Strong US farmer demand in the spring will likely support the US urea market, which has sharply declined since October.

Urea and overall nitrogen consumption is poised to rise for the 2019-20 season because of changes to the crop mix. Demand will likely favor urea because it is a relatively cheap source of nitrogen at the moment.

Bullish farm demand

Crop fundamentals are bullish based on an estimated 3mn acre increase in corn acreage to 92mn acres, according to the US Department of Agriculture (USDA).

With typical consumption rates, one could assume an annual increase of 300,000st of nitrogen use based on USDA's projections for 2018-19 plantings.

Soybean acreage could fall by 6.6mn acres leading to a significant increase in nitrogen demand during the next two years as soybean fixes most of its nitrogen requirement, as well as lowering the nitrogen requirement for a corn-after-soybeans rotation.

In addition, fall ammonia applications were seriously hindered by weather, and market participants generally estimate that up to 1mn st less ammonia than usual was applied. Much of this will be caught up in the spring, but weather and logistical bottlenecks should mean that farmers turn to alternative sources of nitrogen to make up the difference.

There is headwind from farm economics — where the USDA describes "relatively lean times ahead". Farm income will fall by 12pc in 2018 from 2017, according to the USDA, and debt levels are expected to rise by 4pc.

Urea values at a discount

While urea prices ran up over the summer, they have pulled back and wholesale offers in the east Corn Belt for spring made in December were about 10-15pc higher than the previous year.

But for UAN and ammonia they were 39pc and 23pc higher than a year ago. On a USC/lb nitrogen basis, urea looks particularly cheap at 30¢/lb — with UAN at 41¢/lb and ammonia at 32¢/lb. Retail prices in Illinois and Iowa have UAN and urea are at parity on a $/N basis, but this is likely to change as the cheaper urea prices filter through.

Farmers do not always purchase the cheapest form of nitrogen available, but some marginal consumption is likely to be affected, further supporting the urea market.

Global trends remain a factor

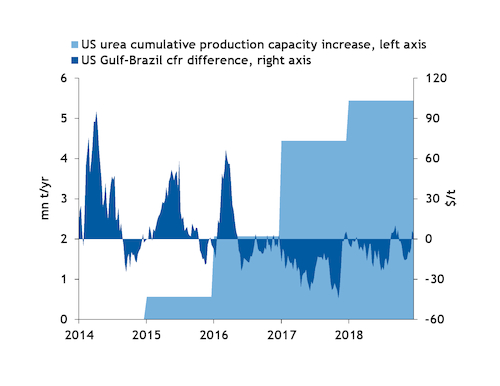

Barge prices are likely to correlate with international markets and drive inland prices. Nola prices are a reliable signal for the urea balance in the US. When the market is well supplied Nola must be at a discount to nearby markets in order to discourage deliveries, while when it is short Nola prices climb to attract import volumes.

Remaining import needs are estimated at 500,000-600,000t of spot urea for spring to meet the regular peak in demand. This suggests a period where Nola trades at a premium to international markets over the next few months, after spending most of this year at a discount.

The outlook for global urea prices is mixed. On the bullish side, prices are low enough to discourage significant Chinese urea exports, and Iranian urea is far less available now that the export route through China is under scrutiny. But overall the market trends back into a global surplus by the end of the first quarter, with a corresponding effect on prices.