A US Sabine Pass LNG cargo was headed for northwest Europe today, with European gas hubs having tightened their discount to Asian LNG markets in recent weeks.

The 136,000m³ Galea was on a course towards northwest Europe today, but had not declared a destination. It loaded its cargo from the US Sabine Pass export facility on 10 September.

If it unloads its cargo in northwest Europe it will be the first US import into the region since the 155,000m³ British Diamond delivered a cargo to the Netherlands' 8.7mn t/yr Gate terminal on 16 April.

Prices for delivery at Northwest European gas hubs have tightened their discount to northeast Asian LNG markets considerably in recent weeks. Much of this has been driven by firmer coal-gas fuel switching prices in northwest Europe, given the recent rise in the cost of European emissions allowances.

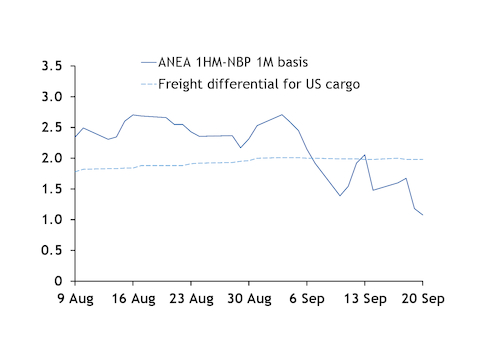

The NBP's front-month contract was close to providing a higher netback to the US Gulf Coast than the Argus northeast Asia (ANEA) front half-month market at the end of August. And the NBP October contract was more competitive than the northeast Asia second-half October market for US supply when accounting for the difference in spot freight costs.

The potential to reload LNG from terminals in northwest Europe also provides an additional option value to delivering into the region, traders said.

Market participants have also mentioned the possibility of using European reloads as a potential tool for bypassing China's imposition of a 10pc tariff on US LNG imports, which begins on 24 September.

But the spot freight costs of $2.25/mn Btu from northwest Europe to Shenzen yesterday would alone be more than a 10pc rise in the China second-half October market to $11.94/mn Btu from $10.85/mn Btu.