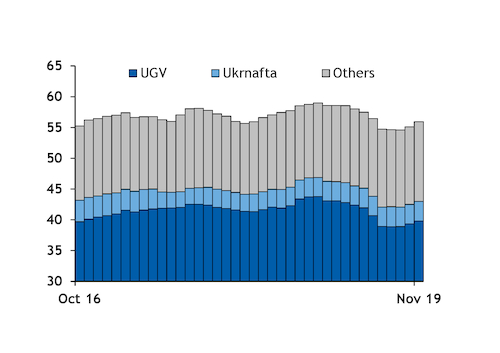

Ukrainian gas production fell in November from a year earlier, driven by lower output from state-owned Ukrgazvydobuvannya (UGV).

Aggregate output fell to 55.9mn m³/d from 58.8mn m³/d in November 2018. The annual decline was less pronounced than in September and October, but broadly similar to August.

Offtake from UGV, Ukraine's largest producer, continued its sharp decline on the year, falling to 39.8mn m³/d from 43.7mn m³/d. UGV output fell on the year for each month in June-November, following a revision to parent company Naftogaz's production strategy to focus on core assets ahead of lifting output. The firm's demand gap was to be made up through quicker imports.

But slower UGV output has been partly offset by higher production from private-sector firms and state-owned Ukrnafta (see Ukrainian production graph).

Output from private firms has risen on the year for every month since May 2018, following changes to regulations, including lower subsoil taxes for new wells, a simplification of administrative procedures for obtaining production permits and the end of mandatory stock evaluations.

And Ukrnafta's output has climbed on the year for every month since November 2018, but remained below output in November 2016, before the firm was forced to suspend output from some fields amid the expiry of some of its upstream licences.

Aggregate Ukrainian production in December remaining stable from October-November would result in cumulative 2019 output reaching over 20.6bn m³. This would be only slightly below the 20.9bn m³ last year, despite UGV's strategic shift since the middle of this year, partly because offtake had been strong earlier in the year.

Transport capacity costs could hit production

But production could drop following a rise in Ukrainian tariffs for gas entering the grid next year, Ukrainian gas producers association AGPU said.

Ukrainian regulator Nerc has approved significantly higher capacity costs for gas entering the Ukrainian transmission network in 2020-24. The cost of entry to the network would rise to 406.68 hryvnia/'000m³ (€1.47/MWh) from HRN97.87/'000m³ (€0.35/MWh). The cost of capacity for exiting the grid to Ukraine's distribution networks or directly to consumers would also rise to HRN297.92/'000m³ (€1.07/MWh) from HRN157.19/'000m³ (€0.54/MWh). These fees would apply to entry capacity to and exit capacity from storage as well (see domestic tariffs table).

The regulator set its rates late last month following a proposal to lift most tariffs by new state-owned entity GTSOU, which is to take over operation of the country's gas transmission system from operator Ukrtransgaz from 1 January. Nerc's tariffs would sharply increase cross-border entry tariffs and lower tariffs for cross-border exit capacity.

Nerc also approved coefficients that would modify cross-border and internal entry and exit capacity fees based on the time of year that the capacity is booked for, as well as whether it is taken up on a quarterly, monthly or day-ahead basis. Tariffs are currently flat, with no seasonal or short-term booking multipliers applied (see seasonal tariff co-efficient table).

And the capacity costs for gas entering Ukraine's transmission network domestically would rise above the cost of capacity for imports under Nerc's new tariffs, which could decrease the competitiveness of domestic production compared with imported gas.

The higher capacity fees would consequently lead to lower production, AGPU said. And they could reduce investment in gas exploration and lead to the abandonment of planned projects, it said. Firms that import and produce gas could be particularly affected by the new fees, leaving them with little capital for financing production, the association said.

Nerc's commissioners have approved the new tariffs, which are based on the assumption that no Russian gas will transit Ukraine next year. But the regulator is holding public consultations with market participants until 10 December before finalising the fees.

The tariff change has proceeded too quickly and violated procedures, which could lead to lawsuits to block their implementation, some market participants said.

By Jacob Mandel and Victoria Dovgal

| Nerc proposed Ukrainian entry, exit tariffs | |||

| 2020-24 | 2019 | ±% | |

| Entry | |||

| Domestic (HRN/'000m³) | 406.68 | 97.87 | 315.5 |

| Cross-border ($/'000m³) | 16.33 | 6.28 | 160.0 |

| Exit | |||

| Domestic (HRN/'000m³) | 297.92 | 157.19 | 89.5 |

| — Nerc | |||

| Nerc proposed seasonal tariff coefficients, 2020-24 | |||

| Month | Quarterly | Monthly | Daily |

| January | 1.40 | 1.75 | 2.35 |

| February | 1.40 | 1.60 | 2.20 |

| March | 1.40 | 1.55 | 2.10 |

| April | 1.05 | 1.30 | 1.80 |

| May | 1.05 | 1.20 | 1.65 |

| June | 1.05 | 1.15 | 1.55 |

| July | 1.00 | 1.15 | 1.55 |

| August | 1.00 | 1.10 | 1.50 |

| September | 1.00 | 1.20 | 1.60 |

| October | 1.30 | 1.35 | 1.85 |

| November | 1.30 | 1.55 | 2.10 |

| December | 1.30 | 1.65 | 2.25 |

| Average | 1.19 | 1.38 | 1.88 |

| — Nerc | |||