Chinese gallium prices fell below the cost of production in April-June, but production cuts alone are unlikely to lift the market rapidly without a repeat of 2018's winter pollution-reduction measures.

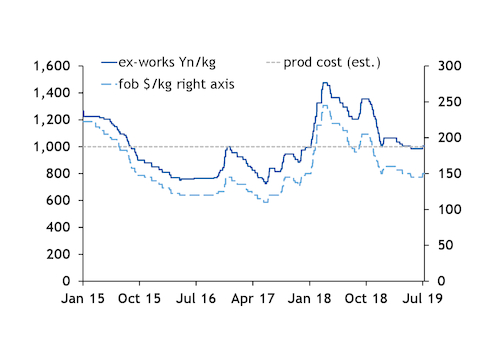

Weaker demand from the biggest consumer — China's light-emitting diode (LED) sector — a global downturn in the semiconductor industry, the US-China trade war and overcapacity dragged gallium prices to a 17-month low of 960-1,010 yuan/kg for 99.99pc metal in the second quarter (see chart).

Production costs are estimated at Yn1,000/kg and the fall in prices prompted cuts at large producers that raised prices slightly. Large producer Beijing Jiya halved its output to 2.5 t/month in June and Chalco also halved output to 1-2 t/month at its plant in Henan province in July.

Beijing Jiya has a capacity of 60 t/yr for 99.99pc grade metal, which is around 20pc of China's total gallium metal production (excluding recycling) of 300 t/yr.

Around 12 companies were producing metal in June, according to the company, but the nationwide utilisation rate was below 50pc.

In early 2018, prices rose by 50pc to a four-year high of Yn1,450-1,500/kg in March (see chart), despite starting the year at a similar level to the start of this year, at around Yn1,000/kg. That followed a government decision to cut alumina production by 30pc in the main producing regions from mid-November to March to reduce air pollution during the winter heating season.

Alumina, which is used to produce aluminium, is the main source of feedstock for gallium metal producers. There are no indications yet as to whether the government plans similar measures this year.

Demand delayed or missing?

Physical demand for prompt material has fallen this year. But it remains unclear how much of this is in response to lower demand for finished products and how much is the result of more cautious purchasing strategies and the running down of inventories.

Global semiconductor sales fell for five consecutive months in January-May, according to industry association SIA. Semiconductor sales totalled $33.1bn in May, down by nearly 15pc from a year earlier. But the second-largest consumer of gallium metal, microchips for wireless communications, is inextricably linked with the rollout of next-generation 5G telecommunications networks in 2019-22.

Gallium arsenide and emerging application gallium nitride will play a critical and growing role in building and supporting the networks and devices for 5G.

The outlook for LED lighting and displays is more uncertain, as sales of smartphones and display devices are expected to be flat or slightly weaker over the near term. But automotive demand is expected to drive growth.

Supply chain disruption caused by the US-China trade war could affect demand for both applications. And growing protectionism and import measures in Asia-Pacific, such as the trade dispute between Japan and South Korea, could reduce near-term demand.

Demand from the solar sector for thin-film copper-indium-gallium-selenium (CIGS) solar panels is forecast to grow steadily but gradually. Gallium is also used in high-performance rare earth magnets found in consumer electronics, appliances, electric and conventional vehicles and wind turbines, but these applications account for a smaller share of consumption.

Prices sensitive to exports, tariffs

China produces and consumes more gallium than any other country. It produced around 345t of gallium metal (excluding recycling) in 2018, which is over 90pc of global supply of 375t. Global supply of recycled metal was around 90t last year, based on industry estimates. This compares with total global demand estimated at 420t last year.

Chinese production capacity is estimated at 600 t/yr, indicating a utilisation rate of just 57pc. Export demand represents a small volume compared with China's consumption, but could still influence prices by affecting decisions to increase or reduce supply.

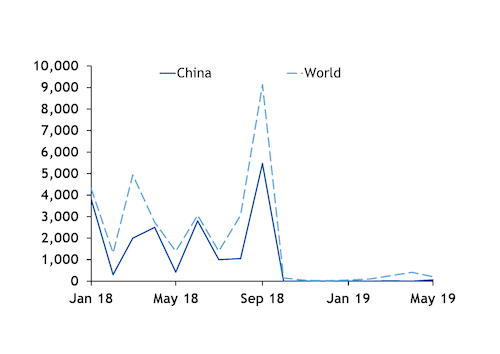

The introduction of 10pc tariffs on imports of Chinese gallium into the US on 24 September after a two-month consultation period prompted heavy stockpiling.

In January-September 2018, the US imported 19t of gallium from China (see chart), which is more than in the previous three years combined. But US imports from China have fallen to just 76kg so far this year and tariffs were increased further to 25pc on 24 May.

The spike in enquiries in the summer may have brought more material to the spot market, delaying production cuts, and contributed to the collapse in prices in October-December, during which ex-works prices fell to Yn1,000/t from Yn1,355/kg in October and export prices fell to $150/kg fob from $205/kg fob.