Russian state-controlled Gazprom's sales to Europe, excluding the Baltic states, and Turkey slumped in January from a year earlier and were the lowest for any month since July 2016.

Sales slipped to 13.1bn m³ — excluding the resale of central Asian gas — from 17.6bn m³ a year earlier. This was their lowest since 13.09bn m³ in July 2016.

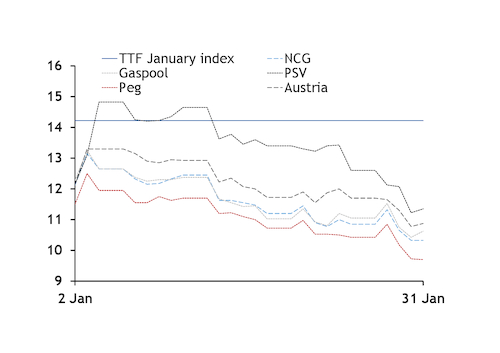

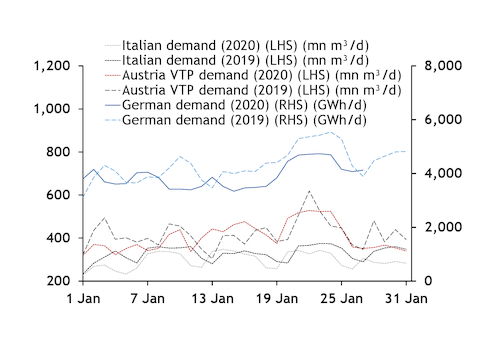

Importers with long-term contracts for Russian supply might have had little incentive for a strong take. Prompt prices across European hubs largely held below the TTF front-month index's settlement for January which might have discouraged imports under long-term contracts (see prompt prices vs TTF index graph). Mild weather and brisk LNG supply continued to squeeze European hub prices from the front of the curve last month (see January demand graph).

And the start of the new year might have provided importers with flexibility to defer contractual receipts under take-or-pay clauses. The need to meet contractual obligations might have buoyed Gazprom's sales late last year, which were much stronger than in January. That said, the firm's sales were also down on the year in December — even accounting for sales to affiliate Gazprombank — following year-on-year increases earlier in winter.

Online sales climb

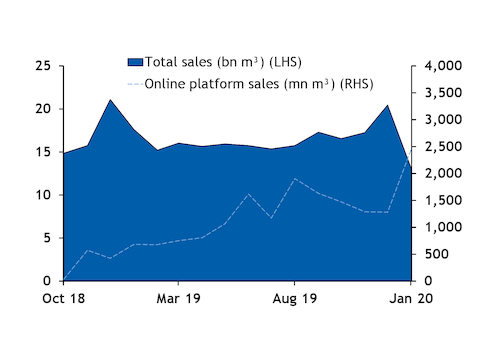

Slower sales under long-term contracts might have been partly offset by much stronger sales on Gazprom's online platform (see online sales graph).

The firm sold 2.45bn m³ for January delivery through the platform — 18.7pc of overall sales. Online sales for January delivery were the highest for any month since the platform launched in September 2018 and also accounted for the largest share of overall monthly sales. Online sales for delivery in January 2019 totalled just 681.5mn m³ — 3.9pc of the month's overall sales of 17.6bn m³.

Gazprom has said it uses the platform to optimise its sales activity and to make deliveries along routes where it can consider capacity costs sunk. Weak deliveries under long-term contracts might have left the firm with ample spare, already-booked capacity, allowing strong sales through the platform without incurring additional capacity booking costs.

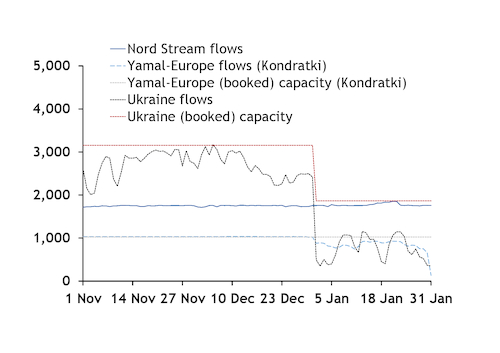

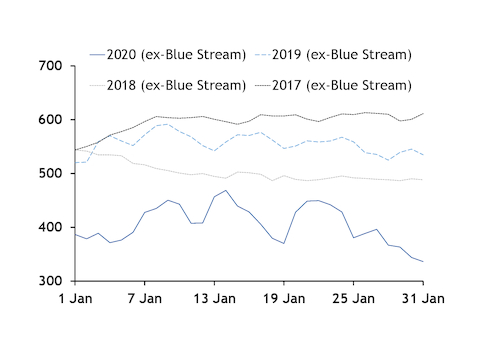

Russian pipeline deliveries, including to the Baltic states, but excluding flows to Turkey and onward destinations in southeast Europe, were 367.6mn m³/d last month, or about 11.4bn m³. And Gazprom said it had shipped 1bn m³ through Turkish Stream — which came on line at the start of the year — to Turkey, Bulgaria and onward destinations by 27 January. Assuming the 1bn m³ of deliveries were made on 1-26 January and the same pace was maintained for the rest of the month, this would have provided additional pipeline deliveries of just under 1.2bn m³, and overall pipeline deliveries of about 406mn m³/d.

This is well down on deliveries in January of previous years (see pipeline deliveries graphs).

That said, more supply could have been delivered through Blue Stream than in previous years, for which data are not available.

And Gazprom could also have used some of its European storage, which was higher at the start of this winter than in previous years, to make deliveries to customers in the region.

Sales fall behind early

The slow start to sales in January means deliveries would have to rise from a year earlier over the remainder of 2020 if Gazprom is to match its 2019 total, assuming sales to subsidiaries and other affiliated parties are stable.

The firm sold just under 199bn m³ last year — down from 201.9bn m³ in 2018 — and has said it aims to keep sales steady in 2020.

Given the 4.5bn m³ drop in sales in January, sales in February-December would have to rise to 185.9mn m³ from 181.4mn m³ a year earlier for 2020 deliveries to reach 199bn m³.

Price also falls

Gazprom's average realised sales price for exports fell in January from a year earlier but was up from December.

The realised price fell to $185/'000m³ from $274/'000m³ in January 2019. But this was higher than December's $168/'000m³, including sales to Gazprombank, and $170/'000m³ excluding these sales.

Gazprom earlier said it expects this year's average sales price to Europe, excluding the Baltic states, and Turkey to be $202-205/'000m³, in line with a year earlier. This would require higher sales prices for the remainder of 2020.

By Paul Martin and Anastasia Goreva