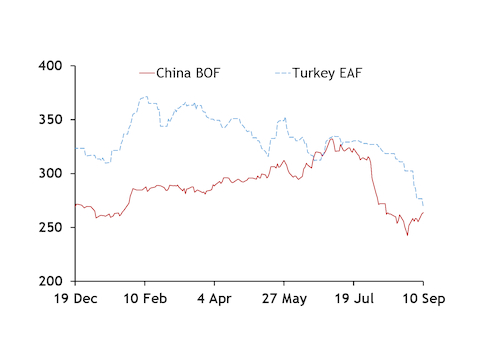

Steel-producing raw material costs in Turkey have fallen to near parity with China's iron ore-based costs, possibly signalling a floor for Turkish scrap prices that have yet to find a bottom.

The Argus ferrous feed unit cost for a Turkish electric arc furnace (EAF) at $268.80 per tonne of steel produced yesterday was only around $5/t higher than a Chinese blast furnace-based steel producer's equivalent raw material costs for iron ore, coking coal and scrap. This premium was nearly $30/t a week ago and more than $50/t a month ago.

Argus calculates ferrous feed unit costs for the main steel-producing regions based on the dominant mode of production.

The Argus HMS 1/2 80:20 cfr Turkey index has fallen by $52/t, or 18pc, to $240/t since 1 August, a 2½-year low. China's 62pc Fe iron ore fines prices have moved the other way, rising to a five-year high at more than $125/dry metric tonne (dmt) in early July but have since fallen to $93.20/dmt cfr Qingdao on increased supplies. The spike in iron ore prices into China briefly sent China's ferrous unit cost to a premium to Turkey in late June.

Raw material costs help determine how well each of these two main steel exporters can compete in battleground regions. For Turkey and China, one battleground is the Asean rebar market. Lower scrap prices have allowed Turkey to offer lower than competitors into Singapore over the past month, helping send the cfr Asean rebar index lower by $20/t to $462/t cfr Singapore since 2 August. Turkish offers at $445-450/t cfr theoretical weight will possibly send the weekly assessment down further on 12 September. Chinese rebar prices at $452/t fob China theoretical weight have little chance to compete, a north China producer said.

But the narrowing difference in ferrous unit costs means shrinking room for Turkey to cut prices relative to China.

The daily ferrous feed unit cost for a Turkish EAF is calculated using the Argus HMS 1/2 80:20 cfr Turkey index price with a loss of 12pc for slagging and other losses in the EAF. The Turkish EAF ferrous feed unit cost was $268.80/t yesterday.

The daily ferrous feed unit cost for a Chinese basic oxygen furnace (BOF) is calculated using the Argus ICX 62pc iron ore index at a ratio of 1.44 per tonne of steel, the Argus premium low-volatile hard coking coal fob Australia index at a ratio of 0.49 per tonne of steel, with the listed price for heavy melt scrap No. 3 in east China at a charge ratio of 15pc in the BOF. The fob Australia coal price yesterday was $151.40/t and the heavy melt scrap price was 2,630 yuan/t ($370/t). The BOF ferrous unit cost was $263.79/t yesterday.

Another indicator on the relative costs between Turkey and China is the ratio of Turkish scrap prices to the Argus ICX 62pc Fe iron ore index. Turkish scrap prices have fallen to less than three times the cost of 62pc Fe iron ore fines into China, after maintaining ratios above 4 for most of 2017-2018. This ratio could mean revert, either by lower iron ore prices in China, or higher scrap prices in Turkey.