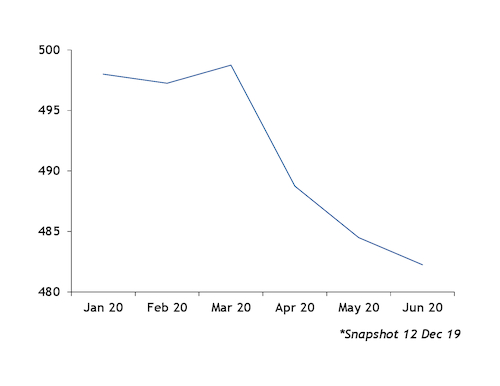

Traders' expectations that high-sulphur fuel oil (HSFO) will be in demand and supply will thin are causing US Gulf coast (USGC) 3pc sulphur residual fuel oil swaps to trade in contango for January-March 2020.

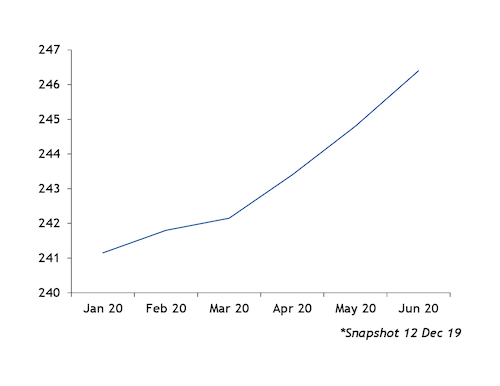

By contrast, expectations that low-sulphur fuel oil (LSFO) supply will increase to meet stronger demand are causing US Gulf 0.5pc sulphur fuel oil swaps to trade at backwardation for the March-June 2020 period.

The International Maritime Organization's (IMO) new sulphur limits for marine fuel go into effect on 1 January, capping the maximum sulphur content to 0.5pc from the current 3.5pc, and reducing bunkering demand for the high-sulphur product. But traders expect that HSFO will find its price floor in 2020 as refiners reduce its output by processing sweeter crudes and running cokers at higher utilization rates. Some of the lost bunker demand for HSFO is expected to be replaced by inland power generation demand.

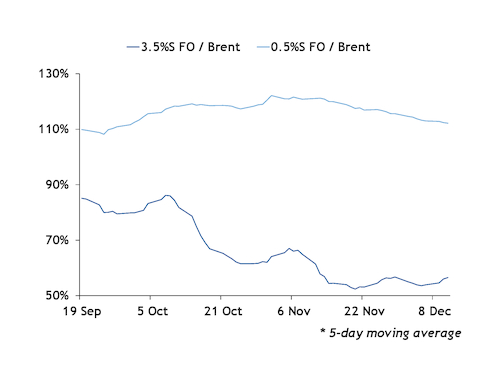

Market sentiments about future demand are also reflected in the physical spot market for December. Despite dwindling spot demand for bunkering HSFO, US Gulf 3.5pc sulphur fuel oil as a share of the price of Brent fluctuated at 52-57pc since mid-November, after dropping from 85pc in October. By contrast, despite higher physical bunkering demand for LSFO, US Gulf 0.5pc sulphur fuel oil as a share of the price of Brent has fluctuated at 112-119pc of the price of Brent, after climbing up to 122pc at the beginning of November.

With 3pc sulphur fuel oil swaps trading in contango and 0.5pc sulphur fuel oil swaps trading in backwardation, the forward curve differential between the low-high sulphur residual fuel oil narrows to $236/t in June 2020 from $257/t in January 2020. The spot, physical 0.5-3.5pc sulphur fuel oil differential averaged $276/t from 2-10 December.

By Stefka Wechsler