The EU is helping Iran bypass banks restrained by US sanctions, but the only real solution will be getting Washington to negotiate

Iran has ended compliance with a key provision of its nuclear deal, and hopes its actions will prompt the remaining participants to the agreement to provide economic relief as its export revenues dwindle because of US sanctions.

Tehran said on 1 July that its stockpiles of enriched uranium exceed its limits under the Joint Comprehensive Plan of Action (JCPOA). It is preparing to end compliance with several other restrictions of the nuclear deal after 7 July. The actions can be reversed if the European parties to the deal carry out their commitments, Iranian foreign minister Mohammad Javad Zarif says. The JCPOA, signed in 2015, lifted oil sanctions on Iran in exchange for curbs on its nuclear programme.

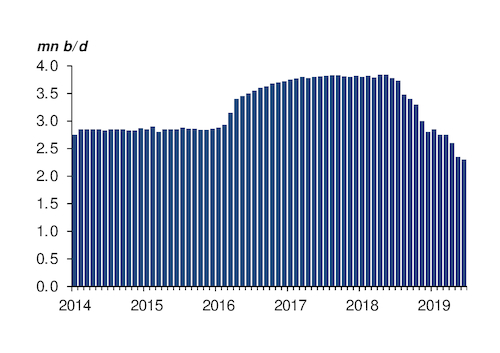

The deal was built on the premise that Tehran might violate the terms, which would then lead to an automatic reimposition of US sanctions and the possibility of the Council of EU member states reintroducing nuclear-related sanctions. But it was Washington that left the agreement last year. US president Donald Trump's administration has implemented a full sanctions ban on Iranian crude exports since early May, with additional measures targeting the petrochemicals and other export industries. Selling Iranian crude "cannot get more difficult than it is", Iranian oil minister Bijan Namdar Zanganeh says.

The EU together with France, Germany and the UK expressed concern about Iran's violation. But they stopped short of noting "significant non-performance" by Iran — a finding that would have allowed the EU to initiate steps to reimpose sanctions. The European parties to the JCPOA have urged Iran to refrain from further measures that undermine the nuclear deal.

The EU on 28 June activated its long-promised Instex exchange, which is meant to bypass the banks cowed by US sanctions and enable Iran to buy food and medicine. Getting Instex off the ground may be significant in itself, given the strong US opposition. But Tehran says the exchange does not enable it to overcome the effect of oil sanctions. European countries stopped buying Iranian oil even before the termination of US sanctions waivers in May.

The nuclear deal provides for a prolonged dispute settlement mechanism in case of violations before the EU initiates the sanctions process. But the EU has little leverage to change the US' position. The JCPOA foreign ministers will meet first to address the issue. Tehran says its own complaints over the past year to the JCPOA members about US actions have not been addressed. The White House condemns Iran's action and says "there is little doubt that even before the deal's existence, Iran was violating its terms". The claim contradicts findings by UN nuclear watchdog the IAEA and the conclusions of US intelligence agencies.

How to make friends

Washington may relish the opportunity to finally find common ground with its European allies if Tehran ends compliance with other JCPOA terms. Trump's Iran policy has received strong backing only from the US' key Middle East allies. Trump and Saudi crown prince Mohammad bin Salman discussed Riyadh's role in ensuring the stability of global oil markets and "the growing threat from Iran" during their 29 June meeting at the G20 summit in Japan, the White House says. And the US is pushing forward with plans to internationalise the cost of the side effects of its Iran policy following the recent attacks on oil tankers in the Mideast Gulf.

Trump and his key advisers say they are open to negotiations with Iran, but vow to keep oil sanctions in place. French president Emmanuel Macron may serve as an intermediary between Washington and Tehran, Trump says. Macron's diplomacy last year failed to dissuade Trump from leaving the JCPOA. Tehran last month rejected mediation efforts by Japanese prime minister Shinzo Abe.