A collapse in receipts of Australian coal slashed Japanese thermal coal imports by more than 2mn t on the year in August, with comparatively full stocks and lower thermal generation likely weighing on consumption during the peak cooling period.

Thermal coal imports fell by 2.3mn t — the biggest annual decline for more than seven years — to 8.9mn t in August, provisional data from the ministry of finance show.

Imports from Australia were no more than 6mn t, although this total may include small volumes from Canada, Colombia and South Africa, which are not differentiated in the provisional data. Japan imported 8mn t of Australian coal in August last year, suggesting a drop in receipts last month of at least 2mn t on the year.

Imports of Indonesian coal also fell, with receipts down by half at a 27-month low of 819,000t. But imports from Russia rose by 264,000t on the year to 1.5mn t in August, a 13-month high, giving the origin a probable record-high 17pc share of the Japanese supply mix.

Japanese thermal coal imports in January-August were down by 4pc on the year, at 73mn t, with the country's annual receipts on course to hit a three-year low this year.

Greater nuclear output and lower overall power demand weighed on Japanese thermal generation in August, but the impact on the country's demand for seaborne coal was likely compounded by unusually high inventories. Japanese coal imports rose for only the second time this year in July, but thermal power generation fell by 10.5TWh, or 16pc, portending a net stockbuild in utility inventory.

Japanese coal stocks were 1.2mn t higher on the year, at 9.4mn t, in May — the latest date for which data are available — and may have climbed further since, given weakness in thermal generation and firm imports in July.

Provisional data suggest that Japanese power demand slipped by 1pc on the year to about 84TWh in August, while nuclear output is likely to have grown by about 700GWh to 4.8TWh, based on reactor maintenance schedules. As a result, thermal output — which totalled 67.8TWh in August 2018 — is likely to have dropped to 65-67TWh last month.

But fossil fuel burn may grow on the year in September, with nuclear output set to record its first year-on-year decline for several years as a result of maintenance, and with power demand elevated amid hotter-than-usual conditions.

Japan's 1.18GW Genkai 4 and 890MW Sendai 2 reactors are scheduled to be off line for the whole of September, while the 1.18GW Ohi 4 has recently returned to service and the 870MW Takahama 4 was idled today. This means output may reach up to 4.4TWh across the month, which would be down from 5.1TWh a year earlier.

In addition, higher-than-average temperatures have boosted Japanese power demand this month. Total power demand in the Tepco, Chugoku, Shikoku and Tohoku-serviced areas — which typically account for a little more than half of national demand — totalled 22.3TWh on 1-17 September, which was up from 21.1TWh in the same days last year and 20.1TWh in 2017. Recent demand suggests national power offtake could reach up to 75TWh this month, compared with a three-year September high of 71.3TWh.

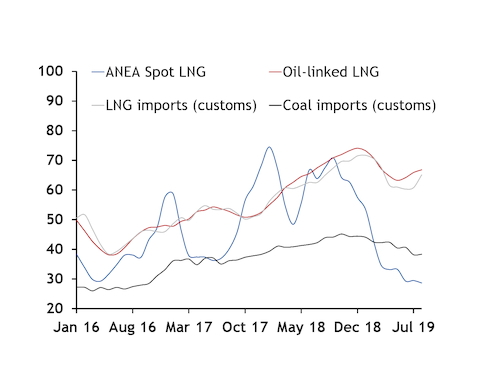

Japanese LNG imports fell by 19pc on the year to 6.1mn t in August, almost matching the 20pc year-on-year decline in thermal coal receipts. Coal's cost advantage over LNG for thermal power generation increased last month, based on the average import price of both commodities.