Dutch and Belgian exports of ferrous scrap to Asia and Africa continued to rise in January-June as exporters sought further diversification away from an increasingly volatile Turkish market.

Overall ferrous scrap exports from the Netherlands and Belgium were virtually flat on the year at 5.41mn t in January-June, according to EU statistical agency Eurostat.

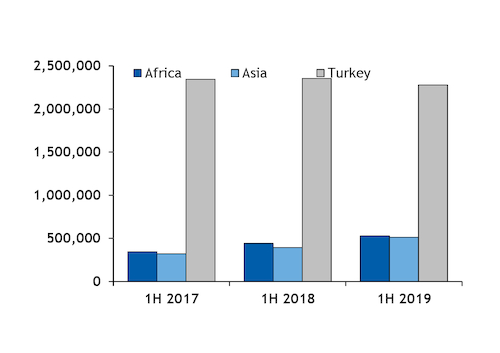

Turkey remained the largest buyer but its offtake fell to 2.28mn t from 2.35mn t a year earlier. The decrease could largely have been a result of a fall in Turkish export and domestic steel demand, which led the country's steelmakers to lower steel production and consequently reduce seaborne scrap demand.

This weaker environment led Turkish mills to accept greater flexibility in steel sales lead times, which fuelled unpredictable and volatile movements in purchase patterns and pricing on a number of occasions in the first half of this year.

The Turkish deep-sea scrap import price experienced several large swings over the past year, including a fall to below $280/t in January from over $340/t in November 2018 and a subsequent rapid recovery to above $320/t in February.

This increase in volatility in Turkish seaborne scrap demand and prices drove Dutch and Belgian exporters to search for alternatives in some of the fastest-growing steel producing regions, such as Asia and Africa.

Steel output in Asia, excluding China, Japan and South Korea, rose by 5.9pc on the year to 149.5mn t in 2018 from 141.2mn t in 2017, while production in Africa increased by over 17pc to 17.4mn t.

The majority of the increase in Dutch and Belgian shipments to Africa came from sales into Egypt, where implementation of anti-dumping duties on imports of rebar from China, Turkey and Ukraine in 2017 supported rapid growth in Egyptian rebar production a year later.

Egypt, the largest steel producing country in Africa, received close to 520,000t of scrap from the Netherlands and Belgium in January-June compared with just over 370,000t a year earlier.

Egypt also imposed provisional safeguard duties of up to 15pc on semi-finished steel and 25pc on rebar imports in April this year. The duties were later suspended by the country's administrative court, against which Cairo appealed. The advisory committee of the Egyptian ministry of trade on 15 September recommended two proposals for a three-year safeguard system that will apply tariffs of up to 15pc on billet imports.

Shipments from the Netherlands and Belgium to Africa were offset by lower volumes sold by these countries into Morocco, where combined exports fell to 8,200t in January-June from 70,000t in the same period of 2018.

Dutch and Belgian ferrous scrap exports to Asia totalled 511,000t in the first six month of this year, up by 30pc on the year.

Exports to Asia were mostly directed towards the large container markets of India, Pakistan, Bangladesh and Taiwan, all of which registered significant growth in Netherlands-Belgium shipments.

Shipments to India rose by over 50pc on the year to 284,000t from 187,000t, while exports to Pakistan were 56.9pc higher on the year at 80,000t. The Netherlands and Belgium sent 35,000t to Bangladesh in January-June, up from 21,000t a year earlier.

Exports to Taiwan totalled just below 30,000t, up from 23,600t in January-June 2018.

Vietnam, another fast-growing steel producing country and a popular buyer for both containerised and bulk scrap cargoes, bought 50,000t of scrap from the Netherlands in April. This was the only sale to Vietnam from the Netherlands and Belgium in 2019. Exports to Vietnam were over 65,000t in January-June 2018.

Shipments to the US, another popular buyer of European scrap, were also down, falling by almost a third on the year to 128,000t in January-June from 181,000t a year earlier. This was likely to have been a result of a slowdown in US steel demand and lower scrap prices throughout 2019 after a fading of the strong market that was supported in 2018 by section 232 import tariffs on steel and aluminium imports. The US national average delivered to consumer price for HMS 1 fell to $244.25/gt on 28 June from $339.25/gt on 2 January, Argus assessments show.

Scrap exporters from the Netherlands, Belgium and other European exporting regions are likely to continue seeking alternative sales destinations to Turkey as it is still widely expected that Turkish scrap demand and prices are unlikely to see a sustainable rebound in the near future, despite prices moving up to $227.80/t today from an almost three-year low of $221.20/t on 30 September.