Much steel market commentary and discourse this year has focused on trade, given US president Donald Trump's battle to rein in the country's trade deficit, but China remains the key market driver.

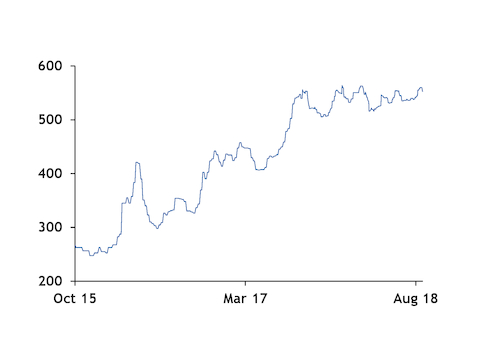

The introduction of the 25pc Section 232 steel tariff in June saw US hot-rolled coil prices rise above $900/st on an ex-works Midwest basis, and altered the ratio between scrap and iron ore pricing.

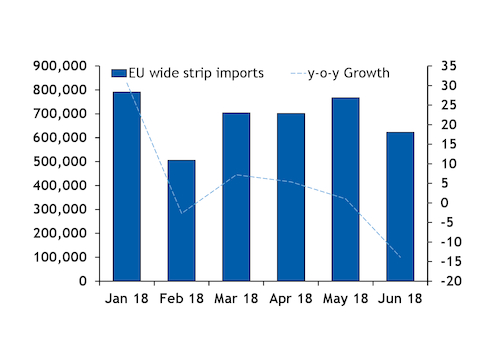

The US action stimulated trade defence measures in other big steel import hubs, such as the EU. In response to Section 232, the EU has a preliminary 25pc tariff in place on imports from the vast majority of countries. EU officials will meet this week to discuss the effectiveness of the tariff and whether definitive measures could be implemented later this year.

The reduction in competitive imports, combined with mill consolidation in Europe, could lead to the establishment of new greenfield mills by re-rollers, which fear inflated pricing going forward. Some European re-rollers are reportedly looking to invest in their own steelmaking capabilities.

And the wider trade dispute between the US and China could have a dramatic impact on the global economy, as the US will shortly have duties in place on everything it imports from China. Should China retaliate by offloading its US debt holdings in response, the macroeconomic environment could deteriorate rapidly.

But despite trade wars grabbing the headlines, Chinese production discipline remains the real driver of steel market fundamentals. Chinese exports collapsed to 75.43mn t in 2017, from selling 112.4mn t abroad in 2015. China has exported around 47.2mn t so far this year, compared with 54.5mn t over the first eight months of last year. The year-on-year fall in sales and the reduction in China's steel inventories mean it is likely that 2018 exports could fall compared with last year, despite previous expectations of being broadly flat — August exports were relatively unchanged from July despite the depreciation of the yuan.

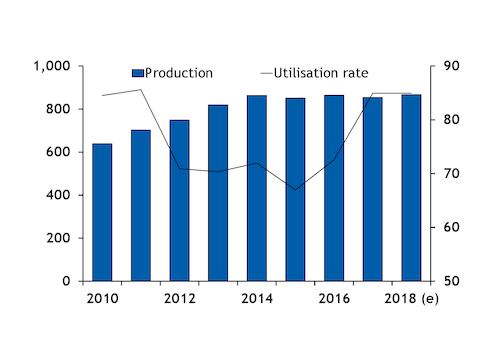

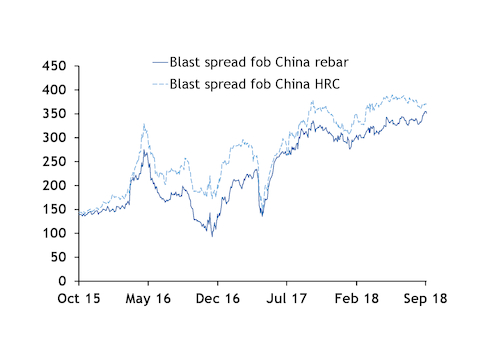

Exports have been constrained by a surprisingly strong domestic market, as well as anti-dumping duties. Strong domestic demand and increased utilisation rates have supported mill profitability in China, and across the rest of the world, bolstering producer returns and share prices. Far from undermining the steel industry as it was once perceived, China is now a relative market leader, underpinning the health of the wider sector.

There is a link between China's strong steel fundamentals and wider trade discord — Beijing will have to ease back on the pace of planned economic reforms given the potential for a trade war-led economic slowdown, so it has reduced credit restraints, aiding a buoyant real estate market. This has provided a spur to Shanghai Futures Exchange rebar as well as spot pricing.