Washington is treading a fine line as it ramps up the pressure on Caracas and Tehran, risking sending oil prices spiralling

Washington has stepped up its campaign against the government of President Nicolas Maduro by placing Venezuela's central bank on its sanctions list.

The measure intensifies the financial pressure on Maduro's regime, creating additional obstacles to the country's oil exports. The sanctions will restrict the central bank's access to US dollars and effectively cut it off from the dollar-based financial system. This should serve as a stern warning to external entities, including Russia, against providing Maduro with support, White House national security adviser John Bolton says.

The Treasury Department has set a one-month period ending on 17 May for the winding down of transactions and contracts with the central bank, although some international organisations, including the IMF, World Bank, UN and Red Cross, have been granted 18-month exemptions.

Transactions involving the provision of food and medicine will also be exempt. US banks will be allowed to process personal remittances through the central bank until 22 March 2020. Credit card services and wire transfer providers also have until then to wind down business. The Treasury has already blocked the bank's financial assets in the US.

A combination of US sanctions and pledges of humanitarian aid has failed to loosen Maduro's hold on power, and he retains the support of senior military commanders and paramilitary groups.

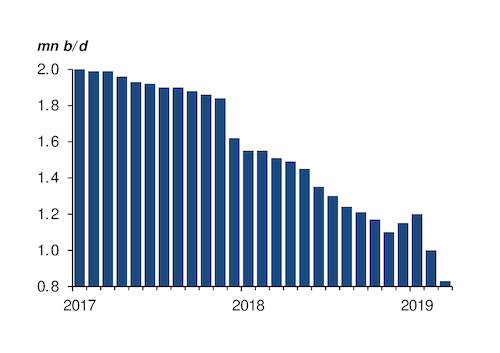

Venezuela's crude production fell to 830,000 b/d in March amid a series of debilitating power cuts from more than 1.2mn b/d before the US imposed oil sanctions on state-owned PdV in late January. US refiners have until 28 April to wind down crude purchases from Venezuela, but those imports — roughly 500,000 b/d before the sanctions — have completely evaporated already.

The US decision on 22 April not to extend sanctions waivers for eight countries to take Iranian oil could have a knock-on effect on Venezuela, limiting the scope for further restrictions targeting Caracas. The largest beneficiaries of the Iran exemptions are China and India — the same countries that account for almost all Venezuelan crude exports after the US imposed sanctions on PdV.

Washington risks accelerating oil price rises if it simultaneously tightens the screws on Iran and Venezuela. "The US cannot sanction Venezuela and Iran at the same time," an oil adviser to opposition leader Juan Guaido says. Sanctions on all sides would be inconsistent with US efforts to keep oil prices in check, pushing them up to $80-100/bl, the adviser says.

Venezuela's opposition is starting to worry about the longer-term economic consequences of the US sanctions. The longer they remain, the harder it will be for Venezuela to claw back oil market share in the future if refiners reconfigure their plants to process oil from more reliable sources, the adviser says.

A passage to India

The loss of the US market has prompted PdV to ship more crude to Asia-Pacific. Venezuela exported just under 300,000 b/d to India in February, about a quarter higher than in January although 4pc lower than a year earlier. India's largest private-sector refiner, Reliance Industries, is limiting its crude purchases from Venezuela and no longer sells naphtha to PdV to use as diluent. Russian state-controlled Rosneft's Indian refining arm, Nayara, is still taking Venezuelan crude, partly as repayment for oil-backed debt.

China's crude imports from Venezuela are similarly tied to the repayment of oil-backed loans, while Spain's Repsol is coming under increasing pressure to halt its oil trade with Venezuela.