The outlook for copper is uncertain for the balance of 2019 as China, the largest consumer of the red metal, is embroiled in a trade war with the US.

Copper prices have declined in recent weeks on fading US-China trade talk optimism and amid uncertainty over a Chinese plan to restrict imports from 1 July on eight different categories of scrap, including copper, aluminum and steel.

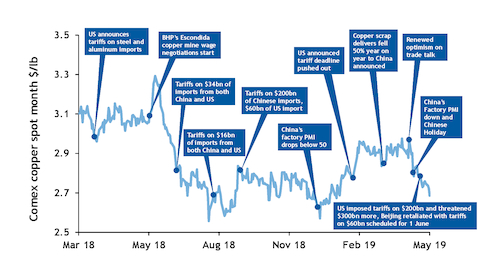

Copper has largely tracked the ebb and flow of the US-China trade conflict, attempts to defuse it and its impact on global trade and the world's two largest economies.

Trade war volatility

Comex copper prices took a dip in March 2018 when the US announced tariffs on imports of steel and aluminum, with the spot price dropping below $3/lb for the first time that year. Copper then hit its high for the year near $3.30/lb in June, when workers at the BHP Escondida mine in Chile threatened to strike during union wage negotiations.

Comex copper fell by nearly 10¢/lb on 11 July as 25pc reciprocal tariffs on $34bn/yr of goods were implemented on imports from China and the US.

In late August 2018, additional tariffs of $16bn/yr tariffs were implemented on imports from China and the US and spot Comex fell to $2.6525/lb.

Tariffs on $200bn/yr of Chinese imports to the US and $60bn/yr on US imports to China were put into effect on 24 September, which pushed copper down from nearly $2.82/lb to close out October at around $2.66/lb.

It pushed up again to around $2.80/lb at times in November and December, then fell to below $2.60/lb in early January when China's factory purchasing managers' indexes dropped well below 50, showing factory contraction in December. But prices rebounded on lower stockpiles, and copper picked up a tailwind when the US pushed back a tariff deadline in mid-February, which pushed copper up to $2.95/lb to close February.

Comex then took another dip in late March as copper scrap deliveries were reported falling by 50pc year on year to China. Copper dropped 6¢/lb in one day to $2.83/lb.

On 1 May, copper dropped by 10¢/lb after China's April factory PMI came in lower than expected and China was on holiday for the week.

Then in the second week of May, the US imposed additional tariffs on $200bn worth of Chinese and threatened additional tariffs on more than $300bn other goods. Beijing retaliated, saying it would levy tariffs on $60bn of US imports on 1 June. Trade talks were broken off and the rhetoric heated up on both sides.

Spot Comex fell to $2.686/lb on 22 May from $2.7585/lb on 16 May and is at its lowest since late January.

Scrap impact

Weak Comex pricing has had a knock-on effect for the US copper scrap market.

Difficulties shipping scrap copper to China has made for additional material available in the domestic US market, putting a headwind against strengthening spreads for scrap despite the drop in Comex.

The current climate in the US of a slowdown from copper and brass mills has some dealers and brokers concerned. With warmer weather, May and June are typically a busy time for mills as they ramp up production to make future orders before many mills and their consumers take a July shutdown for preventive maintenance.

That increased production and additional buying of scrap has not materialized for many, and mills have been restrictively buying or out of the market all together and even looking to move scheduled deliveries further out.