Record premiums for high-quality NAR 6,000 kcal/kg Australian coal are encouraging producers to wash up NAR 5,500 kcal/kg high-ash coal to reduce ash and raise calorific values (CV). But capacity constraints, yield losses, transport and environmental costs limit how much high-ash coal can be upgraded for sale to more lucrative markets.

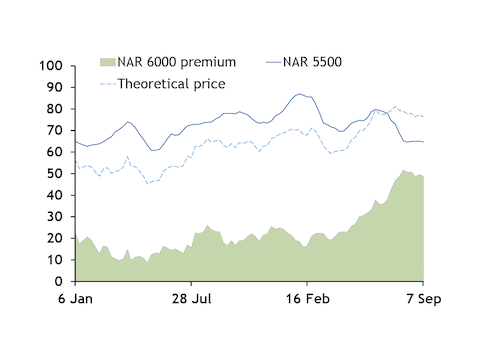

The price premium for fob Newcastle NAR 6,000kcal/kg to NAR 5,500 coal from the same key port has been above the long-term average for the past 18 months and has widened to new records over the past six months. Fob Newcastle 6,000 kcal/kg coal was at $113.60/t on 7 September, over $48/t higher on a non-heat adjusted basis than fob Newcastle NAR 5,500 high-ash coal at $64.78/t, partly because high-ash coal has been hit by softer Chinese demand over the past two months and because higher-premium coal is in tighter supply.

Tender demand from buyers in Korea and Taiwan — which favour NAR 5,700-5,900 kcal/kg coal — has been strong, and encouraged blending or washing of high-ash coal for sale into those markets. But even with the heat-adjusted premium for 6,000kcal/kg NAR to 5,500kcal/kg wider now at $43/t compared with around $32/t two months ago, the cost and challenges of washing coal can still make it uneconomic for some mining firms to upgrade their lower-grade thermal coals, Australian producer and coal trading sources said.

Washing thermal coal creates significant waste, which reduces the volume sold and can cause an environmental problem at the mine site. In some cases, washing coal to reduce ash from around 22pc to 18pc can lift the CV to NAR 6,000 from NAR 5,500, but result in a 25pc volume loss, market sources say. And producers of coals with unusually high ash have no incentive to wash up because nearly half the volume would be lost to reduce ash to a level acceptable for premium markets, market sources said.

Producers also have to add trucking costs for transporting coal from the mine to the washing facility, as well as the cost of returning large volumes of waste coal back to the mine for permanent storage, resulting in a washing cost of $5-10/t.

In New South Wales (NSW) — which is home to the main Australian thermal coal region of the Hunter Valley — wash costs are also swelled by an A$14.80/t ($10.54/t) washery reject levy designed to reduce pollution. The levy is applied on each tonne of reject material from the washery and applied to land.

Incorporating yield losses, wash costs and the reject levy implies that NAR 6000 kcal/kg coal must exceed $40/t for producers to economically wash up high-ash NAR 5500 kcal/kg material to NAR 6,000 kcal/kg, Argus estimates.

Investment challenges

Many thermal coal mining firms in Australia do not have the option to increase the grade of the coals, either because they do not have a wash plant or because they are already operating it at around full capacity.

There is little appetite to invest in new wash plants, as investors and shareholders are concerned about the capital return over the long term. Shareholders in major mining firms, such as BHP, have made it clear that they would rather see money returned to shareholders than invested in coal.

Many of the larger coal mining firms produce both higher and lower grade thermal coal and are unwilling to invest heavily in producing more high-grade, which could undermine the wide premiums they currently receive for existing top-quality grades. This has become more pronounced following the consolidation of the industry in Australia, and especially following the exit of UK-Australian mining firm Rio Tinto last year.

Cost-cutting has been the focus of most coal mining firms over the past five years, and investing in washeries has been minimal in the thermal coal sector. More has been invested in washing and processing plants for high-grade coking coals, where prices have been around double those for high-grade thermal coals and the cost base has historically been higher.

Junior mining firms are also struggling to raise funds in the current environment, with many banks declining to provide project finance for coal developments. This may change as more private equity moves into the space, but they will need to be confident that premiums will remain elevated over the longer term.

The aging of Australian coal mines is also reducing the quality of coals being exported, as much of the high-grade coal production is brought on line first to cover developments costs.

Mining firms also targeted high-grade coal seams when prices were depressed in 2015-16 to maximise margins at a time when most Australian coal mining operations were making a loss. This has tightened the supply of high CV coal and left producers with lower-grade coal that needs to be removed to access remaining high-grade coal that might be in deeper coal seams.

The drought in NSW has had little effect on the washeries, as they recycle much of their water and are a much smaller user of water than dust suppression conducted at the mine site.