Deliveries to Europe from the 16.5mn t/yr Yamal LNG project are set to rise this winter from a year earlier as production holds above nameplate capacity and shipping sanctions appear unlikely to constrain loadings.

Higher production could support European LNG receipts through the period, even if the inter-basin arbitrage widens and deliveries to the region from elsewhere in the Atlantic basin slow, as Europe appears set to be the primary delivered market for Yamal LNG again.

Only seven of the 92 cargoes loaded at Yamal last winter were not delivered to European regasification terminals, two of which were loaded in October for delivery through the Northern Sea Route (NSR) to China. None of the remaining five cargoes were delivered through the NSR over the period.

Deliveries to regasification terminals outside of Europe this winter could be limited again, because of the closure of the NSR. The passage closed in November last year, with no new icebreakers committed to the Yamal project coming on the water this summer, indicating that significant volumes passing through the NSR may be unlikely. The project's LNG carriers have yet to transit the route laden during its winter closure.

Project operator Novatek expects the NSR to close by late October-early November, chief financial officer Mark Gyetvay said today.

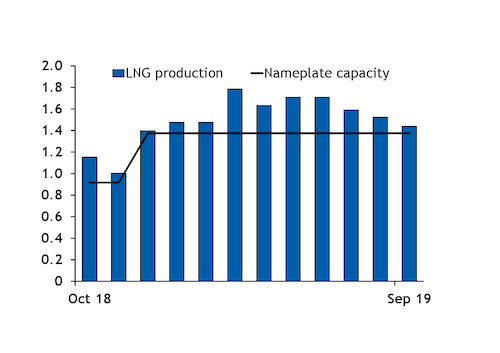

Holding above nameplate capacity

Production at Yamal has remained significantly above the facility's nameplate capacity, with monthly loadings in the second and third quarters averaging 20.8. This would equate to around 1.58mn t/month, judging by vessel size and accounting for heel gas — 201,000 t/month above the project's nameplate capacity.

If production at this level holds through winter, loaded volumes would rise by an average of 215,000 t/month from a year earlier. This would equate to an additional 2.7 cargoes each month, judging by an Arc7's 172,600m³ capacity and accounting for heel gas.

Fourth train delay to curb liquefaction growth

The fourth train planned at Yamal, which has capacity of 940,000 t/yr, is not expected to begin production until the first quarter of next year.

At full operational capacity, the train would add around one more Arc7 cargo per month, meaning the delayed start-up could remove up to three cargoes from Yamal's expected winter production.

Depending on its ramp up, an extra cargo or two could still be added to aggregate loadings from already commissioned trains in the first quarter of 2020.

Sanctions could require transshipments again

Sanctions imposed on six Arc7 vessels by the US Treasury Department are unlikely to constrain Yamal's loading capacity, but would require a restarting of transshipments to provide additional shipping capacity.

One of the vessels under sanction is set to be delivered to the project on 13 October, with the last scheduled for late-November delivery. This would leave Yamal with nine operational Arc7s.

Only Arc7s can load at Yamal's Sabetta terminal during winter months, with lower ice-class Arc4 and Ice-2 vessels able to make passage to the port in summer.

This tighter shipping capacity means most cargoes will likely have to be transshipped en route to Europe, alleviating supply demand for the Arc7 vessels.

Operator Russian independent Novatek expects to transship cargoes at Honningsvag and Murmansk this winter, Gyetvay said today.

If, following the closure of the NSR, all Yamal cargoes were transshipped at Honningsvag or Murmansk, Yamal would require only six Arc7 vessels to load a monthly production of 1.58mn t, assuming a round trip to the transshipment facility of nine days.

And direct delivery to European regasification terminals would require 13-14 Arc7s, based on a historical 20 day roundtrip, requiring more vessels of this ice-class than the project has.

But the project may have to increase the number of other vessels under short-term charters, with tankers required to receive the transshipped cargoes at Honningsvag and Murmansk. Having previously had enough Arc7 capacity to deliver directly to Europe, the project could have to enter the short-term charter market to secure this additional receiving vessel capacity.

Novatek is considering short-term agreements for additional shipping capacity, Gyetvay said.

Rates for six-month charters covering the winter period were heard as high as $90,000/d in recent days, reflecting recent gains in spot charter rates, with market participants expecting these to breach $100,000/d in the current quarter.