The Opec/non-Opec pact wants to build up a more complete picture of the market before deciding what to do in the second half

Opec and its partners remain focused on their efforts to draw down global oil stocks, sidestepping escalating geopolitical tensions that may ultimately not have any lasting impact on supply-demand balances.

The Joint Ministerial Monitoring Committee (JMMC), co-chaired by Saudi oil minister Khalid al-Falih and Russian energy minister Alexander Novak, opted on 19 May to defer making any formal production policy recommendations, citing "critical uncertainties" affecting markets and macroeconomics, the trade dispute between the US and China, monetary policy and "geopolitical challenges".

There was consensus at the gathering that the current production cut pact should stay in place in the second half of this year to allow global stocks to gradually drain. But the group needs more time and data before a final recommendation can be made to the producers' alliance at the full ministerial conference, now scheduled for 3-4 July in Vienna.

"With 14 ministers present, you can expect a range [of proposals]... the one that seemed to resonate the most with a large number of ministers is simply to roll over the agreement in the first half, while also noting that things could change between now and then," al-Falih says.

Despite speculation that worsening tensions between the US and Saudi Arabia with Iran could derail the talks, Opec has largely managed to exclude political conflicts from production policy discussions, with financial imperatives a key pillar of policy decisions.

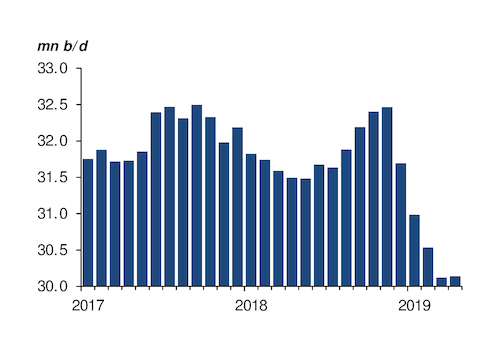

Ministers in the group, known collectively as Opec+, stressed after the meeting that, despite a number of supply shocks hitting the market, the fundamentals still indicate that inventories remain higher than what they collectively consider to be "normal" levels.

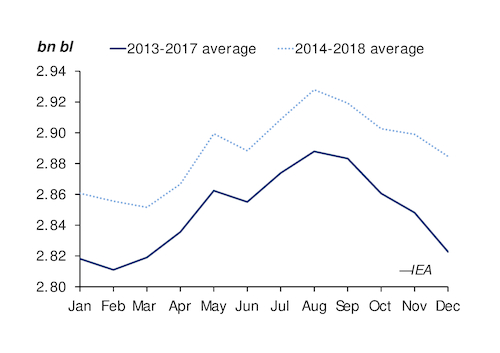

OECD inventories have risen by 60mn-70mn bl since July, despite the Opec+ alliance's deep cuts and supply shutdowns in Iran and Venezuela, al-Falih says. Opec has been targeting the five-year average stock level as a benchmark for assessing the market balance but this metric is now being reviewed. "Today, as we approach 2020, the last five years have been inflated," al-Falih says. Opec+ will be holding discussions in the coming weeks on what metrics, or timeframes, it should be considering when planning the next step.

Known unknowns

The JMMC gathering in Jeddah was the first time that Opec+ ministers had met since Washington announced in late April that it would try to force a zero-export policy on Iran, which has sparked concerns over potential supply shortages, forcing market analysts to review market balances for the rest of the year.

"Nobody knows what Iran is producing or exporting. It is highly, highly speculative," al-Falih says. "Certainly the numbers that are quoted do not reconcile with the demand/supply in consuming regions. So I will add my voice to those speculators by telling you that I think there is a lot of oil that is leaving the shores of Iran or the borders of Iran that is not accounted for, and it is presenting in the markets," al-Falih says. "We are therefore not seeing as much demand for other crudes as many analysts had expected, which is one of the uncertainties and realities that we have to deal with in deciding what to do in the second half," he says.

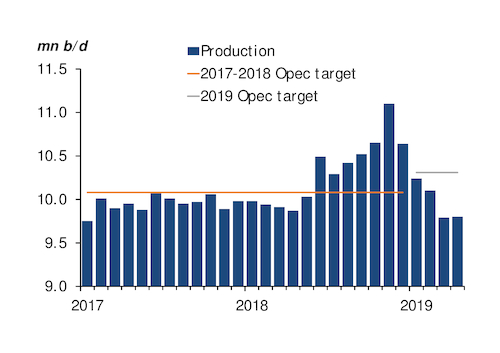

Saudi Arabia has been producing a steep 500,000 b/d below its 10.3mn b/d output target given lower-than-expected demand for its crude. Saudi production stood at 9.8mn b/d in April, Argus estimates and the country plans to produce 9.7mn-9.8mn b/d in May and June, according to al-Falih.