Increases in US liquefaction capacity in recent months could boost LNG freight demand from a year earlier this winter, when additional trains are expected to come on line, but slow inter-basin flows may limit the rise.

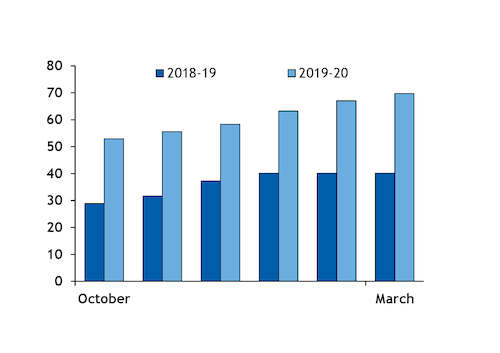

The rise in liquefaction capacity has increased loading demand from US facilities to more than 50 cargoes/month from 29 in September last year, assuming all operational trains are running at capacity and based on an average cargo size so far this year of 165,000m³.

The increase is driven by the 10mn t/yr Corpus Christi facility and Sabine Pass' fifth 5mn t/yr train coming fully on stream, as well as the recent start-ups of the first 5mn t/yr trains at Cameron LNG and Freeport.

Exports could increase to around 70 cargoes/month by the end of winter, as Freeport's and Cameron's first trains ramp up, and the facilities' second 5mn t/yr trains also come on line over the period. The start-up of 4mn t/yr Elba Island's 400,000 t/yr modular trains at a rate of one a month will further drive liquefaction increases this winter.

US liquefaction facilities have the highest tonnage demand — the number of vessels required to load each million tonne — globally at an average 1.77 in the past two winters.

Firms with US offtake have been active in the spot and term charter markets, market participants said, to secure the required vessels to load their contracted volumes over winter. This has likely weighed on vessel availability across both basins, helping to hold rates higher through late summer than their lows earlier this year.

These offtakers broadly hold balanced LNG freight positions, market participants said, but noted that any firms seeking to capture an open inter-basin arbitrage for US loadings, or the contango in delivered LNG prices through delayed delivery, would be required to lengthen their positions through chartering additional vessels on the spot charter market.

Only around 35 LNG carriers have been delivered so far in 2019, with around 10 more scheduled to come on the water in October-March. But liquefaction capacity in countries other than the US has increased by only 4.8mn t/yr so far in 2019, with the 3.6mn t/yr Prelude liquefaction facility the only large-scale non-US project to come on line.

A further 2.4mn-7.7mn t/yr of additional liquefaction capacity could come on line outside of the US over the coming winter, depending on the start-ups of the third 3.8mn t/yr train at Tangguh LNG and Petronas' 1.5mn t/yr PFLNG2 facility.

Tight inter-basin arbitrage may pare tonnage demand

A tight inter-basin differential providing an incentive for US spot cargoes to stay in the Atlantic basin this winter could curb tonnage demand.

LNG deliveries from the US to western Europe have typically taken around 16 days, compared with 31 days to northeast Asia. This means quick deliveries of spot cargoes primarily to Europe could be maintained with fewer vessels.

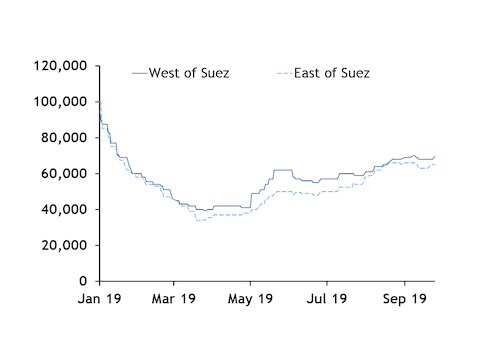

Lower tonnage demand last winter and through this summer because of weak northeast Asian demand curbing inter-basin flows of spot cargoes has been a large driver of low spot charter rates, shipowners have said.

Tonnage demand averaged 1.74 in the fourth quarter of 2018, requiring around 51 LNG carriers of a 165,000m³ capacity, with the inter-basin arbitrage holding tight for most of the period.

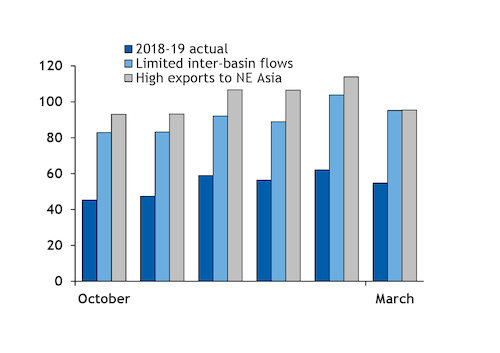

If the destination of US exports are proportioned in a similar way in the fourth quarter of 2019, around 86 vessels would be required to meet average loading demand of 56/month, judging by the assumed round trips to the delivered markets for US LNG.

In the first quarter of 2019, tonnage demand was lower, averaging 1.62. If this was maintained over the first quarter of 2020, around 100 vessels would be required to meet around 67 loadings/month, as US liquefaction capacity is buoyed by new production trains and full output from those expected to ramp up in October-December.

Northeast Asia could push up tonnage demand

But a rise in northeast Asian spot demand resulting in the inter-basis differential widening could drive tonnage demand higher, as increased inter-basin flows drive up the required travel time for deliveries from the US.

US tonnage demand over the fourth quarter of 2017, when there was an incentive for US loadings to be shipped to northeast Asia ahead of Europe, was 1.97.

Similar tonnage demand in the next quarter would require around 100 vessels, 14 more than if tonnage demand was in line with October-December 2018.

Tonnage demand in January-March 2018 fell to 1.78, largely because of slower deliveries from the US to northeast Asia in March. But if matched in the first quarter of 2020, this would still require around 105 vessels to meet loading demand.

Delayed deliveries could tighten vessel availability

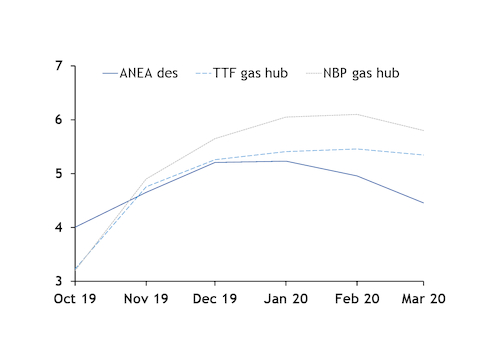

Delaying deliveries to capture the contango in forward des prices could mean that firms have to secure some tankers on the spot charter market.

A steep contango in fourth quarter des prices, both in Europe and in northeast Asia, may have encouraged firms to delay deliveries from October to November and November to December, respectively, for cargoes to be loaded in October at US liquefaction facilities.

Firms seeking to delay a delivery may have to source an additional vessel to maintain the loading schedule for its contracted volumes, either from its own fleet or from the spot charter market.

Firms with balanced LNG freight positions that are intending to delay multiple US-loaded cargoes would be required to seek additional vessels depending on the location of the intended delivery.

But tighter vessel availability could support spot charter day rates, which may reduce the incentive for firms to slow sail more cargoes.

| Assumed round trips from US liquefaction facilities | days |

| Delivered region | Round trip duration |

| Europe | 32 |

| Western Asia | 46 |

| Southern Asia | 56 |

| Northern Africa | 46 |

| Eastern Asia | 62 |

| South America | 38 |

| Central America | 23 |

| Southeast Asia | 68 |

| Caribbean | 34 |

| — Argus Media | |