Australia's mainstream iron ore shipments to China have increased by 2mn deadweight tonnage (dwt) in the week to 28 September, which may boost arrivals at Chinese ports over the next few days and likely cap widely expected post-holiday price gains.

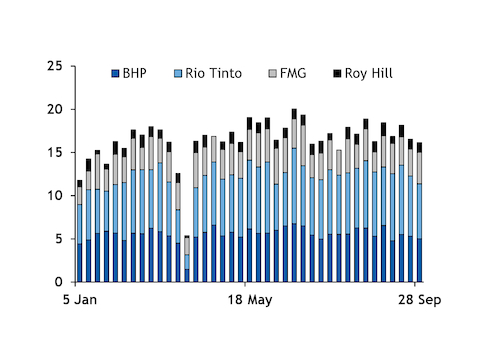

Shipments by Rio Tinto, BHP, Fortescue and Roy Hill to China were 14.5mn dwt in the week to 28 September, up from 12.52mn dwt in the week ended 21 September.

But total shipments by these producers in the week to 28 September were 16.49mn dwt, down slightly from 16.83mn dwt in the same comparison.

Rio Tinto's iron ore shipments to China slipped by 3.7pc to 4.93mn dwt. An analyst report from Morgan Stanley had forecast a drop in Rio Tinto's late-September exports because of an overhaul of its railway systems in the Pilbara mining region. The fall in Rio Tinto's exports was not significant and compensated by higher shipments from BHP and Fortescue.

BHP shipped 4.84mn dwt last week to China, up from 4.06mn dwt in the preceding week, while Fortescue shipped 3.68mn dwt compared with 2.64mn dwt in the same comparison.

Concerns over Rio Tinto's supply had lifted PB fines prices in September. An early-November loading cargo of 61pc PB fines was sold at $93/dry metric tonne (dmt) on 1 October, while a similar cargo was sold lower at $88.10/dmt on 26 September.

The market outlook for iron ore prices remains bullish on supply concerns. But the outlook for steel demand is still uncertain, with real estate and infrastructure investment growth remaining stuck in a 4-5pc range, despite Beijing allocating more funds for infrastructure projects.

"There are traders, including me, who are bearish on steel prices but are bullish on iron ore because of the supply tightness of ores. Mainstream medium-grade iron ore stocks are tight now. There is talk that Vale's shipments to China in October-December may be lower than expected," said a south China-based trader.

The Argus ICX 62pc seaborne index has traded above $90/dmt since 2 September, with buying likely to accelerate once mills return from the 1-7 October national day holiday.

Sellers are more interested in selling November-linked iron ore cargoes compared with October-indexed ones currently as the post-holiday burst in deals is likely to be mostly linked to November indices, said a Singapore-based trader.