The German gas stockdraw could remain slower than average in the coming weeks, unless NCG and Gaspool prompt prices open up wide premiums to contracts for delivery in April-September.

The stockdraw quickened in January, partly to offset a fall in Russian pipeline deliveries to Europe, but remained far slower than in recent years. And withdrawals could slip further in the coming weeks, with German prices delivering over the rest of the winter holding discounts to their corresponding front-summer contracts.

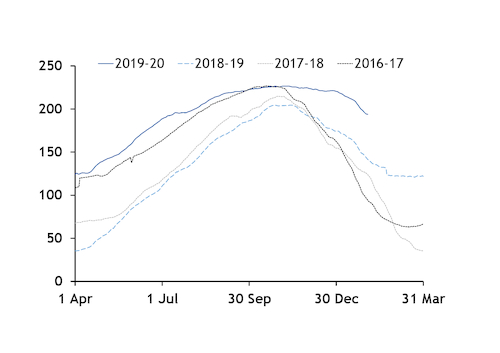

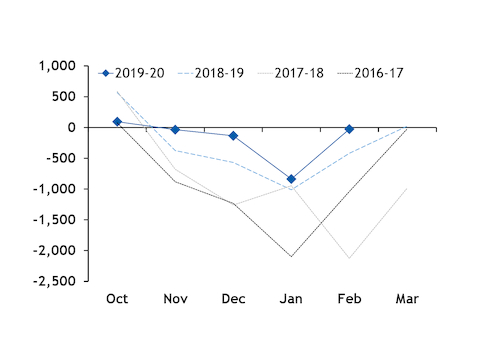

German withdrawals were 837 GWh/d in January, up from 135 GWh/d in December, but below the three-year January average of 1.35 TWh/d and the slowest for the month since they stood at 825 GWh/d in January 2016(see chart). This left German stocks at nearly 194TWh yesterday morning, well above the three-year 2 February average of 120TWh. And the 74TWh stock surplus was well out from 57TWh surplus on 1 January and only 20.7TWh on 1 October (see chart).

And gas withdrawals could hold well below average in the coming weeks, expanding the stock surplus further, unless NCG and Gaspool prompt prices open up a wide enough premium to contracts for delivery in the summer to offset variable fees for summer injections.

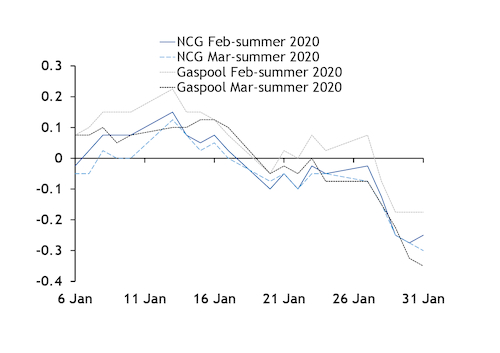

The NCG February market was €0.25/MWh below the summer 2020 contract at its 31 January close, with the corresponding Gaspool February contract closing €0.175/MWh below the summer 2020 market. And the NCG and Gaspool March contracts closed at least €0.30/MWh below the summer 2020 market (see chart).

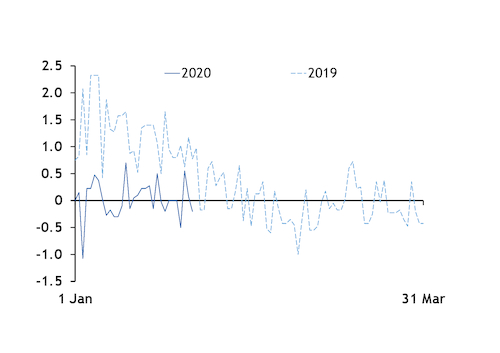

This could encourage withdrawals to lag well behind recent years if the differential persists. German everyday prices in January-March typically hold well above contracts delivering in the summer. That said, NCG and Gaspool everyday prices last February and March averaged discounts to the summer 2019 contract amid mostly mild weather (see chart). German withdrawals were particularly weak last February, at under 420 GWh/d, well below the three-year average of 1.26 TWh/d and the slowest for the month since they fell to 239 GWh/d in 2014. And Germany averaged net injections in March 2019 — the first time for the month since 2012.

Mild weather was forecast again for most of February, although longer-term outlooks suggest the return of low temperatures in early March.

But even if prompt prices switch to a premium to contracts delivering in the summer, they would need to be wide enough to cover variable fees levied by many storage operators.

Most German storage operators charge variable injection fees, depending on the facility and storage product offered. Uniper Energy Storage — which operates a number of sites linked to the NCG market area and is Germany's largest storage operator — levies a €0.472/MWh fee this storage year. And VNG, which operates the 22.1TWh VGS storage hub in Gaspool, levies a variable injection fee of €0.469/MWh for the 2019-20 storage year and €0.495/MWh for the 2020-21 storage year.

Astora — with the second-largest capacity — varies its fees depending on the storage facility. The firm levied no variable injection fee at an auction for Jemgum capacity this storage year, but charged €0.35/MWh at an auction for Rehden space.

And a conversion neutrality charge of €0.005/MWh is levied on firms withdrawing from storage into the Gaspool grid, although the fee is set at zero in the NCG.