US high-volatile type A (HVA) coking coal's premium to other US grades has narrowed in recent weeks, as price relativities reconfigure amid the global price slump.

The Argus fob Hampton Roads index for HVA is at $157/t today, at a premium of just 50¢/t to the fob Hampton Roads low-vol index — in from a $16.70/t premium at the start of July. Relative to other key indexes, HVA is today at a premium of $15/t to HVB and a discount of just 40¢/t to the daily fob Australia index for premium hard low-volatile coking coal.

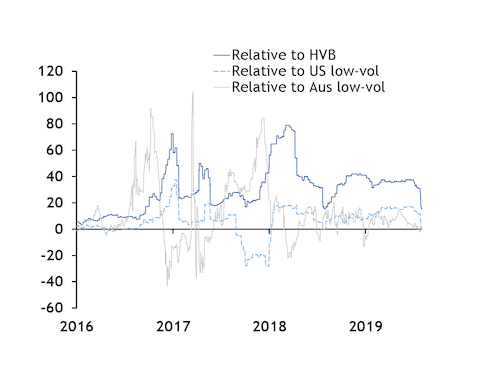

To put these figures in context, HVA's premium to US low-vols averaged $10.09/t last year and the premium to HVB averaged $44/t, according to Argus assessments. This year, HVA's premium to US low-vol has averaged $14.07/t, and the premium to HVB has averaged $35.46/t (see chart).

Many market participants see the narrowing of the HVA premium as long overdue. As yet, it remains slightly higher than US low-vol indexes, but this could be short-lived. One major US producer has for months been expecting HVA to slip back below US low-vol indexes. The Argus fob Hampton Roads index was previously at a discount to the US low-vol index for a sustained period in the fourth quarter of 2017.

HVA's wide premium to HVB has been a point of contention, with some European steelmakers estimating that their own calculated value-in-use of HVA over HVB would theoretically be no more than $10/t — albeit with scope for variation depending on the exact grades and mill.

US producers have attributed HVA's wide premium to its limited availability and the way in which it is sold — usually more locked up in term contracts than other grades because of high demand and limited production, rendering spot supply tight.

But not all participants are convinced of the fundamentals underlying HVA's wide premium, with one US producer having held back from developing a new HVA mine for months because of uncertainty about whether prices for this grade were sustainable, a source at the firm said.

Atlantic coking coal pricing has been extremely unstable in recent weeks, as a particularly slow summer period combines with sharp and continuing declines in the Asia-Pacific market. The Argus daily fob Australia index for premium hard low-volatile coking coal is at $157.40/t today, down from $198/t fob at the start of 2019.

US price indications have ranged widely in recent weeks, on a shortage of firm trading activity. "It will be interesting to see how Atlantic prices stabilise once people return from holidays," a trader said, adding that "it's very difficult to get a firm idea of price right now, if no one's needing to buy".

Another source noted that HVB has been on offer lately at around the mid-$140s fob Hampton Roads, but said no buyer would be likely to take it because of seasonality and a preference to wait and see how much further prices will drop.

That said, one European market participant said US coking coal prices might even be poised for a slight upward correction once buyers return, noting that the caution engendered by low demand might have obscured a lack of availability for key US brands. "People have been very focused on the lack of demand, but that is partly due to the season and there is a limit to how long some buyers can go without seeking a top-up, at which point it might become more apparent that there really isn't much available at the moment," he said.

A producer of HVB said it is sold out — except for the usual marginal tonnes of off-spec material — and will next have spot cargoes on offer in the fourth quarter.

More broadly, some supply-side factors have yet to be fully quantified — in particular the production outlook for Blackjewel and Cambrian Coal assets after their chapter 11 filings.

While most US export tonnage for 2019 has now been committed under term contracts, the rapid shift towards index use in the past two years means producers cannot avoid spot price volatility, and some are now voicing concerns about how low seaborne prices are falling.

As yet, no major red flags are being raised, with the recent trio of chapter 11 filings attributed to company-specific issues rather than market factors, and some mills said they do not want to drive prices down so far as to put their coal suppliers into financial difficulties.

US coking coal prices are still comfortably above the lows of 2015-16 that triggered a wave of bankruptcies. The Argus HVA index hit a low of $75.85/t fob Hampton Roads in November 2015, at which point HVB was at $71.50/t fob and the US low-vol index at $75/t fob.