A slump in steel mill profits since November has sharply increased demand for imports of low-grade ores to China, leading to a narrowing of discounts for lower-priced brands that has accelerated in 2019.

"Mills' profits are still at low levels with strips at 200-300 yuan/t ($29-44/t) and rebar at Yn300-400/t. Most of them still prefer low grade ores," a Hong Kong iron ore trader said.

A weak winter steel inventory build and slow rollout of stimulus measures have only added to mills' nervousness about steel demand in 2019. Construction growth is slowing as China reins in credit, while trade tensions are further weighing on outlooks.

That has led mills to stay conservative on ore procurement.

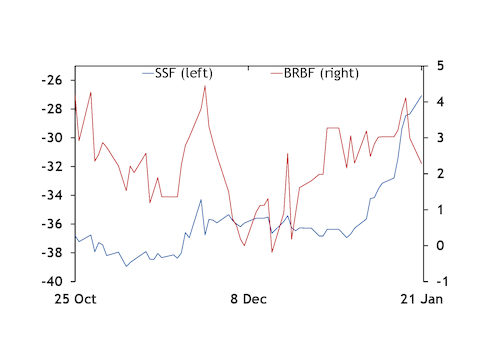

The most dramatic shift has been in portside trade for Australian producer Fortescue Metals' 56.7pc Fe SSF fines, which have narrowed their discount to the Argus PCX 62pc portside index.

SSF traded at Yn415/wet metric tonne (wmt) fot Qingdao yesterday, a 27pc discount to the PCX at Yn569/wmt fot Qingdao. That is down from a 37pc discount at the start of the year and a 35-39pc range at the end of 2018.

Fortescue narrowed its seaborne contract February discounts to 33pc to the reference 62pc index from 37pc in January.

Australian producer BHP's JMBF fines have also attracted bids, trading at Yn539/wmt fot Tangshan yesterday, a 5.2pc or $4.42/wmt discount.

Spreads have narrowed between the three major seaborne indexes as well as between brands within the mainstream 62pc segment.

The Argus 58pc index that closely tracks BHP's YDF fines has narrowed its discount to 11.2pc to the Argus ICX 62pc index. That discount was at 13pc at the start of 2019 and averaged 17pc to the ICX in 2018.

Chinese mills blend low-grade ores with Brazilian mining firm Vale's 65pc Fe IOCJ fines. The rise in low-grade prices has pressured high-grade premiums lower.

The Argus 65pc index that closely tracks IOCJ fines priced at a 17.4pc premium to the ICX yesterday, down from premiums as high as 40-45pc in mid-2018. The 65pc index averaged a 30pc premium to the ICX in 2018.

Premiums for Vale's 63pc Fe BRBF fines to the ICX and PCX indexes peaked in mid-2018 before falling as the emphasis on alumina and its penalties declined in the second half of the year. More recent BRBF price trends have been less clear. Its seaborne floating premiums have steadily declined since early December. And BRBF prices in portside trade have been more volatile, falling from a premium of 4pc to the PCX in late November to flat or a slight discount to the PCX on several days in December, before regaining its 2-4pc premiums this month.

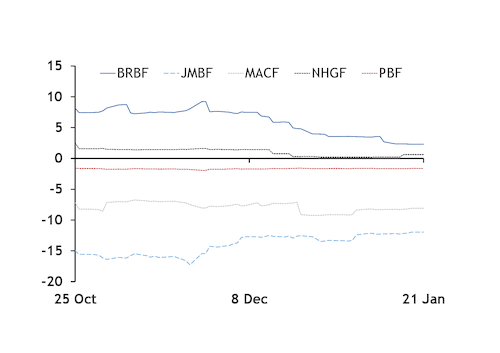

The Argus seaborne value-in-market (ViM) quality adjustment for 64pc Fe basis BRBF was at $1.76/dmt above the $76.60/dmt ICX yesterday, or a premium of 2.3pc. The fot Qingdao portside differential of Yn13/wmt for BRBF fot Qingdao basis equates to a 2.3pc premium to the PCX.

Winter restocking demand and sellers holding firm on prices have driven the rebound in BRBF portside premiums. Mills that are limited in how quickly they can change iron ore burden ratios will continue to stock up on BRBF, even if alumina is less of a price concern. BRBF spot supply is controlled by larger trading firms and Vale, which are holding firm on offers, buyers said.

Argus seaborne quality adjustments for BHP's JMBF fines have narrowed, supported by demand, while MACF seaborne discounts are marginally flat on a percent basis to the ICX. Quality adjustments for BHP's NHGF fines have also narrowed, while Rio Tinto's PBF adjustments have held flat.

The result has been a narrowing of the range for seaborne 62pc mainstream fines prices to a $10.92/dmt difference between BRBF and JMBF yesterday from spreads of more than $18/dmt last year.