A large increase in open interest in EU emissions trading system (ETS) allowance call options is likely to have been prompted by a vote in the UK Parliament this week to reject a "no-deal" Brexit.

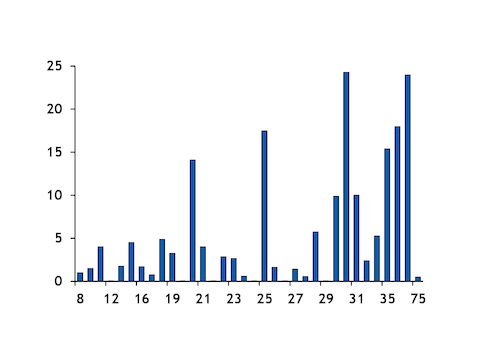

Open interest in EU ETS December 2019 call options increased by 10.25mn allowances yesterday — adding 6pc to total open interest in calls on this contract on the day — as options holders placed new bets that prices will rise between now and December.

This was the largest increase in front-year call options open interest in a day since 13 February 2018.

Total open interest in EU ETS call options for December 2019 delivery now stands at 184.1mn allowances.

All of the open interest added yesterday was in call options with a strike price above the December 2019 contract's prevailing value — suggesting that options holders expect EU ETS prices to increase between now and December, when the contract expires.

The options buying is likely to have been triggered by a UK parliamentary vote on 13 March, held in the evening after the market had closed, which resulted in members of Parliament (MPs) voting to rule out the UK exiting the EU without a deal.

The vote outcome appeared to reduce the risk that the UK will crash out of the carbon market on 29 March, which would be the default scenario under a no-deal Brexit. A no-deal scenario is widely considered to be bearish for EU ETS fundamentals, as UK emitters could sell 50mn-70mn allowances back to the market as they would no longer need these permits for compliance.

By removing the prospect of a no-deal Brexit — at least temporarily — the vote created more bullish sentiment among EU ETS market participants, and triggered the increase in open interest.

With considerable uncertainty remaining over the UK's future participation in the EU ETS, some market participants are unwilling to take large outright positions in allowances until more clarity emerges over Brexit. The options market presents a way for participants to "indirectly" play the EU ETS market, a trader said.

EU ETS allowance futures prices rallied in the session following the no-deal vote, with the front-year contract recording its largest day-on-day price gain for more than a week.

The December 2019 contract closed yesterday's session at €22.72/t CO2 equivalent (CO2e), having added €0.43/t CO2e on the day.

A subsequent UK parliamentary vote yesterday saw MPs call for the government to approach the EU to request a delay to Brexit. But the duration of any delay is not yet known, and it is not clear if the EU will grant such an extension.