way to circumvent styrene ADD. This comes as China remains net short SM and ethylene-based feedstock EB. China received 78pc (87,000t) of total US EB exports from January-May 2018, which totaled 112,000t, up from 42pc (28,000t) of total EB exports from January-May 2017, which totaled 65,000t.

Even though the US has exported 17,160t less total styrene to China so far in 2018 compared to the same time frame in 2017, China has imported 59,500t more ethylbenzene from January-May 2018 compared to January-May 2017. In short, the US has exported 33pc less styrene to China in 2018 compared to last year but exported more than three times the EB in 2018 compared to last year.

As China consumes more feedstock ethylbenzene rather than styrene, other countries that usually import EB from the US, such as the Netherlands, are now receiving EB from countries in Western Europe.

Ethylbenzene has proven a more opportunistic export for the US in 2017 and 2018 because of extended turnarounds and unexpected outages at US styrene units, during which EB units have continued running at higher rates. This allowed US producers to export the styrene feedstock more readily.

Although shipping EB takes away the natural gas cost-advantage that US producers have when shipping styrene, EB has become more opportunistic to ship to China this year following the implementation of SM ADDs levied against the US at a revised 13.7-55.7pc.

As a result of EB volume moving to China from the US, US participants noted that EB inventories in China are high, estimated at 50,000t at the end of June. China's imports of benzene, styrene, phenol and cumene are lower from 2017, but China is expected to remain short C6 molecules in 2018.