Tighter domestic concentrate supply in China and declines in the 65/62 index differentials have narrowed discounts for iron ore concentrate imports to China.

Demand for concentrate imports, which Chinese steelmakers use to make pellet or add to sintering feed, was boosted late last month because of a ban on explosives in mining areas ahead of China's national day holiday from 1-7 October. The ban threatened to cut output of domestic concentrate.

An October-delivery cargo of low-sulphur Chilean concentrate was heard sold flat to the October MB65 index last week. A 204,000t cargo of PFFT with mid-October loading was sold at a $3.50/dry metric tonne (dmt) discount to the October MB 65pc index in a 19 September tender. The PFFT sintering concentrate cargo, which was sourced from Brazilian mining firm Vale's southern system mines, has specifications of 68.14pc Fe, 1.89pc silica, 0.22pc alumina and 0.017pc phosphorus.

Ukrainian concentrate was offered at a discount of $1/dmt and Citic's Australian concentrate was offered at a discount of $2/dmt at the China iron ore and steel association (Cisa) conference in Qingdao last week, much narrower than previous offer and deal levels.

Concentrate differentials earlier widened to $5-8/dmt, a range that held into early September. PFFG, another sintering concentrate from Vale, sold at a $8/dmt discount in a 4 September tender.

China's domestic concentrate output increased by 7.2pc to 177mn t in the first eight months of 2019, according to the Chinese Metallurgical Mine Association, supported by higher prices in the wake of Vale's dam collapse early this year.

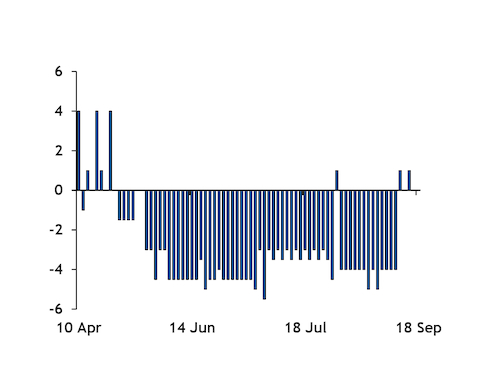

Increased supply of Vale's 65pc IOCJ fines has narrowed the premium for 65pc fines to 62pc mainstream fines. The 65pc index differential to the Argus ICX 62pc index fell below $5/dmt briefly in September, encouraging buyers to take cargoes linked to the 65pc index. The September Argus 65/62 differential average narrowed to $5.60/dmt from an August average of $7.74/dmt.

Some market participants cite the narrower 65-62pc differential as a reason for higher asking floating prices for imported concentrates.

"It is more attractive to buy on 65 index after 65/62 differentials narrowed to below $6/dmt, a new low for at least a year," an east China-based trader says.

Other deals that bear out the trend include a cargo of Vale's northern sintering concentrate PFCJ with October delivery that was sold at Oct MB65 index minus $2.7/dmt on 17 September. An unconfirmed deal of Citic concentrate was done at minus $3/dmt in late September, while a portion of recent Karara concentrate was sold at the minus $2.5-3/dmt level.