Polish exports of metallurgical coke have picked up in recent months, in particular through ports as opposed to rail crossings, as high Chinese prices encourage some mills to boost consumption of alternative origins.

Port operators in the port of Gdansk told Argus that met coke export shipments have become a steady feature since September and their current schedule indicates a continuation of this trend into early 2019.

One operator at Gdansk port said that prior to September, it had not loaded any met coke cargoes for two years. The operator is now exporting 1-2 met coke cargoes each month, each holding 20,000-40,000t.

The operator exported two met coke cargoes in November, and one cargo so far this month. It has another met coke export cargo scheduled for January. The shipments are heading to a range of destinations including Spain, Italy, Brazil and South Africa.

In total, Poland exported 4.8mn t of met coke in January-September, national statistics office GUS data show. Poland exported 6.2mn t of met coke in all of 2017.

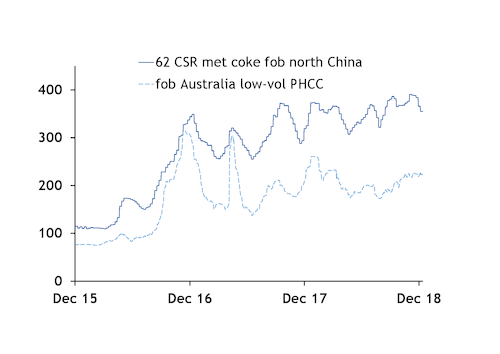

Steelmakers in Europe and further afield have expressed shock through much of this year at fob China price levels, arguing that they are highly inflated compared with premium hard coking coal prices and often driven more by China's domestic market dynamics than by seaborne factors (see chart).

The Argus daily fob north China assessment for 62 CSR met coke is at $355/t — down from a year-to-date high of $390.85/t fob in early November, but still up considerably from $325/t a year ago and $111/t fob on 10 December 2015.

The Argus daily fob Australia assessment for premium hard low-volatile coking coal is at $226/t today, indicating a $129/t spread between this index and 62 CSR met coke fob north China. By comparison, the spread between these two indexes was at just $88/t a year ago and at just $34.90/t on 10 December 2015.

With global met coke demand high but Chinese price levels pressuring margins, some mills have looked at ways to reduce their reliance on Chinese met coke and boost consumption of other origins instead. Flexibility is limited and depends on each steelmaker's exact requirements in terms of coke specifications, but some market participants have noted a push from certain buyers to diversify in recent months.

"We have see more enquiries for other origins — Polish, Colombian, Russian. People are trying to buy less Chinese met coke where they can because it is just so expensive," a European trader said.

In terms of Polish availability, the country's met coke output rose by 1.5pc year on year to 7.8mn t in January-October, GUS data show. Over the same period, crude steel output fell by 2.5pc to 9.5mn t, implying the potential for more met coke being made available for export.

Market participants said the decline in steel output might be related to the one-month maintenance outage at ArcelorMittal's blast furnace in Dabrowa Gornicza in July-August.

Meanwhile, Poland's coking coal imports remain strong, tracking similar levels to last year. Poland imported almost 2.27mn t in January-September, GUS data show. Australia was the largest supplier, followed by the US, Russia and Mozambique.

Polish coking coal buyers told Argus that rail capacity limitations remain a challenge in transporting coking coal to their plants — both imported coking coal stockpiled at ports and domestically produced material.

A strong increase in thermal coal transportation this year has further contributed to bottlenecks in ports and rail capacities. But the rail limitations are not critical and plants are able to maintain their operations at planned levels, market participants said.