Rising imports of competitively priced US crude have arguably made WTI more representative of European refining economics

Rising transatlantic flows of US crude are dramatically affecting European pricing, raising the possibility that WTI will be part of an Atlantic basin benchmark.

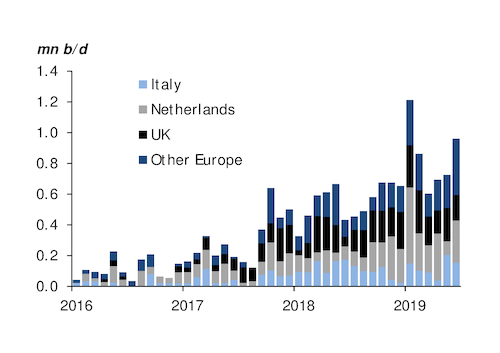

US crude has fast become a staple for Europe's refineries since Washington relaxed export restrictions in late 2015. Nearly 850,000 b/d of US crude loaded to go to Europe in the first half of this year, up from 550,000 b/d in the whole of 2018 and just 300,000 b/d in 2017 (see graph). And those flows are expected to step up further in the year ahead as the expansion of US transportation and loading infrastructure allows for more exports. Nearly 850,000 b/d has loaded to go to Europe so far this month, data from oil analytics firm Vortexa show, and that figure could rise above 1mn b/d in September for only the second time.

This flow of US crude has already necessitated the launch of new price assessments by price reporting agencies (PRAs) such as Argus. Pipeline deliveries to Houston are covered by a WTI Houston price. Gulf coast cargo loadings are covered by WTI fob Houston. And arrivals in Europe are covered by WTI cif Rotterdam. The latter was among the assessments that Argus included in its New North Sea Dated index launched in February to establish a reliable price for light sweet crude in Europe, as the existing North Sea Dated price suffers from dwindling physical supply and distortions caused by Asia-Pacific demand for UK Forties crude. WTI joined Algerian Saharan Blend, Azeri BTC Blend and Nigerian grades Qua Iboe, Bonny Light and Escravos as delivered elements into the New North Sea Dated fob index.

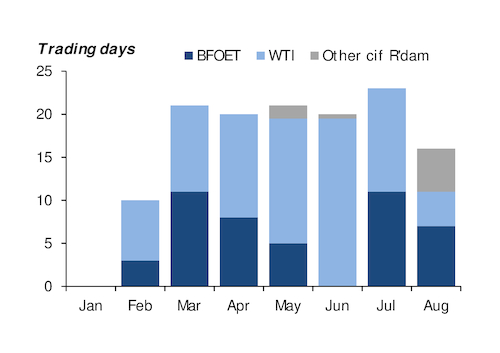

New North Sea Dated is set by the cheapest of these six freight-adjusted delivered grades and the five existing North Sea benchmark grades — Brent, Forties, Oseberg, Ekofisk and Troll. The evidence of the new benchmark's first six months is that WTI is by far the dominant element in establishing a light sweet price in northwest Europe. Thanks to the wave of lower-cost US oil reaching Europe, WTI has set the benchmark 61pc of the time in the 131 trading days since mid-February (see graph). BFOET grades have set the benchmark 34pc of the time, while other cif Rotterdam grades have set it just 5pc of the time. Argus is narrowing the focus of New North Sea Dated by removing BTC Blend, Saharan Blend and Escravos from the basket, because they set the benchmark so infrequently.

Naughty Forties

New North Sea Dated is partly designed to iron out some of the volatility caused by variable exports of Forties to Asia-Pacific. Forties prices can swing sharply depending on whether Asian refiners are buying, which makes the old North Sea Dated benchmark fluctuate in ways that do not always reflect refining economics in northwest Europe. The evidence so far suggests that New North Sea Dated does not show the same level of volatility that the old benchmark did.

But New North Sea Dated is a lower price than the old benchmark. European refiners have accepted WTI mostly because of its price. Its inclusion in New North Sea Dated has resulted in a benchmark averaging 45¢/bl lower than the old North Sea Dated price. Because Asia-Pacific demand can inflate the Forties price, this makes WTI arguably more representative of European refining economics.

As trade in WTI becomes more entrenched in Europe, transparency is likely to increase. Transatlantic flows have been driven by majors such as ExxonMobil taking their own volumes to their European refineries. Spot deals are shrouded in secrecy, while some European buyers have sourced their US crude through tenders. All this makes price discovery more difficult. But the amount of crude trading on PRA Platts' platform appears to be rising, including recent cargo sales by US independent Occidental to Total. The planned launch of the Argus Open Markets price transparency platform for crude next month could increase traded volumes further.