US bulk ferrous scrap exporters have reacted swiftly to a rapid deterioration in the global ferrous scrap and steel market by lowering ferrous scrap collection prices.

Average east coast dock buying prices for #1 HMS have fallen by more than $60/gt since July to $180/gt as assessed by Argus and face additional downward pressure because of low demand and rising freight rates for shipment to key consumer Turkey.

The falloff brings dock-side prices to the lowest level since February 2017, a period which was marked by a short-lived downturn and then followed by a more than one-year rally in prices.

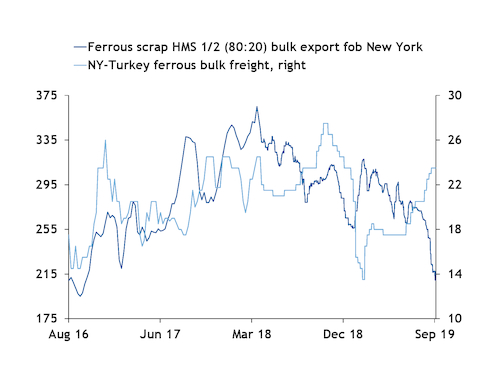

But drops in collection prices have not kept pace with the falloff in east coast fob prices for bulk HMS 1/2 (80:20), which reflect netbacks from Turkey. The latest Argus assessment fell to $209/t fob New York, the lowest level since October 2016.

When fob export prices were last this low, average east coast dock prices traded between roughly $24-27/gt lower at $153-156/gt, which suggests collection prices could move lower.

Low demand in the steel sector amid broader economic headwinds continue to weigh on US ferrous scrap prices.

Key economic indicators — including the production managers index, gross domestic product and non-residential construction spending — have also contracted with the most recent figures more closely mirroring the fundamentals seen in the fourth quarter of 2016 when US scrap prices were last this low.

Exacerbating the situation are freight rates for bulk ferrous scrap from New York to Turkey. The Argus weekly freight assessments for 40,000t scrap cargoes on Supramax vessels from New York and Houston to Turkey rose today by $1/t to $24-25/t and $27-28/t, respectively, to 2019 highs amid limited ship availability. Other US exporters have reported freight to Turkey as high as $28/t.

Compared to October 2016, when bulk fob New York prices were on par with today's prices, freight rates were 52pc lower at $15.5/t, roughly $8/t below freight rates today.

The rise in freight coupled with lower Turkish selling prices provides further pressure on exporters to drop dock buying prices in order to preserve margins.