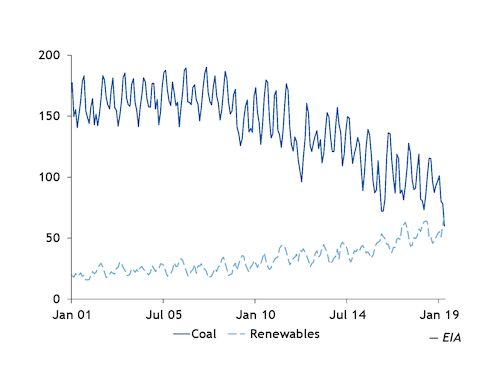

Coal-fired generation fell by 18.1pc across the US in April as increases in wind and solar generation pushed renewables ahead of coal for the first time on record, according to the US Energy Information Administration (EIA).

US generators dispatched 60.1mn MWh of coal power during the month, down from 73.4mn MWh a year earlier, EIA said in its latest Electric Power Monthly, which was released yesterday. That was the lowest level in EIA records going back to 1973.

Coal generation has fallen as generators shift away from the fuel in favor of natural gas and renewable projects. About 47GW of coal-fired generation has retired since the start of 2015, and EIA expects another 4.1GW to go off line this year.

That lost generation has been replaced by wind and solar, including 15GW of capacity that was added last year, according to the EIA.

Renewable generation in April totaled 68.5mn MWh, up from 66.6mn MWh a year earlier. Wind generation hit a record high of 30.2mn MWh, up by 12.8pc from last year.

Solar generation climbed to 6.9mn MWh in April from 6.2mn MWh last year. EIA expects solar power to pass the record 7.8mn MWh set in June 2018 this summer.

Hydroelectric generation fell in April to 25.4mn MWh, down by 7.5pc from last year's 27.5mn MWh.

Total generation in the US fell during the month to 295.1mn MWh from 301.7mn MWh a year earlier. Coal accounted for 20.4pc of generation while renewables had 23.2pc market share.

EIA also tied coal's decline against renewables to seasonal factors. Electricity consumption is generally lowest in the spring and fall months because moderate weather reduces demand for heating and air conditioning. In addition, plant operators typically take natural gas, coal and nuclear units off line for maintenance during those seasons, EIA said.

But natural gas and nuclear generation increased in April by 3.5pc and 2.4pc, respectively, to 102.9mn MWh and 60.6mn MWh.

On a year-to-date basis, coal generation still had a lead over renewables, but its margin has slipped. Coal accounted for 24.8pc, or 319.6mn MWh, of US generation from January through April. Renewables totaled 247.5mn MWh, or 19pc of the country's generation.

In the first four months of 2018, coal made up 27.2pc of US generation while renewables accounted for 19.6pc.

Natural gas generation climbed to 444.9mn MWh during January-April from 410.4mn MWh in the same period last year. Nuclear power fell by less than 1pc to 264.1mn MWh during the same period.

Coal generation is expected to remain higher than renewables for the rest of this year and in 2020, according to forecasts in the EIA's most recent Short-Term Energy Outlook. But renewables will continue to gain ground, surpassing nuclear next year.

In April, coal-fired generation fell in all regions of the US except the contiguous and noncontiguous Pacific, which includes California, Oregon, Washington, Alaska and Hawaii. And the increases there were insignificant: Total generation from coal in those states accounted for just 400,000 MWh, or 0.7pc of the US total.

In the East North Central region, coal-fired generation fell by 15.2pc to 15.5mn MWh. In the West North Central region, it declined by 28.9pc to 9.2mn MWh.

Coal consumption for electricity generation across the US fell to 33.4mn short tons (30.3mn metric tonnes) in April from 40.6mn st a year before.

Power plant inventories also continued to decline, falling to 108.6mn st from 129.7mn. Deliveries climbed to 44.6mn st from 42.6mn st.

Bituminous and sub-bituminous stockpiles fell to 49.6mn st and 55mn st, respectively, from 51mn st and 74.8mn st.

Generating facilities held the equivalent of 85 days of bituminous coal consumption in inventory in April, compared with 80 days a year earlier. Sub-bituminous coal stockpiles fell to 71 days of burn from 90 days.