South African thermal coal shipments to key markets India and Pakistan supported total loadings from the Richards Bay Coal Terminal (RBCT) in August, but uncertainty over industrial demand in south Asia could curtail exports over the remainder of the year.

RBCT loadings rose by 275,600t on the year to 5.25mn t in August, supported by steady demand from India and Pakistan as well as increased shipments to South Korea.

RBCT exports to south Asia crept higher last month with 2.76mn t sailing for India and 953,400t for Pakistan, up by 254,900t and 20,800t from August 2018, respectively.

A jump in exports to South Korea boosted August loadings, with 628,500t shipped to the northeast Asian country compared with zero in August 2018. This was the highest loading for South Korea since May 2018, but exports over the first eight months of 2019 stumbled to 2.53mn t from 5.2mn t a year earlier.

Falling high-grade spot prices may have sparked South Korean buying interest. Argus NAR 6,000 kcal/kg fob Richards Bay (RB) spot assessments averaged $63.14/t in June and $65.68/t in July. By contrast, high-grade South African spot prices averaged $91.13/t fob RB in January and over $100/t fob RB in June-July 2018.

Exports also likely benefitted from an easing of South Korean coal-fired plant restrictions for the peak summer cooling period and slower annual growth in nuclear output in recent months.

Elsewhere, South African exports to Europe continued to be limited amid high port inventories and weak power-sector coal demand driven by competitive gas prices. RBCT shipments to the Netherlands totalled 162,800t last month, the first export to this transhipment hub since May, but down from 414,300t in August 2018.

Future export prospects pinned on India, Pakistan demand

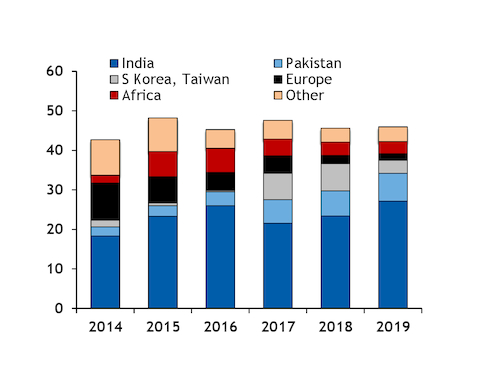

Aggregate January-August RBCT exports rose by 340,900t from the same period of 2018 to 45.96mn t, but were still down from an average of 47.02mn t during the same eight-month period in 2015-17.

The year-to-date export total implies RBCT loadings would need to average 7.76mn t/month over the final four months of 2019 to achieve the terminal's 77mn t export target. This would be higher than the loading rate seen in recent years, with September-December shipments averaging 6.96mn t/month in 2018, 7.24mn t/month in 2017 and 6.76mn t/month in the final four months of 2015-16.

A strong performance in the final months of the year will depend on demand from RBCT's main export markets — India and Pakistan — which accounted for 59.1pc and 15.3pc, respectively, of the terminal's total January-August exports.

Shipments to India climbed to 27.16mn t in January-August, up from 23.41mn t a year earlier, but exports could slow amid a recent decline in sponge iron production — a sector that some market participants estimate takes around 25mn t/year of seaborne thermal coal, most of which is South African NAR 5,500 kcal/kg.

Sponge iron output has been limited in recent months amid squeezed margins and a lack of funding, market participants said. Some steel and sponge iron plants have curtailed production to 50-60pc, a market participant added earlier this month.

India's total coal-based sponge iron production rose to 21.4mn t in the 2018-19 year, ending 31 March, up by 5.08mn t on the year, the Sponge Iron Manufacturers Association said. Output over the 2018-19 fiscal year implied a utilisation rate of nearly 59pc for the country's 36.5mn t installed coal-based sponge iron capacity, which edged up by 470,000t on the year.

But some participants active in coal markets are optimistic that imported fuel demand from India's industrial sector will pick up with the end of the monsoon season later this month and new government funding on the horizon.

Elsewhere, RBCT exports to Pakistan rose by 674,900t from the previous year to 7.02mn t over the first eight months of the year.

Pakistan's power sector demand held steady with the new 1.32GW imported coal-based Balochistan plant becoming commercially operational last month, but a weaker economy and depreciating local currency have truncated industrial demand for imported fuels. Domestic cement sales in Pakistan eased by 813,400t on the year to 40.33mn t in the 2018-19 fiscal year, ending 30 June, data from the All Pakistan Cement Manufacturer Association (APCMA) show.

Pakistan's cement demand declined with large-scale manufacturing posting a fall of 2.1pc in the year ending 30 June, reversing growth of 6.1pc last year, cement producer Bestway said in its 2018-19 annual report. Construction activity also eased by 7.6pc in the 2018-19 year after recording a growth of 9pc in 2017-18.

Subsequently, Bestway's production inched lower to 8.1mn t in the 2018-19 fiscal year from 8.56mn t over the previous year.

And major cement producer Lucky Cement said the depreciation of the rupee had posed additional challenges in the form of higher coal and fuels costs. Imported coal accounted for a 49.2pc share of production costs with other fuels and power making up another 17.5pc in 2018-19. The combined fuel and power costs rose to a 66.7pc share of total costs, up by six percentage points on the year.

Buying seaborne volumes in dollars with a depreciating rupee has put pressure on Pakistan's coal importers. A fluctuation of coal prices by 100 rupees/t (64¢/t) impacts cement production costs by Rs15/t, Lucky Cement added.

Despite the economic slowdown, domestic cement sales rose by around 1.1mn t on the year and from the previous quarter to 10.88mn t in April-June, APCMA data show.