The prospect of further sanctions after Maduro began his second term could put US and EU oil companies' projects in jeopardy

US and European oil companies with assets in Venezuela are expected to come under growing pressure in the aftermath of autocratic president Nicolas Maduro's widely condemned inauguration for a second term on 10 January.

The ceremony — shunned by most of the international community — sparked fresh sanctions, deepening the Opec country's isolation. Argentina has followed Peru in imposing travel bans and financial restrictions on senior Venezuelan government officials. Paraguay broke off diplomatic relations altogether, but pledged to honour its $300mn oil debt to Caracas. The Organization of American States (OAS) voted not to recognise Maduro's second term, with the notable abstention of Mexico, which has adopted a non-confrontational stance since left-wing president Andres Manuel Lopez Obrador took power in December.

The US, EU and Canada already have targeted sanctions in place, while Washington has imposed financial sanctions on the government and state-owned PdV since August 2017. None of these directly targets Venezuela's oil exports — source of all of the government's legitimate revenue. The financial restrictions have had the most far-reaching impact, but even the sanctions on individual officials could make it more difficult for foreign oil companies to operate and interact with their Venezuelan counterparts.

Oil ministry officials say tougher sanctions could also limit the ability of some US and European companies to finance their share of joint-venture investments in Venezuela, and PdV's ability to attract new investors. Chevron, Total, Norway's Equinor, Spain's Repsol and Italy's Eni are among PdV's partners with assets on the ground. Shell recently sold its 40pc in an upstream oil venture, but continues to operate alongside PdV to reduce flaring at eastern fields and is poised to develop and transport offshore gas to neighboring Trinidad and Tobago.

All of the companies have maintained a low profile as Venezuela has sunk into economic ruin and many have written off chronic losses. ExxonMobil and ConocoPhillips withdrew from Venezuela after their assets were expropriated in 2007. Now ExxonMobil is developing massive oil reserves offshore neighbouring Guyana on territory that Venezuela claims as its own. And ConocoPhillips is collecting on a $2bn arbitration settlement after imposing liens on PdV's Caribbean assets.

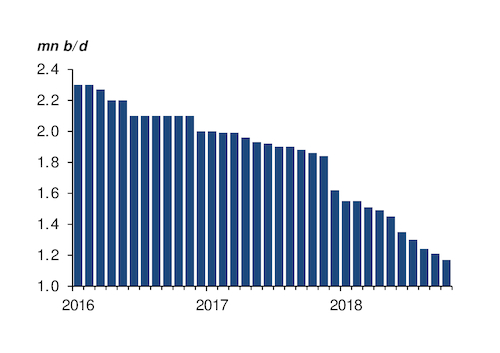

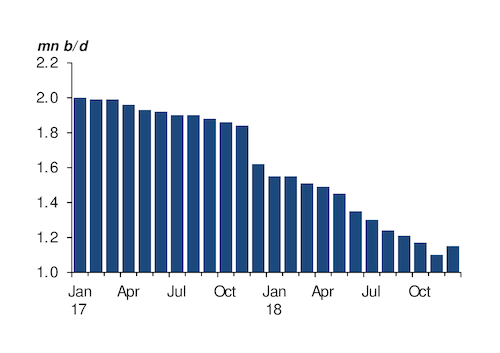

Maduro's immediate challenge heading into his second six-year term is remedying Venezuela's broken oil-based economy. PdV appears to have stabilised crude production at around 1.15mn b/d for now. But Caracas will need to sustain and revive output to generate sorely needed hard currency for imports of basic goods and to service over $9bn of bond principal and interest due this year.

Leaner oil revenue in 2019 will not be enough to cover food imports and honour bond debt while maintaining oil-backed loan and barter commitments — mainly to China and Russia, Venezuela's primary foreign patrons.

Keep an eye on that Juan

Maduro also faces the prospect of a parallel opposition government led by Juan Guaido, the newly elected head of the opposition-controlled National Assembly, considered by domestic and foreign opponents of Maduro's government as the country's last legitimate democratic institution.

The National Assembly is passing measures repudiating some Maduro-era oil deals and preparing for a political transition. US secretary of state Mike Pompeo called Guaido on 10 January to congratulate him and pledged to co-operate to restore Venezuelan democracy. Maduro is counting on China, Russia and Turkey, but none of the diplomatic officials that they sent had a particularly high profile at his inauguration ceremony.