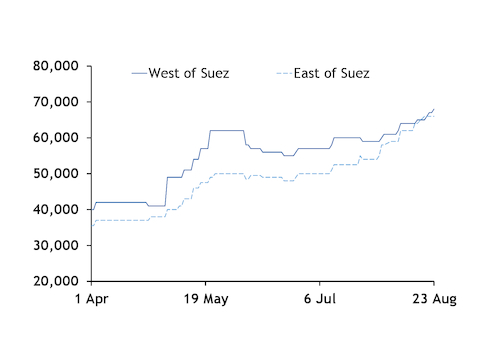

Day rates for tri-fuel diesel-electric (TFDE) LNG carriers fixed on a spot basis west of Suez were buoyed on Friday by tighter vessel availability in the Atlantic basin.

The rise to $68,000/d for west of Suez spot charters on Friday widened the inter-basin TFDE day rate differential, with east of Suez TFDE spot charter rates holding flat at $66,000/d, indicating greater vessel availability in the Pacific basin.

Spot charter rates for two-stroke vessels, which generally have a larger loading capacity, also rose in both basins on Friday, reflecting weaker availability following Flex LNG securing charters for two of its carriers. The shipowner's current and ordered fleet is fully populated with two-stroke vessels.

And new fob tenders from Nigeria LNG and Inpex earlier this week may further tighten availability. Nigeria LNG was heard to issue a vessel requirement to load a September cargo, but was unable to secure a charter, market participants said.

Tightness in the Atlantic spot charter market may also buoy the volume of LNG offered on a spot fob basis, if firms with offtake from the basin's liquefaction projects lack the required shipping capacity to load their contractual volumes.

Weak des prices in both basins and an expected winter contango in day rates could make spot chartering an unattractive option for firms seeking to fulfil their loading commitments. Spot charters could rise as high as $115,000-120,000/d in the middle of the fourth quarter of this year, market participants said. This could lead to firms instead seeking to offer their contractual loading volumes to firms with ample shipping capacity.

A number of firms are set to enter the winter period with spare shipping capacity, market participants said, which is likely also weighing on the number of vessels available for spot charters ahead of the shoulder season. This may be in anticipation of weak fob prices if some firms do seek to offload their fob volumes.

That said, shipowners may also be holding off before securing spot charters for their vessels, market participants said, expecting to attain greater returns later in the year in the event of spot charter rates strengthening from the third quarter to the fourth.

Firms with US offtake may also be most exposed to spot charter rates gaining over the fourth quarter, if they have not secured ample shipping capacity to load their take, because of the location of US liquefaction projects away from key demand markets. The US in the fourth quarter of last year had a loading efficiency — the number of vessels required per mn t of LNG — of 1.58, down from 1.79 a year earlier. This comparatively high freight tonnage demand for US loadings could weigh on vessel availability into the fourth quarter, with US aggregate liquefaction capacity scheduled to increase to 46mn t/yr, requiring around 50 loadings per month, judging by a 165,000m³ average vessel capacity.

If the US' loading efficiency in the fourth quarter of this year mirrors last year's at 1.58, US tonnage demand would reach around 73 vessels to load the country's LNG production.