Brazil is drawing in more diesel ahead of the new IMO 2020 rules, write Wendy Dulaney, Yawen Lu and Benedict George

Countries in Latin America, and Brazil in particular, are drawing in more US Gulf coast diesel, partly as regional refineries gear up for the new IMO 2020 rules.

Brazil is positioning itself to be an exporter of marine fuels that comply with the IMO rules, which will cut the permissible sulphur levels in bunker fuel to 0.5pc from 3.5pc on 1 January for vessels that do not have scrubbing technology fitted. The reconfiguration of Brazil's refineries means that more of its diesel production is going to the marine fuel pool, leading to a diesel shortfall that is mainly being filled by US imports.

The Gulf coast accounts for around 90pc of US ultra low-sulphur diesel exports. Roughly a quarter of those flows have typically gone to Mexico, while Brazil and Chile have tended to take another 25pc between them. But Brazil overtook Mexico as the top importer of diesel from the Gulf coast in September. A record 330,000 b/d went on the route, oil analytics firm Vortexa data show. This was double Brazil's two-year US import average of 165,000 b/d and higher than Mexico's 275,000 b/d average over the same period.

The sudden increase in flows to Brazil has been driven in part by the changes to its diesel infrastructure, and partly because the country's largest refinery, the 415,000 b/d Paulinia plant, was undergoing maintenance for most of September. Brazil began adapting refineries earlier this year to produce IMO 2020-ready fuel, with around 6pc of its diesel output going to the marine fuel pool in the second quarter, rising to more than 15pc in the summer. Brazil also began to stockpile low-sulphur marine fuel in Malaysia and Singapore earlier this year.

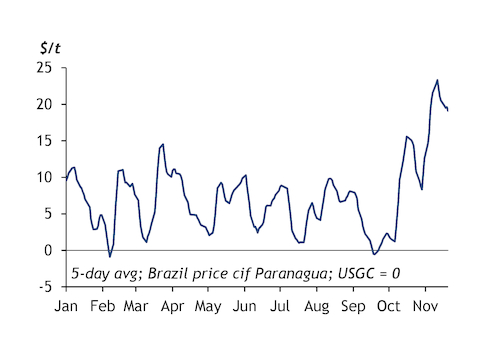

Brazilian receipts from the Gulf coast remained high in October at 205,000 b/d despite Paulinia's return. Economics on the southbound route have become increasingly attractive as rising Brazilian demand has increased the need for imports (see graph). Brazil took over 85pc of its September and October diesel imports from the Gulf coast, with another 10pc coming from Europe and the Middle East combined. The September spike in US exports to Brazil coincided with the beginning of the refinery maintenance season on the Gulf coast. Diesel markets weakened for most of October after hitting a two-year high early in the month.

European refiners have also been sending more diesel to Brazil, although the quantities remain relatively low. But regional exports could rise, particularly if US producers target their own domestic market to capture higher values. European exports were less than 5,000 b/d in June-August, but have risen to more than 20,000 b/d in September-November. Shipments to Venezuela were nearly 50,000 b/d in the third quarter, but have fallen to nearly zero since then.

Out of India

Viable arbitrage economics have also prompted more diesel to move from India to Latin America, as Asia-Pacific diesel margins have come under pressure from higher regional availabilities. India is not one of the principal diesel suppliers to South America — it was the region's fourth-largest supplier over the past year, according to Vortexa data.

Trading firm Mercuria provisionally chartered the Ionian Star to load 260,000 bl of diesel at Mumbai on 20 November to take to Brazil. And BP appears to have fixed the tanker Kibaz, also to load 260,000 bl of diesel at Mumbai, on 26 November for delivery to Argentina. The Largo Sun took around 280,000 bl of diesel from Kochi on India's west coast to the Brazilian port of Paranagua, discharging on 1 November. Indian state-controlled refiner BPCL operates a 310,000 b/d refinery in Kochi. There were no diesel cargo movements along this route previously, Vortexa data show.