Limited availability of phosphate in the US continues to push prices higher, even as farm economics have diminished and import tonnage rises.

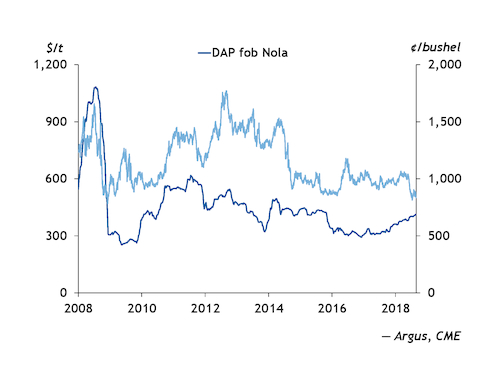

The US phosphate and row crop markets have been on diverging paths since 29 May, when escalating trade tensions between the US and China sent crop prices tumbling but the unexpected strength of Mosaic's summer-fill program shortened already thin phosphate supplies. Since then, expected returns from the 2018 crop have been in decline, with corn prices falling by 16pc to $3.56/bushel and soybeans have fallen 21pc to a 10-year low of $8.34/bushel as of 28 August.

At the same time, Nola barge values for DAP and MAP have risen by 9pc (to $412.50/st fob as of on 23 August) and 12pc (to $422/st fob), respectively.

Phosphate prices have risen because of rising international prices, Mosaic's decision to idle its Plant City, Florida, facility in December, removing about 320,000t/quarter of actual domestic phosphate production and limited domestic stocks.

In the six months following the plant's closure, US phosphate imports have risen to compensate for the loss of Plant City's output. Customs data show imports of DAP and MAP from January-June rising by 43pc from last year to 1.39mn t, while exports during that time fell by 11pc to 1.69mn t, keeping the market fairly balanced through that point. But Argus projects third quarter phosphate imports at around 648,000t — a slight increase from last year's 647,947t — but not enough to offset the decline in production.

The additional import tonnage needed could be hard to come by this year as competition from the prolonged South American demand season has siphoned off any excess tonnage off of the global marketplace. While global supply availability is expected to improve in October, it may be too late for the US as the October river close date forces many exporters to stop loading vessels for the market in late September. US prices will likely need to be at a premium to global prices to attract the necessary tonnage.

Early planting prospects from the field suggest that corn acreage could climb to 95mn acres next year as soybean values plummet amid ongoing trade disputes with China and crop expansion in Brazil and Argentina. The estimated 91,000t rise in phosphate consumption associated with this increased corn crop, coupled with supply limitations, has resulted in market participants raising their forecast outlook for phosphate barges by another $15-20/st before the end of the fall application season in November.