Marine fuel scrubber installation planning surged over the last six months to include 842 vessels, but that scrubber count is still insufficient to absorb a projected surplus in high-sulphur residual fuel oil in 2020.

Containerships are the biggest residual fuel oil bunker consumers, and the bigger containership conglomerates have yet to commit to a scrubber installation strategy. Tankers, the second biggest category of residual bunker fuel consumers, saw an uptick in scrubber demand, especially for VLCCs, but the count remains small in the context of the global fleet.

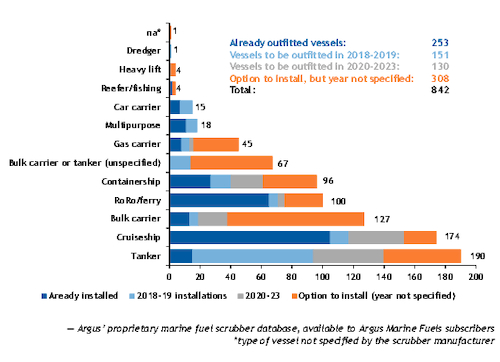

Argus Media's proprietary marine fuel scrubber database recorded 253 vessels currently outfitted with scrubbers, with 151 vessels set to come online in 2018 and 2019. A further 130 vessels will be outfitted with scrubbers between 2020 and 2023 and there are 309 vessels for which commissioning dates are not specified. Tankers, containerships and bulk carriers are the biggest consumers of heavy bunker fuel oil, but the number of those vessels with scrubbers accounts for less than 5pc of their respective fleets.

A study by the US-headquartered organization International Council on Clean Transportation (ICCT) estimated that in 2015 tankers, containerships and bulk carriers accounted for 78pc of the global residual fuel oil bunker demand: containerships for 30pc, bulk carriers for 25pc, oil tankers for 16pc and chemical tankers for 7pc. The study pegged global demand for residual bunker fuel at 210.27mn t and for marine distillates at 49.52mn t in 2015.

In 2017 cruiseships accounted for the bulk of the vessels outfitted with scrubbers, followed by RoRo freight vessels and ferries. To date in 2018, tankers have outpaced cruiseships when it comes to the number of vessel scrubber installations. The tanker count, which includes crude, product and chemical tankers, reached 190 and the cruiseship count was at 174. But tanker scrubber installations account for less than 5pc of the global tanker fleet. According to Argus' database, fifteen of these are already outfitted with scrubbers, 79 are expected to be outfitted before 2020 and 46 are on order between 2020 and 2023. Among the shipowners with the most tanker orders are – Frontline, which ordered scrubbers for 14 tankers with the option to add 22 more tankers of unspecified size and DHT Holdings, which is retrofitting scrubbers on 12 of its existing VLCCs and commissioning two newbuild VLCC with scrubbers. Other tanker shipowners outfitting VLCCs and Suezmaxes with scrubbers include Cosmo, Hunter Group, Kyklades Maritime, Maran Tankers, Sentek Marine & Trading and Trafigura.

In addition Trafigura plans to charter up to 32 newbuild tankers of undisclosed size with scrubbers when they are delivered before 2020. Other oil companies that have been looking to secure time-charter of tankers with scrubbers include ExxonMobil, Koch, Total, Statoil, Irving Oil, and GS Caltex, among others.

The Exhaust Gas Cleaning System Association pegged the number of vessels currently installed and on order at 983 as of the end of May compared with Argus' vessel scrubber count of 842 as of the end of July. The discrepancy in the numbers can be attributed to the fact that some shipowners prefer to keep their scrubber installation plans confidential as it could affect their competitive advantage of offering cheaper freight rates in 2020.