Magnesium prices rose sharply last year, but the timing and extent of a retreat could depend as much on Beijing's environmental policies as on automotive demand and the wider economic outlook.

Tight supply and high prices could reduce the competitiveness of magnesium metal with aluminium and other lightweight alternatives over the longer term, and erode consumer demand.

But over the next 12 months the evolution of Beijing's policy on cutting pollution could determine prices, because of Europe and Japan's dependence on supply from China. The country produced 85pc of global primary metal supply last year.

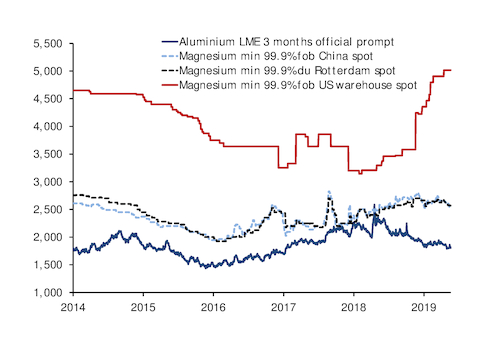

The US primarily uses domestically produced magnesium because of high anti-dumping duties on Chinese material, and US prices remain at a premium to the European market (see chart). European spot prices for 99.9pc grade metal rose to $2,663/t duty unpaid Rotterdam at the end of December 2018 from $2,250/t at the start of the year, on tight supply in China. After some volatility at the start of the year, prices have fallen by $105/t in the past six weeks to $2,570/t from $2,675/t in mid-April. Spot demand has dropped as buyers have begun to reject higher prices.

"We forecast a slight downwards correction in 2019 and higher prices in 2020... a major factor will be the further enforcement and rollout of emission reduction policies for energy-intensive industries in China," said Martin Tauber, a Belgium-based consultant at Australia's CM Group.

CM Group estimates that the majority of Chinese magnesium smelters were profitable last year. And with production in China operating at an estimated 56pc of active capacity in 2018 compared with 63pc in 2017, more capacity could come on line this year.

The implementation of environmental policy will play a key role. Beijing introduced a new industrial emissions standard in October 2018 that could potentially prevent some of this idle capacity from restarting.

CM Group expects Beijing to roll out a nationwide pollution reduction programme in 2020-21 that will reduce supply substantially, raise the cost of ferro-silicon and coal feedstock, and push up magnesium prices.

Other market participants expect prices in Asia-Pacific and Europe to remain stable for the rest of this year and then fall in 2020. This view is based on the assumption that environmental inspections will ramp up before next year and that production will fall during the summer because of maintenance. Prices are expected to fall, with the current level unlikely to be sustainable (see chart).

Longer-term demand and risks

The automotive sector is the largest consumer of magnesium in the form of die-cast parts and aluminium alloys, for which the demand outlook is uncertain. A million fewer cars were produced in 2018 than in the previous year. And sales fell in Europe in the [first quarter](https://direct.argusmedia.com/newsandanalysis/article/1906527]. A rise in protectionism and trade disputes around the world has contributed to increasing global economic uncertainty.

But the picture is also complicated by environmental policy. Many carmakers in Europe have struggled to maintain delivery volumes since the implementation of the EU's Worldwide Harmonised Light Vehicle Test Procedure, which replaced the previous test in the wake of the Volkswagen emissions testing scandal, which broke in September 2015 and led to heavy fines against automakers in the US. It is difficult to estimate how much pent-up demand exists in the supply chains as automotive manufacturers scramble to apply new regulations.

Over the longer term, a key risk for magnesium demand is price competitiveness with aluminium and carbon composite light construction materials (see chart), as manufacturers look for ways to join the push towards lower-emission transportation and electric vehicles.

Volkswagen research scientist David Klaumuenzer presented a concept for a magnesium decklid with a weight of just 6kg at the International Magnesium Association conference in Hungary last week. The research, which is still in its early stages, underlines the potential for magnesium as a lightweight material. But there are concerns in the industry that the large-scale investment being made in the development of autonomous vehicles and battery technology is drawing away financing to support the development of the construction materials needed to build them.