Corrects private NBL deal in paragraph 7

Renewed efforts to curb north China pollution are supporting seaborne iron ore lump premiums beyond winter, surprising some traders that expected the typical downturn in spring.

Steel mills are being forced to limit sintering throughout the year, rather than just over winter, to keep ratios higher for direct-charge iron ores like lump and pellet in the blast furnace. Paper markets for lump were active last month with some traders anticipating a fall in premiums as winter restrictions roll off from mid-March.

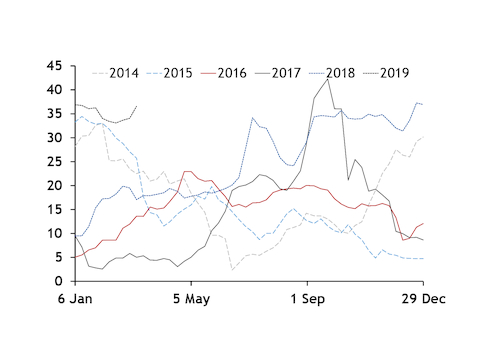

The Argus 62pc lump assessment fell from 38.10¢/dmt unit (dmtu) premium to the Argus ICX 62pc fines index in late January to 32.70¢/dmtu in late February, although it has since reversed these falls and risen back to 38.10¢/dmtu this week. It fell to 36.9¢/dmtu on 12 March. This range is the second highest since Argus started lump assessments in 2014, following a range of 38.22-42.29¢/dmtu in September 2017.

"The seasonal change for lump premiums is not that significant anymore because there are so many temporary restrictions on sinter furnaces," a south China iron ore trader said. "Like in mid-March there will be another round of sintering restrictions in Tangshan that we think will support lump prices."

But Tangshan has missed its air quality reduction targets this winter, with it is under more pressure from the central government to crack down on polluters, mill officials said. Inspections have picked up this week and there is the possibility of even stricter cuts soon. Some mills have been caught cheating such as cutting networks used to send real-time emissions data and including shuttered capacity as part of production restrictions.

Mills that did not fulfil winter output targets are being required to halt sintering and shaft furnaces, which will keep lump premiums firm in March, a Hebei mill official said.

Seaborne trade in lump has picked up this week with the increased environmental scrutiny. A 90,000t cargo of Newman Blend lump (NBL) with 21-30 March laycan sold at a $1.61/dmt premium to April 62pc index with the monthly lump premium in a 11 March private deal. An April-loading cargo of Pilbara blend (PB) lump traded at a 38¢/dmtu premium off screen on 11 March, and a parcel of NBL traded at a floating premium of $1.50/dmt to April 62pc index on the Globalore platform on 12 March.

Some traders see political pressure as temporary during China's national people's congress in Beijing that will end after this week. But mill buyers in Handan and Tangshan are "showing big interest in lump" as they face increased sintering restrictions, a Hebei mill manager said.

Others disagree because air quality is expected to remain poor, and other major events are planned in the coming months. Continuous rounds of restrictions could keep a floor on lump prices, said a trader who estimates premiums will hover around 30¢/dmtu.

With profit margins narrowed or negative, some mills are looking at lower cost lump brands like Roy Hill lump that is selling at around 100 yuan/wet metric tonne (wmt) lower than PB lump with an Fe content that is just 1pc lower. "Mills still need to buy lump, but they will switch to cheaper brands, just like with fines," a south China trader said.

Lump enquiries increased on 11 March for early March deliveries, focused on PBL, Roy Hill lump and FMG lump, but higher prices for NBL limiting its interest. NBL traded at Yn865-870/wmt last week at Jingtang and Caofeidian.

Caofeidian 61.34pc Roy Hill lump on 11 March was offered at Yn760/wmt and 57.69pc FMG lump was offered at Yn635/wmt.